Question: Here are the problem and also its solution. My questions are: In part (b) why he repeated the equation with different result ?! And in

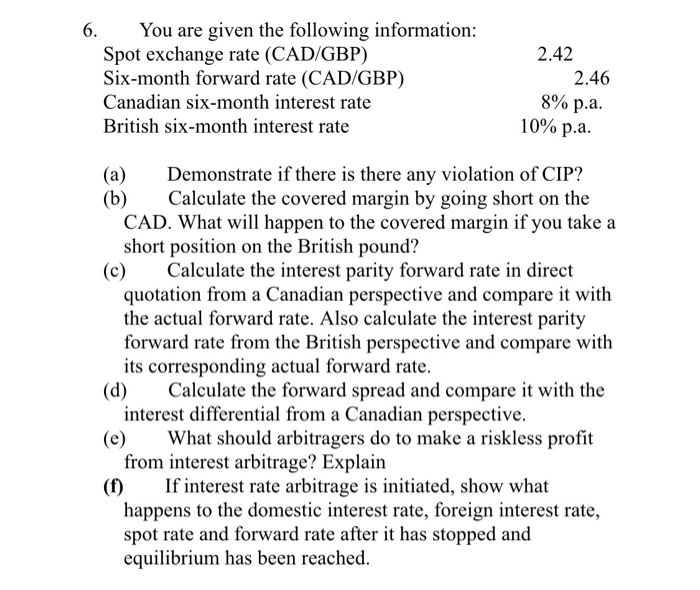

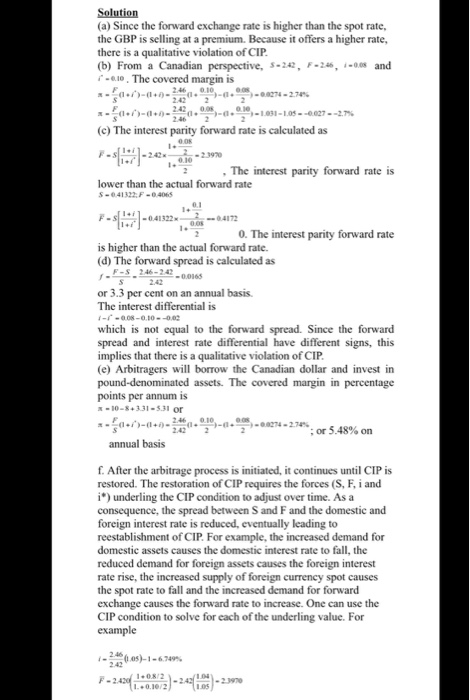

You are given the following information 2.42 Spot exchange rate (CAD/GBP) Six-month forward rate (CAD/GBP) Canadian six-month interest rate British six-month interest rate 2.46 2% p.a 10% p.a (a)Demonstrate if there is there any violation of CIP? (b) Calculate the covered margin by going short on the CAD. What will happen to the covered margin if you take a short position on the British pound? (c) Calculate the interest parity forward rate in direct quotation from a Canadian perspective and compare it with the actual forward rate. Also calculate the interest parity forward rate from the British perspective and compare with its corresponding actual forward rate (d)Calculate the forward spread and compare it with the (e)What should arbitragers do to make a riskless profit (f)If interest rate arbitrage is initiated, show what interest differential from a Canadian perspective from interest arbitrage? Explairn happens to the domestic interest rate, foreign interest rate, spot rate and forward rate after it has stopped and equilibrium has been reached Solution (a) Since the forward exchange rate is higher than the spot rate, the GBP is selling at a premium. Because it offers a higher rate, there is a qualitative violation of CIP (b) From a Canadian perspective, s.24, F-246,-014 and -810. The covered margin is 246 0.10 242 246 2 (c) The interest parity forward rate is calculated as . The interest parity forward rate is lower than the actual forward rate S..41322; F-04065 0.1 ,.1 ali"..1720. The interest parity forward rate um is higher than the actual forward rate. (d) The forward spread is calculated as F-S.246-242.0 2.42 or 3.3 per cent on an annual basis. The interest differential is which is not equal to the forward spread. Since the forward spread and interest rate differential have different signs, this implies that there is a qualitative violation of CIP (e) Arbitragers will borrow the Canadian dollar and invest in assets. The covered margin in percentage points per annum is -10-8+331-531 or 242 2 , or 5.48% on annual basis f. After the arbitrage process is initiated, it continues until CIP is restored. The restoration of CIP requires the forces (S, F, i and i) underling the CIP condition to adjust over time. As a consequence, the spread between S and F and the domestic and foreign interest rate is reduced, eventually leading to reestablishment of CIP. For example, the increased demand for domestic assets causes the domestic interest rate to fall, the reduced demand for foreign assets causes the foreign interest rat te rise, the increased supply of foreign currency spot the spot rate to fall and the increased demand for forward exchange causes the forward rate to increase. One can use the CIP condition to solve for each of the underling value. For example causes ( 05)--1-6749% 242 F-2.4200.10/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts