Question: Here is my final question. NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington

Here is my final question.

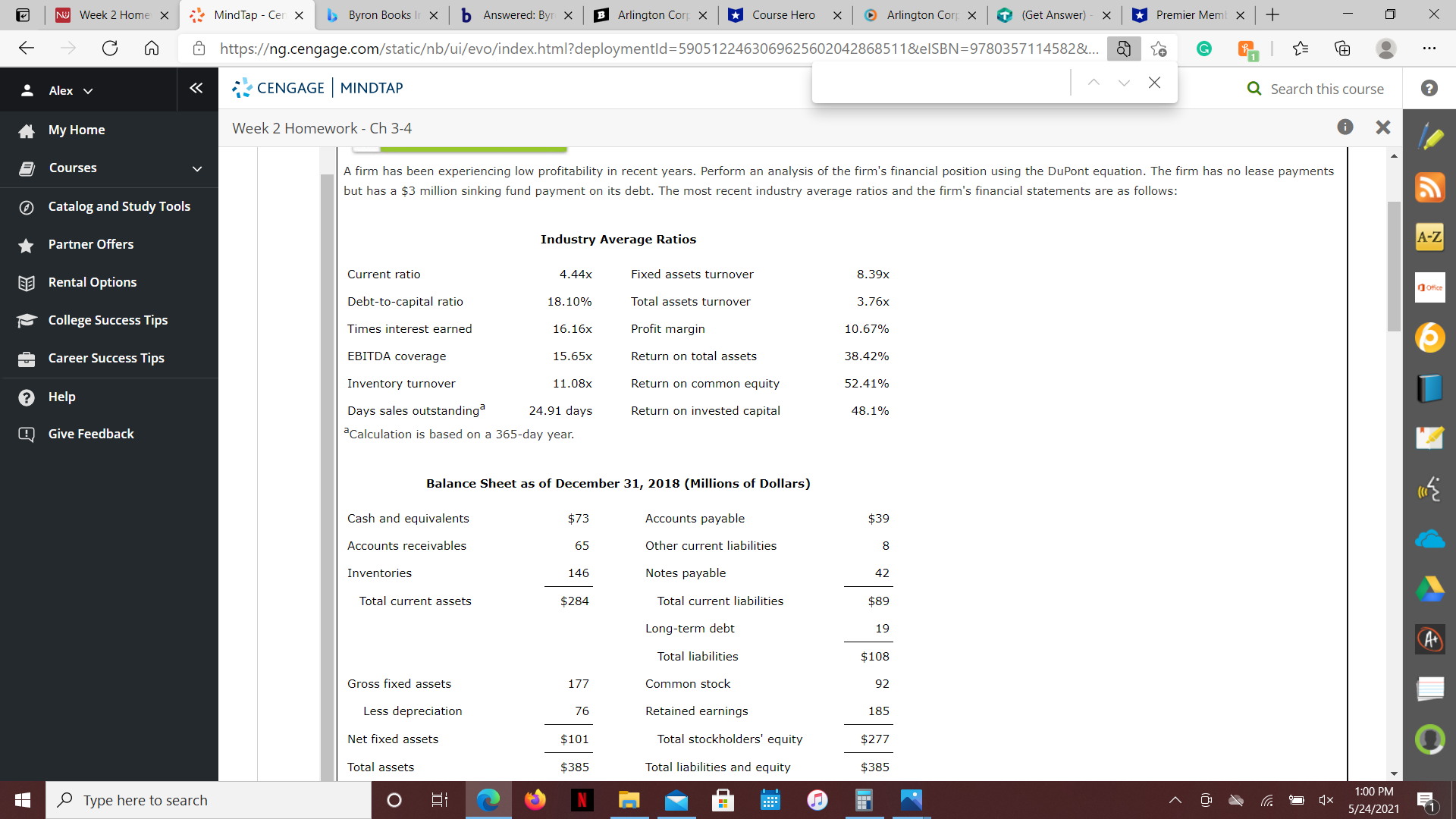

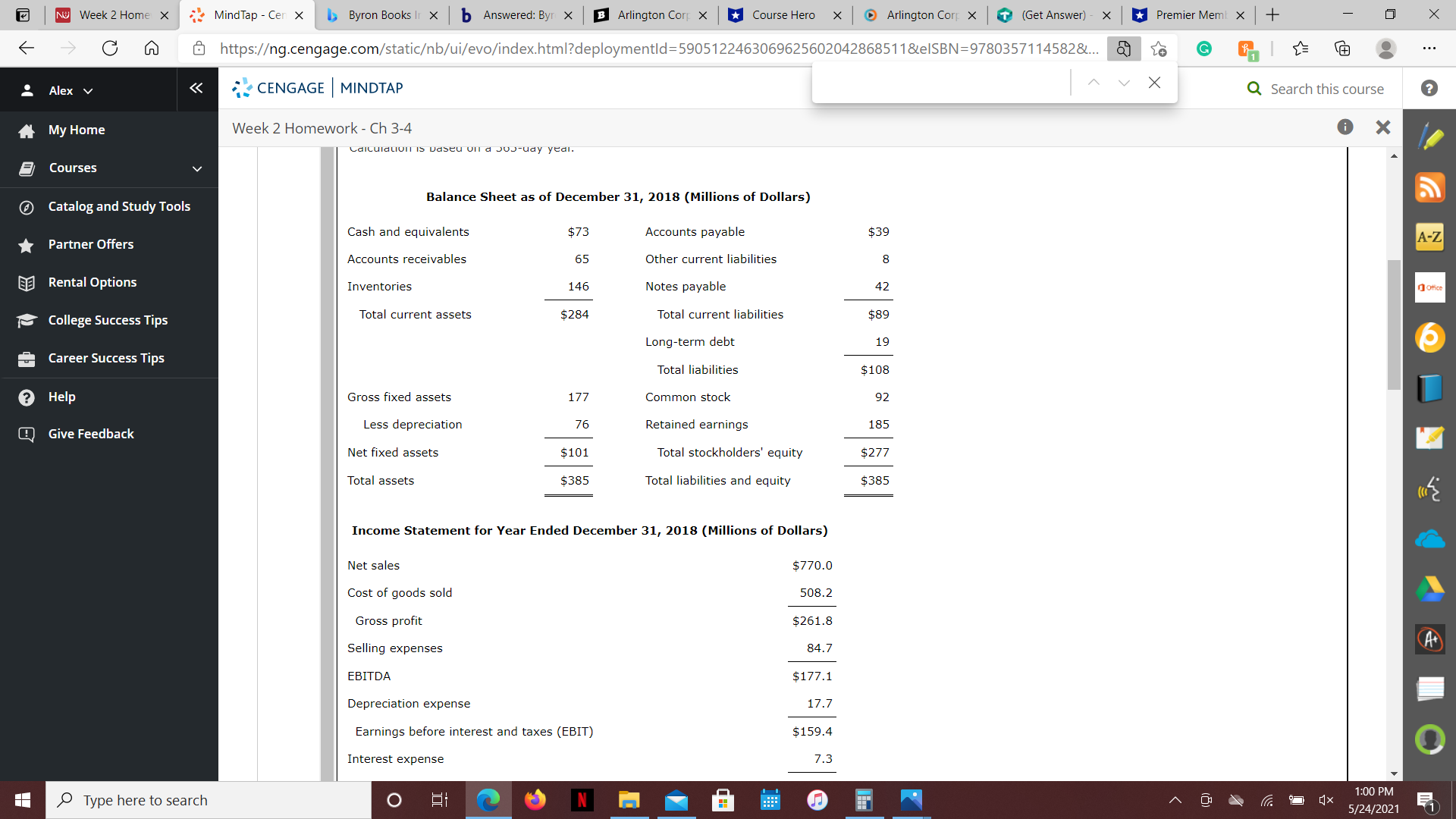

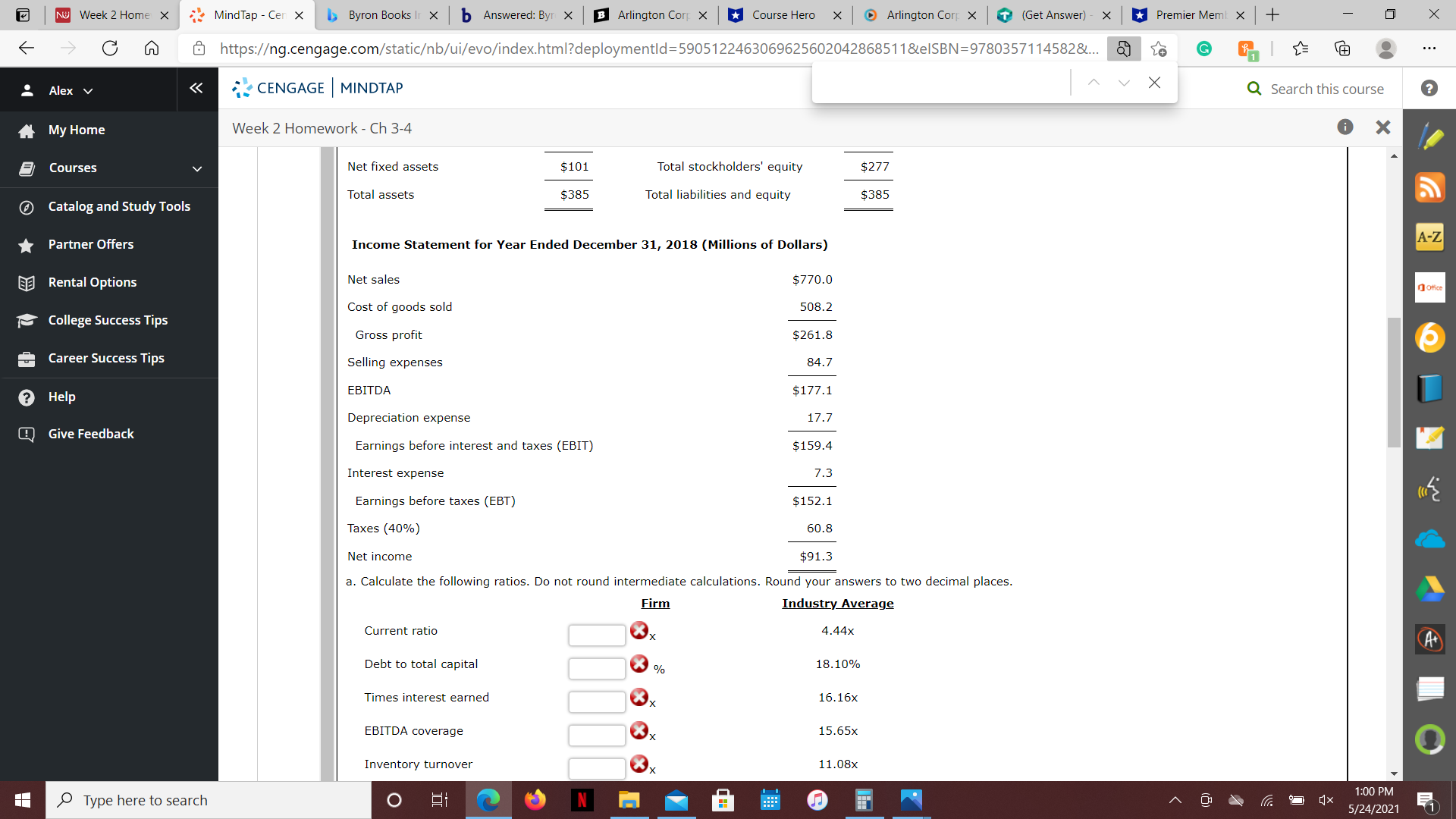

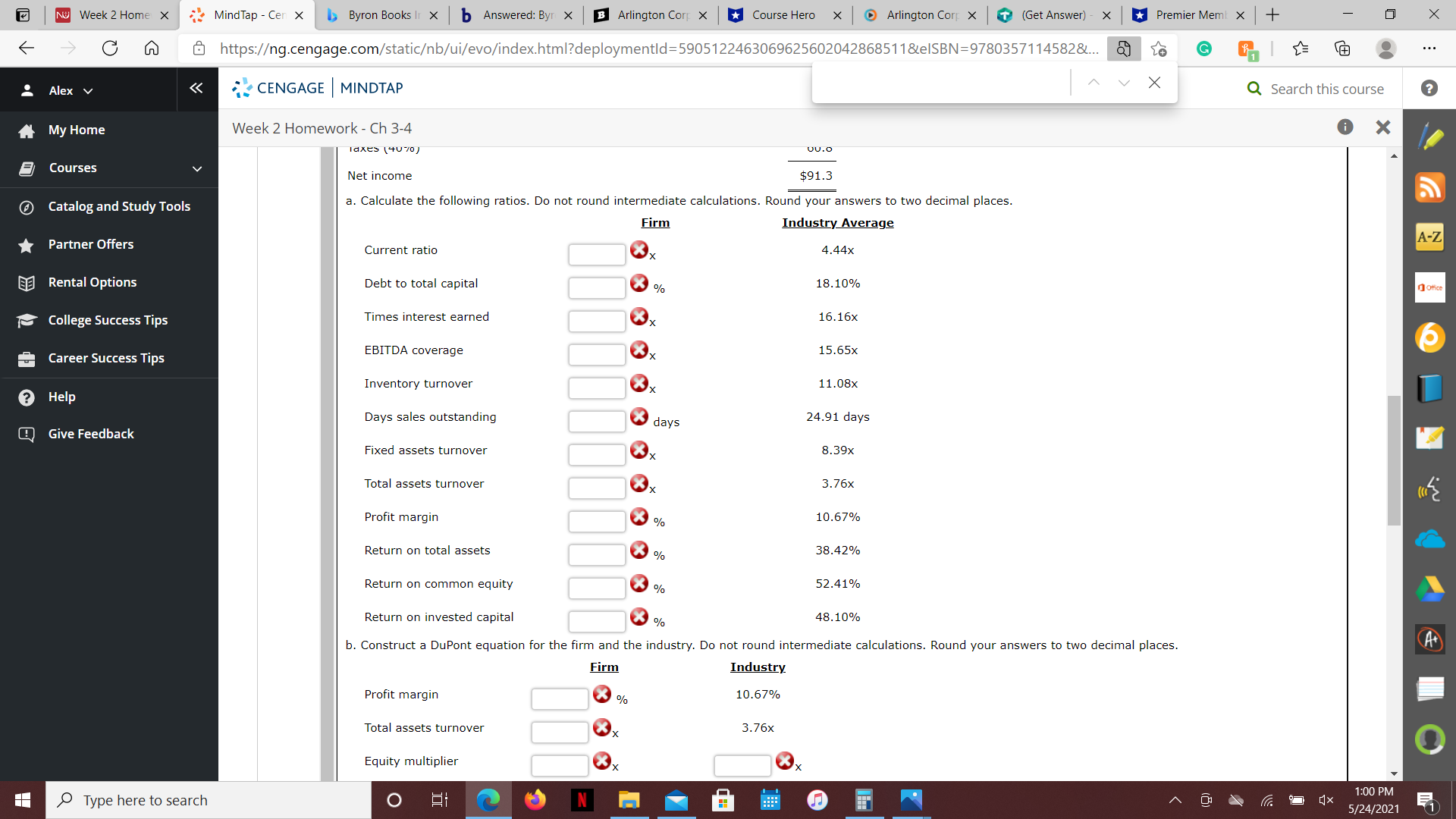

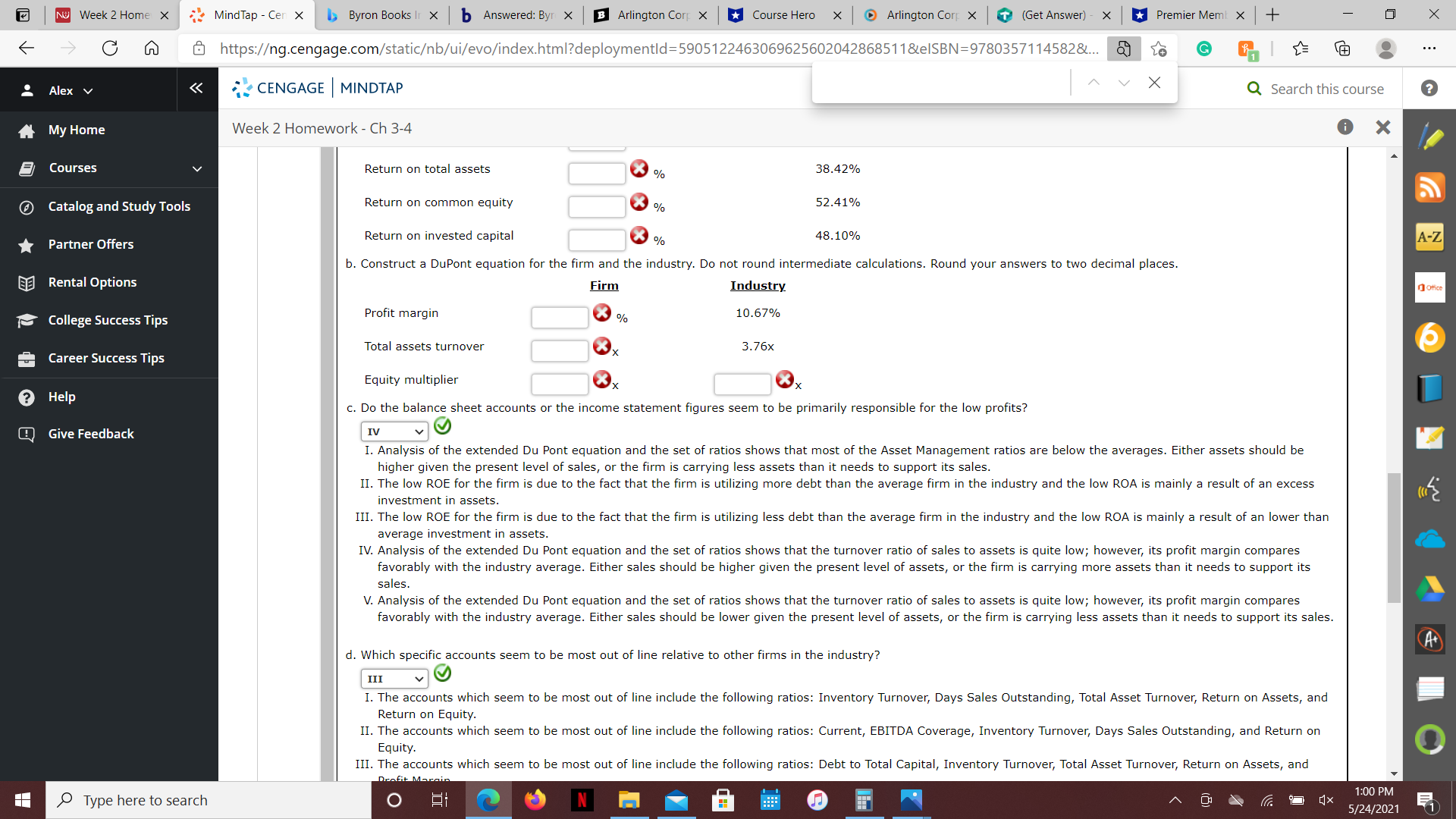

NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington Corp x Course Hero X Arlington Corp X T (Get Answer) - X Premier Meml X + X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5905122463069625602042868511&elSBN=9780357114582&... 29 to G . . . Alex v CENGAGE MINDTAP v X Q Search this course ? My Home Week 2 Homework - Ch 3-4 X Courses A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's financial position using the DuPont equation. The firm has no lease payments but has a $3 million sinking fund payment on its debt. The most recent industry average ratios and the firm's financial statements are as follows: Catalog and Study Tools Partner Offers Industry Average Ratios A-Z Fixed assets turnover 8.39x Rental Options Current ratio 4.44x Office Debt-to-capital ratio 18.10% Total assets turnover 3.76x College Success Tips Times interest earned 16.16x Profit margin 10.67% Career Success Tips EBITDA coverage 15.65x Return on total assets 38.42% Inventory turnover 11.08x Return on common equity 52.41% ? Help Days sales outstanding 24.91 days Return on invested capital 48.1% Q Give Feedback aCalculation is based on a 365-day year. Balance Sheet as of December 31, 2018 (Millions of Dollars) Cash and equivalents $73 Accounts payable $39 Accounts receivables 65 Other current liabilities 8 Inventories 146 Notes payable 42 Total current assets $284 Total current liabilities $89 Long-term debt 19 At Total liabilities $108 Gross fixed assets 177 Common stock 92 Less depreciation 76 Retained earn 185 Net fixed assets $101 Total stockholders' equity $277 Total assets $385 Total liabilities and equity $385 Type here to search O N 1:00 PM E. 5/24/2021NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington Corp X Course Hero X Arlington Corp X T (Get Answer) - X Premier Meml X + X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5905122463069625602042868511&elSBN=9780357114582&... 29 to G . . . Alex v CENGAGE MINDTAP v X Q Search this course ? My Home Week 2 Homework - Ch 3-4 X Calculation Is based on a JuJ-udy yedi. Courses Catalog and Study Tools Balance Sheet as of December 31, 2018 (Millions of Dollars) Cash and equivalents $73 Accounts payable $39 Partner Offers A-Z Accounts receivables 65 her current liabilities 8 Rental Options Inventories 146 Notes payable 42 Office College Success Tips Total current assets $284 Total current liabilities $89 Long-term debt 19 O Career Success Tips Total liabilities $108 ? Help Gross fixed assets 177 Common stock 92 Less depreciation 76 Retained earnings 185 Q Give Feedback Net fixed assets $101 Total stockholders' equity $277 Total assets $385 Total liabilities and equity $385 Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales $770.0 Cost of goods sold 508.2 Gross profit $261.8 Selling expenses 84.7 At EBITDA $177.1 Depreciation expense 17.7 Earnings before interest and taxes (EBIT) $159.4 Interest expense 7.3 Type here to search O 1:00 PM E. 5/24/2021NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington Corp x Course Hero X Arlington Corp X T (Get Answer) - X Premier Meml X + X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5905122463069625602042868511&elSBN=9780357114582&... 29 to G . . . Alex v CENGAGE MINDTAP v X Q Search this course ? My Home Week 2 Homework - Ch 3-4 X Courses Net fixed assets $101 Total stockholders' equity $277 Total assets $385 Total liabilities and equity $385 Catalog and Study Tools Partner Offers Income Statement for Year Ended December 31, 2018 (Millions of Dollars) A-Z Rental Options Net sales $770.0 Ofice Cost of goods sold 508.2 College Success Tips Gross profit $261.8 Career Success Tips Selling expenses 84.7 ? Help EBITDA $177.1 Depreciation expense 17.7 Q Give Feedback Earnings before interest and taxes (EBIT) $159.4 Interest expense 7.3 Earnings before taxes (EBT) $152.1 Taxes (40%) 60.8 Net income $91.3 a. Calculate the following ratios. Do not round intermediate calculations. Round your answers to two decimal places. Firm Industry Average Current ratio X x 4.44x At Debt to total capital 18.10% Times interest earned Xx 16.16x EBITDA coverage Xx 15.65x Inventory turnover X. 11.08x Type here to search O 1:00 PM E. 5/24/2021NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington Corp x Course Hero X Arlington Corp X T (Get Answer) - X Premier Meml X + X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5905122463069625602042868511&elSBN=9780357114582&... 29 to G . . . CENGAGE | MINDTAP v X Alex v Q Search this course ? My Home Week 2 Homework - Ch 3-4 X laxes ( 4070 ) UU.O Courses Net income $91.3 Catalog and Study Tools a. Calculate the following ratios. Do not round intermediate calculations. Round your answers to two decimal places. Firm Industry Average A-Z Partner Offers Current ratio Xx 4.44X Rental Options Debt to total capital * % 18.10% Office College Success Tips Times interest earned Xx 16.16x O EBITDA coverage 15.65x Career Success Tips X x Inventory turnover X x 11.08x ? Help Days sales outstanding X 24.91 day Q Give Feedback Fixed assets turnover 8.39x Total assets turnover 3.76x Profit margin 10.67% Return on total assets 38.42% Return on common equity 52.41% Return on invested capital 48.10% b. Construct a DuPont equation for the firm and the industry. Do not round intermediate calculations. Round your answers to two decimal places. At Firm Industry Profit margin % 10.67% Total assets turnover X x 3.76x Equity multiplier X x 1:00 PM Type here to search O CH E. 5/24/2021NO Week 2 Home X MindTap - Cen X > Byron Books Ir X b Answered: Byr X B Arlington Corp x Course Hero X Arlington Corp X T (Get Answer) - X Premier Meml X + X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=5905122463069625602042868511&elSBN=9780357114582&... 29 to G . . . Alex v CENGAGE | MINDTAP v X Q Search this course ? My Home Week 2 Homework - Ch 3-4 X Courses Return on total assets 38.42% Catalog and Study Tools Return on common equity 52.41% Return on invested capital 48.10% A-Z Partner Offers b. Construct a DuPont equation for the firm and the industry. Do not round intermediate calculations. Round your answers to two decimal places. Rental Options Firm Industry Office College Success Tips Profit margin 10.67% Total assets turnover Xx 3.76x O Career Success Tips Equity multiplier X x ? Help c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? Q Give Feedback IV V V I. Analysis of the extended Du Pont equation and the set of ratios shows that most of the Asset Management ratios are below the averages. Either assets should be higher given the present level of sales, or the firm is carrying less assets than it needs to support its sales. II. The low ROE for the firm is due to the fact that the firm is utilizing more debt than the average firm in the industry and the low ROA is mainly a result of an excess investment in assets. III. The low ROE for the firm is due to the fact that the firm is utilizing less debt than the average firm in the industry and the low ROA is mainly a result of an lower than average investment in assets. IV. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low; however, its profit margin compares favorably with the industry average. Either sales should be higher given the present level of assets, or the firm is carrying more assets than it needs to support its sales. V. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low; however, its profit margin compares favorably with the industry average. Either sales should be lower given the present level of assets, or the firm is carrying less assets than it needs to support its sales. A+ d. Which specific accounts seem to be most out of line relative to other firms in the industry? III V V I. The accounts which seem to be most out of line include the following ratios: Inventory Turnover, Days Sales Outstanding, Total Asset Turnover, Return on Assets, and Return on Equity. II. The accounts which seem to be most out of line include the following ratios: Current, EBITDA Coverage, Inventory Turnover, Days Sales Outstanding, and Return on Equity. III. The accounts which seem to be most out of line include the following ratios: Debt to Total Capital, Inventory Turnover, Total Asset Turnover, Return on Assets, and profit Mar Type here to search 1:00 PM O N 5/24/2021 E