Question: Here is Question 3 with a better image quality : Question 3 10 Points (a) Archetrave plc has an equity beta of 1.5. The company

Here is Question 3 with a better image quality :

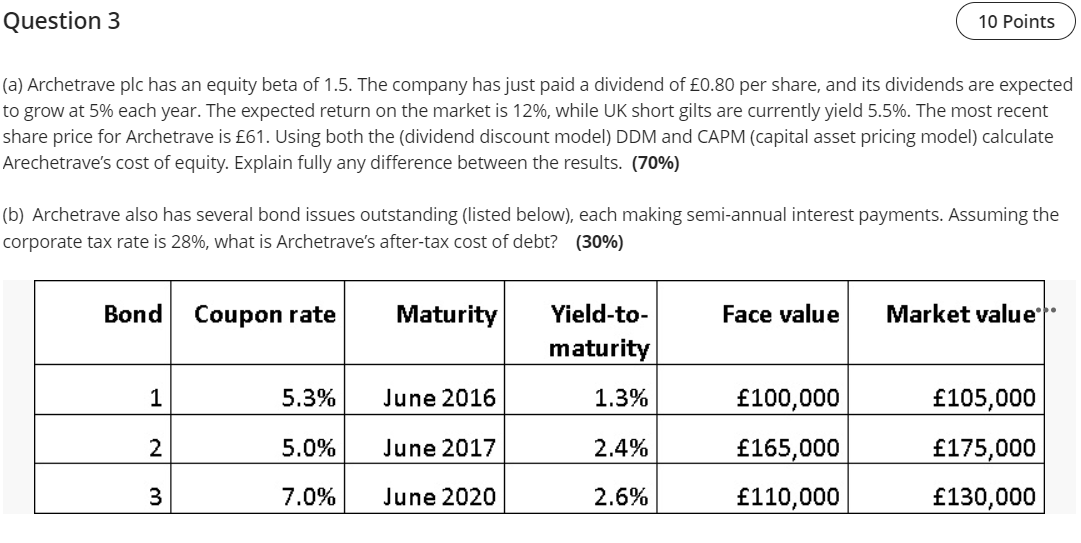

Question 3 10 Points (a) Archetrave plc has an equity beta of 1.5. The company has just paid a dividend of 0.80 per share, and its dividends are expected to grow at 5% each year. The expected return on the market is 12%, while UK short gilts are currently yield 5.5%. The most recent share price for Archetrave is 61. Using both the (dividend discount model) DDM and CAPM (capital asset pricing model) calculate Arechetrave's cost of equity. Explain fully any difference between the results. (70%) (b) Archetrave also has several bond issues outstanding (listed below), each making semi-annual interest payments. Assuming the corporate tax rate is 28%, what is Archetrave's after-tax cost of debt? (30%) Bond Coupon rate Maturity Face value Market value Yield-to- maturity 1 5.3% June 2016 1.3% 105,000 100,000 165,000 5.0% June 2017 2.4% WN 175,000 130,000 7.0% June 2020 2.6% 110,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts