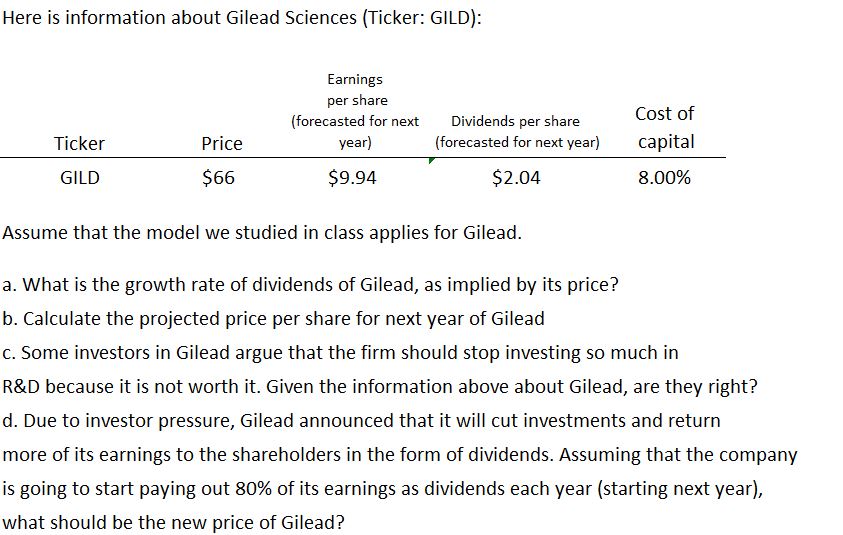

Question: Here is information about Gilead Sciences (Ticker: GILD): Ticker GILD Price $66 Earnings per share (forecasted for next year) $9.94 Dividends per share (forecasted

Here is information about Gilead Sciences (Ticker: GILD): Ticker GILD Price $66 Earnings per share (forecasted for next year) $9.94 Dividends per share (forecasted for next year) $2.04 Cost of capital 8.00% Assume that the model we studied in class applies for Gilead. a. What is the growth rate of dividends of Gilead, as implied by its price? b. Calculate the projected price per share for next year of Gilead c. Some investors in Gilead argue that the firm should stop investing so much in R&D because it is not worth it. Given the information above about Gilead, are they right? d. Due to investor pressure, Gilead announced that it will cut investments and return more of its earnings to the shareholders in the form of dividends. Assuming that the company is going to start paying out 80% of its earnings as dividends each year (starting next year), what should be the new price of Gilead?

Step by Step Solution

There are 3 Steps involved in it

To answer the questions we can use the Gordon Growth Model also known as the Dividend Discount Model ... View full answer

Get step-by-step solutions from verified subject matter experts