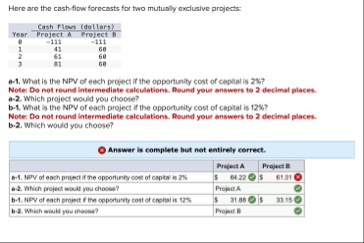

Question: Here are the cash - flow forecasts for two mutually exclusive projects: table [ [ , Cash rleas,Idoliars ) ] , [ Year ,

Here are the cashflow forecasts for two mutually exclusive projects:

tableCash rleas,IdoliarsYearProject AProject B

e What is the NPV of each project if the opportunity cost of capial is

Noter Do not round intermediate calculations. Round your answers to declmal places.

a Which project would you choose?

b What is the NPV of each project if the opporturity cost of ceptal is

Note: Do not round intermediate calculations. Aound your answers to decimal places. b Which would you choose?

Answer is complete but net entirely cerrect.

tableProjeat aProject EB MpY of each propet if the opportunly oont of captsi is e Which propect mowil you choose?,Projedt Ab Ne of each proinct if the opporturity cost of cephal is b Whish miuld you dhasea?,Projear,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock