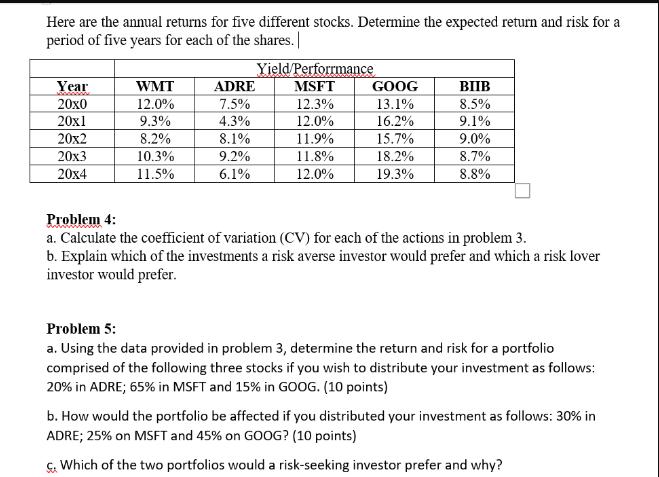

Question: Here are the annual returns for five different stocks. Determine the expected return and risk for a period of five years for each of

Here are the annual returns for five different stocks. Determine the expected return and risk for a period of five years for each of the shares. Year wwwwww 20x0 20x1 20x2 20x3 20x4 WMT 12.0% 9.3% 8.2% 10.3% 11.5% ADRE 7.5% 4.3% 8.1% 9.2% 6.1% Yield/Perforrmance MSFT 12.3% 12.0% 11.9% 11.8% 12.0% GOOG 13.1% 16.2% 15.7% 18.2% 19.3% BIIB 8.5% 9.1% 9.0% 8.7% 8.8% Problem 4: a. Calculate the coefficient of variation (CV) for each of the actions in problem 3. b. Explain which of the investments a risk averse investor would prefer and which a risk lover investor would prefer. Problem 5: a. Using the data provided in problem 3, determine the return and risk for a portfolio comprised of the following three stocks if you wish to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG. (10 points) b. How would the portfolio be affected if you distributed your investment as follows: 30% in ADRE; 25% on MSFT and 45% on GOOG? (10 points) C. Which of the two portfolios would a risk-seeking investor prefer and why?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts