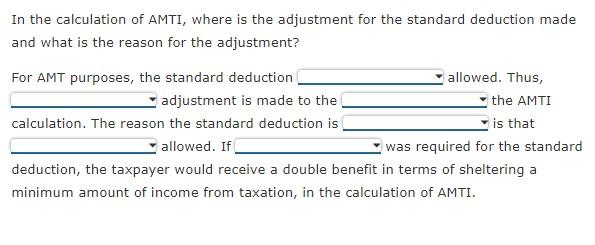

Question: Here are the options for each question starting with For AMT purposes... 1. is, is not 2. no, a positive, a negative 3. regular taxable

Here are the options for each question starting with "For AMT purposes..."

1. is, is not

2. no, a positive, a negative

3. regular taxable income starting point of, tentative minimum taxable amount of

4. allowed, not allowed

5. personal and dependency exemptions are, an AMT exemption is

6. an adjustment, no adjustment

In the calculation of AMTI, where is the adjustment for the standard deduction made and what is the reason for the adjustment? For AMT purposes, the standard deduction allowed. Thus, adjustment is made to the the AMTI calculation. The reason the standard deduction is is that allowed. If was required for the standard deduction, the taxpayer would receive a double benefit in terms of sheltering a minimum amount of income from taxation, in the calculation of AMTI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts