Question: Here is an exercice. Thanks Question 3 Mapleleaf Inc. is a Canadian exporter of timber. Its largest export market is the US, and typically receives

Here is an exercice.

Thanks

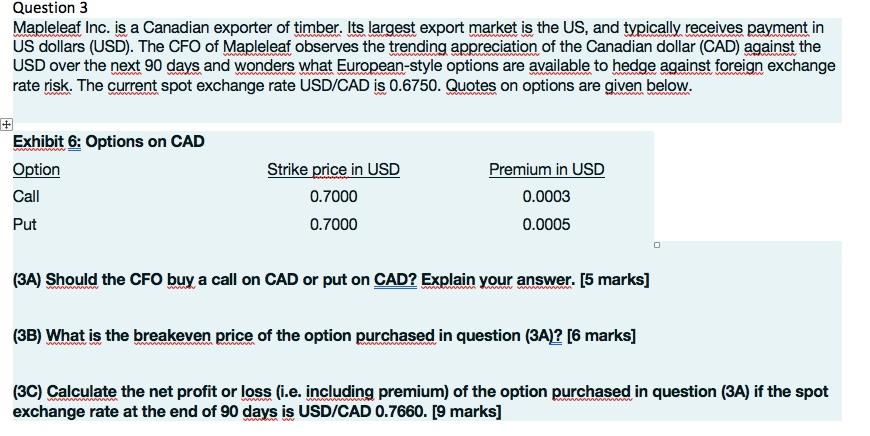

Question 3 Mapleleaf Inc. is a Canadian exporter of timber. Its largest export market is the US, and typically receives payment in US dollars (USD). The CFO of Mapleleaf observes the trending appreciation of the Canadian dollar (CAD) against the USD over the next 90 days and wonders what European-style options are available to hedge against foreign exchange rate risk. The current spot exchange rate USD/CAD is 0.6750. Quotes on options are given below. Exhibit 6: Options on CAD Option Call Put Strike price in USD 0.7000 0.7000 Premium in USD 0.0003 0.0005 (3A) Should the CFO buy a call on CAD or put on CAD? Explain your answer. [5 marks] (3B) What is the breakeven price of the option purchased in question (3A)? [6 marks] (3C) Calculate the net profit or loss (i.e. including premium) of the option purchased in question (3A) if the spot exchange rate at the end of 90 days is USD/CAD 0.7660. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts