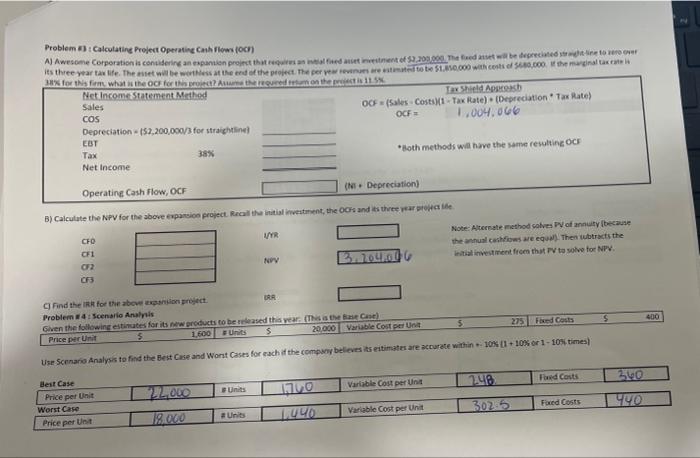

Question: here is my problem Problem Calculating Project Operating Cash Flows toch AlAwesome Corporation is considering an expansion project that required an intent of $2,200.000 meteed

Problem Calculating Project Operating Cash Flows toch AlAwesome Corporation is considering an expansion project that required an intent of $2,200.000 meteed net wat be deprecies weet were its three year taxite. The set will be wortes at the end of the project. The per veteenused to be S110.000 with costi e S680,000 the marginal 30% for this form what the Oct for this point? A on the is Net Income Statement Method Tax Shield Aps och Sales OOF (Sales Costi)(1 - Tax Rate) (Depreciation Tax Rate) COS OCF 004.000 Depreciation (52,200,000/3 for straightline) EBT Tax 38% Both methods will have the same resulting OCH Net Income Operating Cash Flow, OCH (N. Depreciation B) Calculate the NPV for the above expansion project Recall the initial investment, the Ocks and its three year proteste CFO VYR Note: Alternate method solves Parannuity because CF1 the annual cashflows are equa). Then subtracts the 02 NOV BLOG natal investment from that to solve to NPV. Find the IRR for the above on project Problem 4: Scenario Analysis Given the following estimates for its new products to be released this year. This is the face Price per Unit 1,600 Units $ 20.000 Variable Coster Unit 400 275 Fixed Costs $ Use Scenario Analysis to find the Best Case and Worst cases for each of the company believes its estimates are accurate within 10 01 +10% or 1 - 105 times Ford Costs 248 220 Variable Cost per Unit Units 110 Best Case Price per Unit Worst Case Price per Unit Foxed Costs 302.5 TO #Units Variable Cost per Unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts