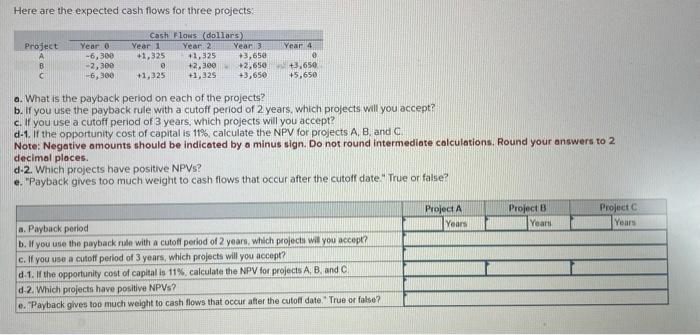

Question: Here are the expected cash flows for three projects: Cash Flows (dollars) Year 2 Project A B C Year 0 -6,300 -2,300 -6,300 Year

Here are the expected cash flows for three projects: Cash Flows (dollars) Year 2 Project A B C Year 0 -6,300 -2,300 -6,300 Year 1 +1,325 0 +1,325 +1,325 +2,300 +1,325 Year 3 +3,650 +2,650 +3,650 Year 4 e +3,650 +5,650 a. What is the payback period on each of the projects? b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? c. If you use a cutoff period of 3 years, which projects will you accept? d-1. If the opportunity cost of capital is 11%, calculate the NPV for projects A, B, and C Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. d-2. Which projects have positive NPVs? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? a. Payback period b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? c. If you use a cutoff period of 3 years, which projects will you accept? d-1. If the opportunity cost of capital is 11%, calculate the NPV for projects A, B, and C d-2. Which projects have positive NPVs? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? Project A Years Project B Years Project C Years

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

a Payback period for each project Project A Cumulative CF at Year 0 CF at Year 0 6300 Cumulative CF at Year 1 Cumulative CF at Year 0 CF at Year 1 630... View full answer

Get step-by-step solutions from verified subject matter experts