Question: Here are the expected cash flows for three projects: a. What is the payback period on each of the projects? b. If you use the

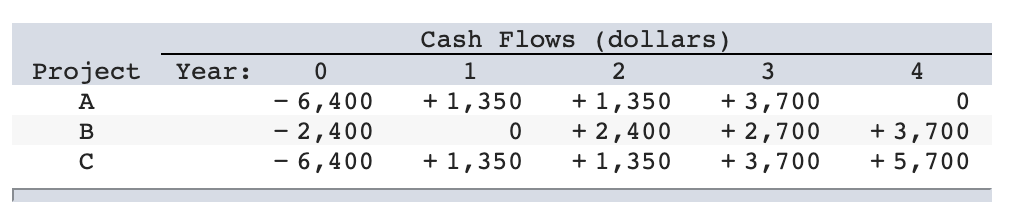

Here are the expected cash flows for three projects:

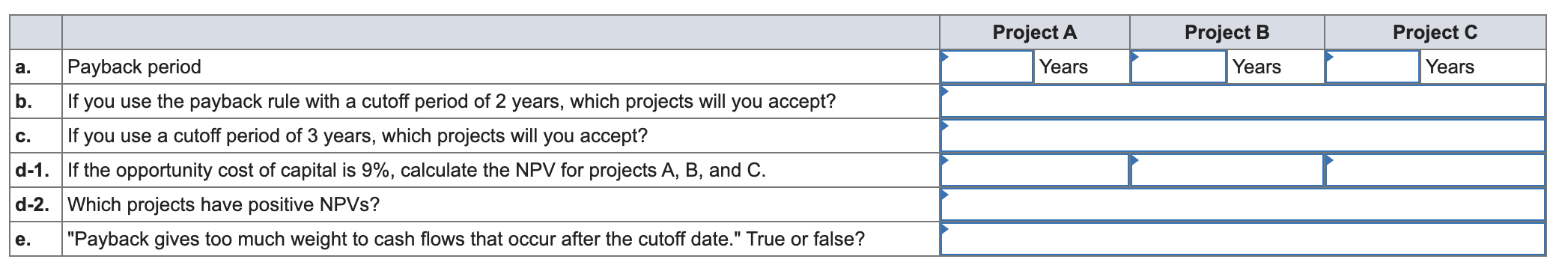

a. What is the payback period on each of the projects?

b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept?

c. If you use a cutoff period of 3 years, which projects will you accept?

d-1. If the opportunity cost of capital is 9%, calculate the NPV for projects A, B, and C.

d-2. Which projects have positive NPVs?

e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false?

\begin{tabular}{ccrrrrr} Project & \multicolumn{7}{c}{ Cash Flows (dollars) } \\ \cline { 2 - 7 } A & Year: & 0 & 1 & 2 & 3 & 4 \\ B & 6,400 & +1,350 & +1,350 & +3,700 & 0 \\ C & 2,400 & 0 & +2,400 & +2,700 & +3,700 \\ & & 6,400 & +1,350 & +1,350 & +3,700 & +5,700 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & & Project C & & Project A \\ \hline a. & Payback period & Years & Years \\ \hline b. & If you use the payback rule with a cutoff period of 2 years, which projects will you accept? \\ \hline c. & If you use a cutoff period of 3 years, which projects will you accept? \\ \hline d-1. & If the opportunity cost of capital is 9\%, calculate the NPV for projects A, B, and C. \\ \hline d-2. & Which projects have positive NPVs? & \\ \hline e. & "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts