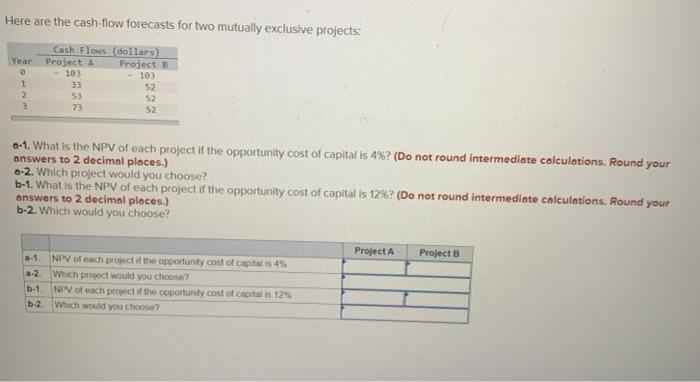

Question: Here are the cash-flow forecasts for two mutually exclusive projects: Cash Flows dollars) Year Project A Project B 0 103 - 103 33 53 73

Here are the cash-flow forecasts for two mutually exclusive projects: Cash Flows dollars) Year Project A Project B 0 103 - 103 33 53 73 52 1 2 52 52 4-1. What is the NPV of each project if the opportunity cost of capital is 4%? (Do not round intermediate calculations. Round your answers to 2 decimal places.) 1-2. Which project would you choose? b-1. What is the NPV of each project if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answers to 2 decimal places.) b-2. Which would you choose? Project A Projects 2.1 a-2 b-1 b-2 NPV of each project of the opportunity cost of capitalis 45 Which project would you choose? NPV of each project if the opportunity cost of capital is 12 Which would you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts