Question: here is an example with DVL to help with my questiom cause majority of DVL is getting answered incorrectly here on chegg i hope this

i hope this helps

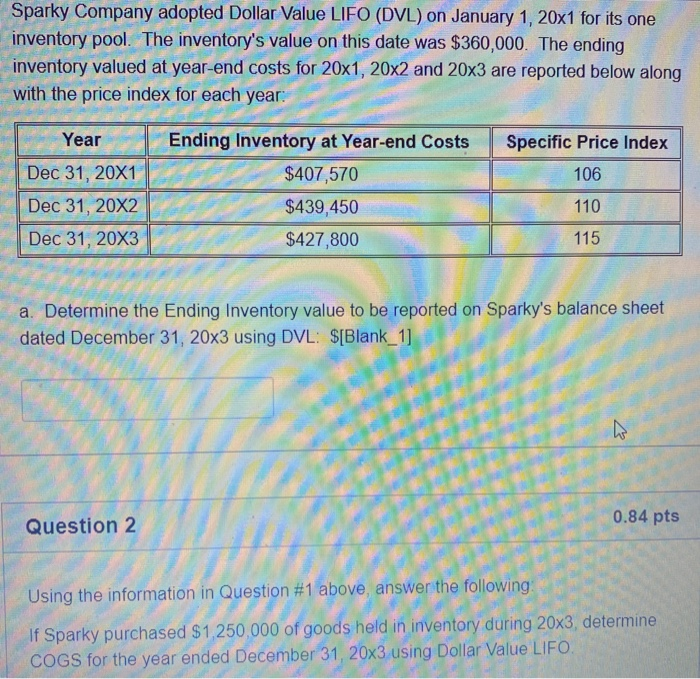

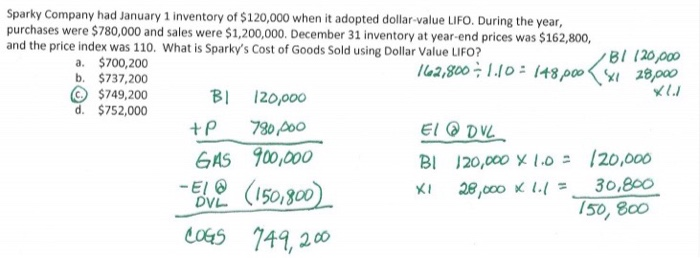

i hope this helpsSparky Company adopted Dollar Value LIFO (DVL) on January 1, 20x1 for its one inventory pool. The inventory's value on this date was $360,000. The ending inventory valued at year-end costs for 20x1, 20x2 and 20x3 are reported below along with the price index for each year: Year Specific Price Index 106 Dec 31, 20X1 Dec 31, 20X2 Dec 31, 20X3 Ending Inventory at Year-end Costs $407,570 $439,450 $427,800 110 115 a. Determine the Ending Inventory value to be reported on Sparky's balance sheet dated December 31, 20x3 using DVL: $[Blank_1] ET Question 2 0.84 pts Using the information in Question #1 above, answer the following: If Sparky purchased $1,250,000 of goods held in inventory during 20x3, determine COGS for the year ended December 31, 20x3 using Dollar Value LIFO. Dollar-value LIFO is an accounting method used for inventory that follows the last-in-first-out model. Dollar-value LIFO uses this approach with all figures in dollar amounts, rather than in inventory units. Oct 10, 2019 Investopedia terms > dollar-value-... Dollar-Value LIFO - Investopedia Sparky Company had January 1 inventory of $120,000 when it adopted dollar-value LIFO. During the year, purchases were $780,000 and sales were $1,200,000. December 31 inventory at year-end prices was $162,800, and the price index was 110. What is Sparky's Cost of Goods Sold using Dollar Value LIFO? B/ 120,000 a. $700,200 162,800 1.103 148 pooX 28000 b. $737,200 @ $749,200 BL 120,000 d. $752,000 +P 780,000 EI DVL GAS 900,000 BL 120,000 X 1.0 = 120,000 XI 28,000 x 1.1 30,800 DVL. -EL @ (150,800) COGS 749,200 150, 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts