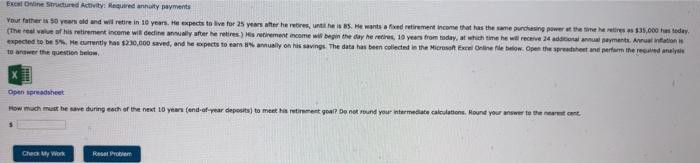

Question: here is excel for first question Ex Online Structured Activity: Required annaty payments Your father is 50 years old and will retire in 10 years.

here is excel for first question

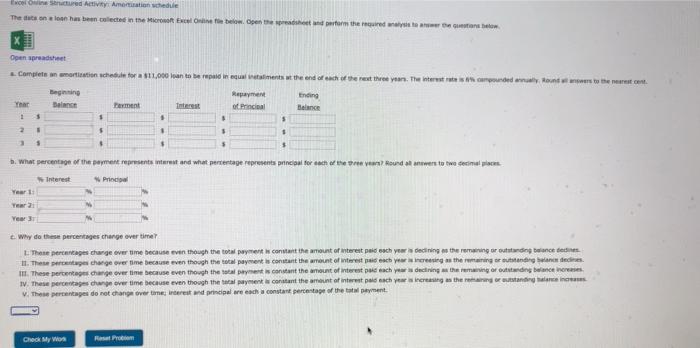

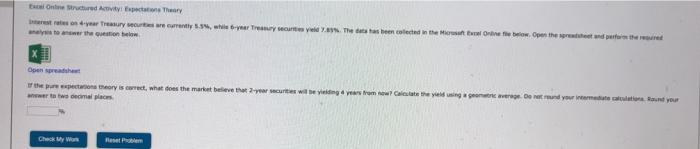

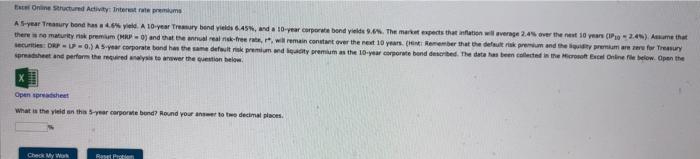

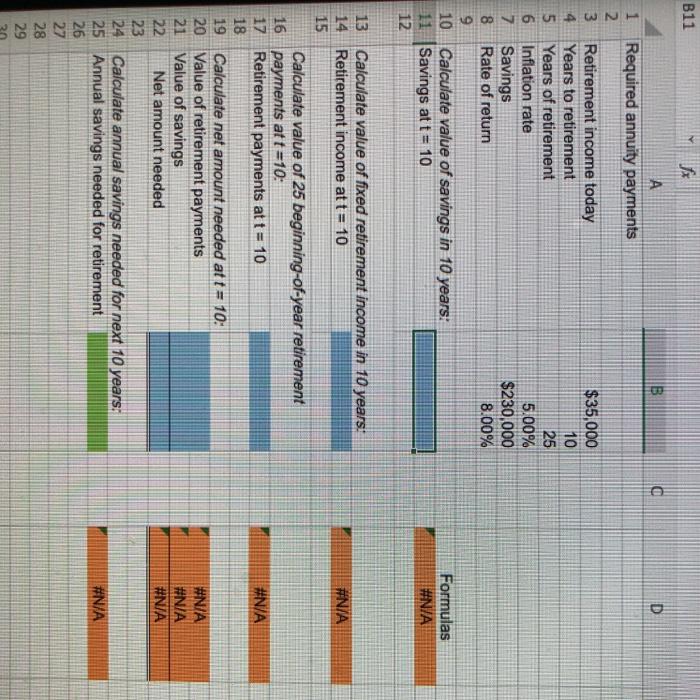

here is excel for first question Ex Online Structured Activity: Required annaty payments Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants and retirement income that has the same purchasing power the time here as 35,000 seday (the real w of his retirement income will decine y after he retires) s retirement income will begin the day he retires, 10 years from today, which time he will receive 24 addicionalmente. Anul fatin expected to be. He currently has 230,000 saved, and the expects to earn annually on his savings. The data has been collected in the Microsoft Excel Online belowOpen the sheet and perform the reared analysis tower the question below Open spreadsheet How much must be save during each of the next 10 years (and-of-year deposits to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the moont Cho My Work Problem Erol Own Structured Activity: Amortion schedule The one has been collected in the Microsoft Excel Online Open trasform their way to me Open spreadsheet Complete an amortion schedule for $11,000 an to be paid iniments at the end of each of the three years. The interested any unders to the Beginning Balance Repayment . Princi Ending Balance Payment Interest Yhar 1 2 1 $ $ 3 5 . 3 5 $ b. What percentage of the payment represents interest and what percentage represents principal for each other Round at we decine Interest Pro Year 1: Year Year 3 w do these percentages change over time Those percentage change over time because even though the payment content the amount of interest paidschyredning as the ordinance de 11. These percentages charge over time because even though the total payment is constant the amount of interest each year is increasing as the remaining standing and II. These percentage change over time because even though the lens constant the amount of interested each year dening the main or outstanding balance here IV. These percentages change over time because even though the total payment constant the amount of interested each year as the origin V. These pages do not change over time; irrest and principal or each constant percentage of the totalment Check My Won Online Structured Action Thery restres en ver Treasury secret 1.5%, while your resury curses. The data as een colected in the Mortal Onto the below Oes the present and pastered later the below Open space ponoris corect, what does the market believe that year curities will be viedinger om water they got av Dound your relation and your wwwert w cimal places Check My Wom Reset Palm Online Structured Activity interest rate premium Ayear Treasury bond has sed. A 10-year roury bend yields 45%, and a 10-year corporwe bond yields. The martupects that inflation will average 24th et 10 years (IP-24N) Asume that there mature premum (MRP) and that the annual real risk-free +, will remain content over the next 10 years. Remember that the default risk prem and the primarea for Treasury securities: -0.) A Ser corporate and has sam defuit risk premium and laty premium as the 10-year carte band described. The data has been collected in the Microsoft Excel Online fillow. Open the spreadsheet and perform the indlysis to wwer the question below Open spreadsheet What is the yield on this year carporte band? Round your ato te decimal places Check My W Rath B11 D 1 Required annuity payments 2. 3 Retirement income today 4. Years to retirement 5 Years of retirement 6 Inflation rate 7 Savings 8 Rate of return 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 $35,000 10 25 5.00% $230,000 8.00% Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income at t = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t=10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 23 24 Calculate annual savings needed for next 10 years: 25 Annual savings needed for retirement 26 27 #N/A #N/A #N/A #N/A 28 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts