Question: Here are the answer options for each blank Grapefruit Inc. purchased Tangelo Inc for $1,000,000. Included in the purchase were tangible net assets with a

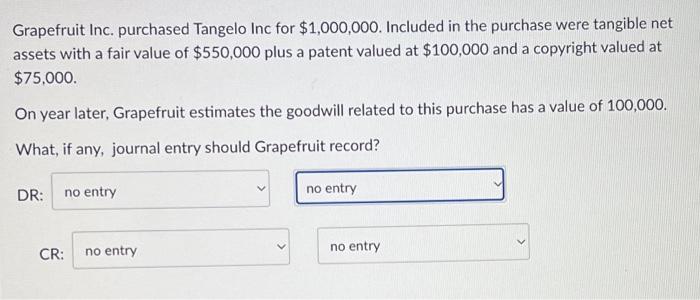

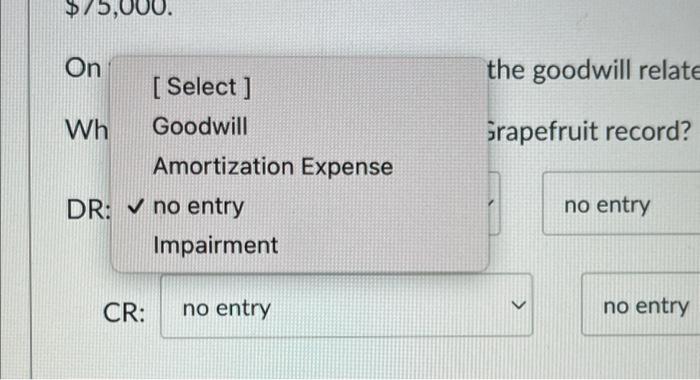

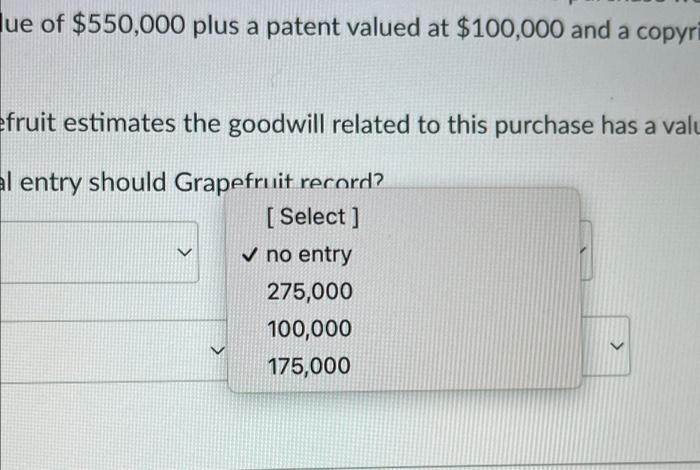

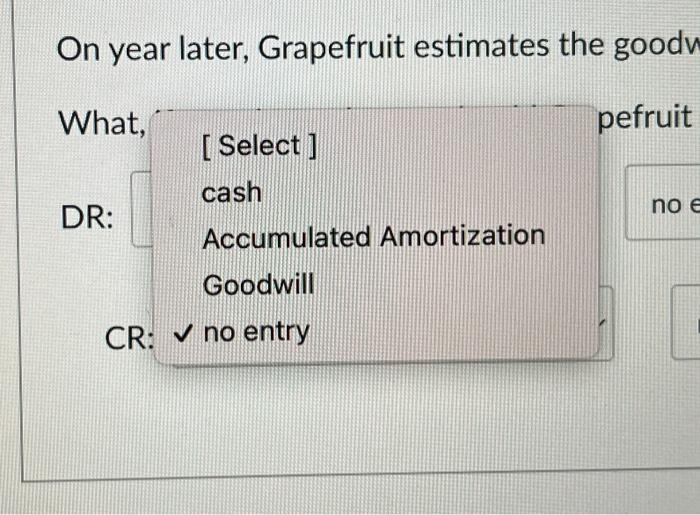

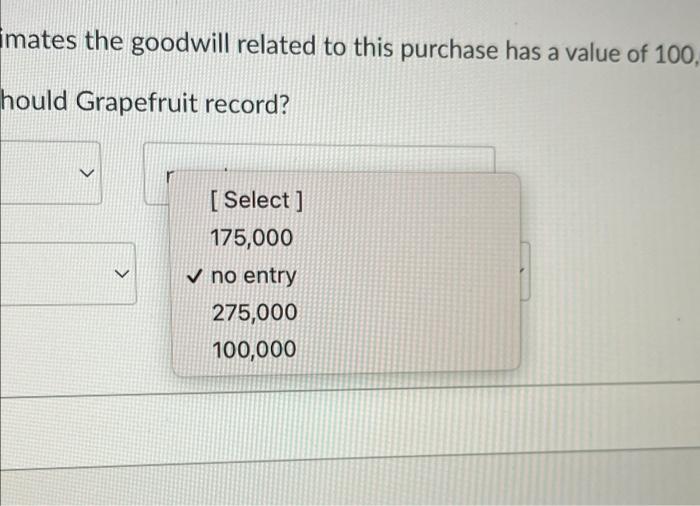

Grapefruit Inc. purchased Tangelo Inc for $1,000,000. Included in the purchase were tangible net assets with a fair value of $550,000 plus a patent valued at $100,000 and a copyright valued at $75,000. On year later, Grapefruit estimates the goodwill related to this purchase has a value of 100,000. What, if any, journal entry should Grapefruit record? DR: no entry no entry CR: no entry no entry $5,000. the goodwill relate Grapefruit record? On [ Select ] Wh Goodwill Amortization Expense DR: V no entry Impairment no entry CR: no entry no entry lue of $550,000 plus a patent valued at $100,000 and a copyri fruit estimates the goodwill related to this purchase has a valu > al entry should Grapefruit record? [Select] no entry 275,000 100,000 175,000 [ Select ] 175,000 no entry 275,000 100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts