Question: Here is question 6 information: The EagleEye is a small firm that manufactures special ski goggles. The company has the opportunity to sell a particular

Here is question 6 information:

The EagleEye is a small firm that manufactures special ski goggles. The company has the opportunity to sell a particular model to The Outdoor Store, a well-known retailer of sports and outdoor gear. The EagleEye is considering signing a business contract with The Outdoor Store. Here is how the contract works.

Contract-1. The Outdoor Store will order the goods from EagleEye three months before the winter season. EagleEye will produce the exact quantity that The Outdoor Store orders. All units produced will be shipped to the store at the beginning of the winter season. EagleEye will sell the product to The Outdoor Store for $150 per unit and agrees to credit The Outdoor Store $75 for each unit returned to EagleEye at the end of the winter (because those units did not sell).

The seasons demand for this model at The Outdoor Store will be normally distributed with mean of 1500 units and standard deviation of 300 units. The Outdoor Store will sell the ski goggles for $300 per unit. EagleEye produces each goggle at a cost of $100. Since styles change from year to year, there is essentially no value of returned merchandise to EagleEye.

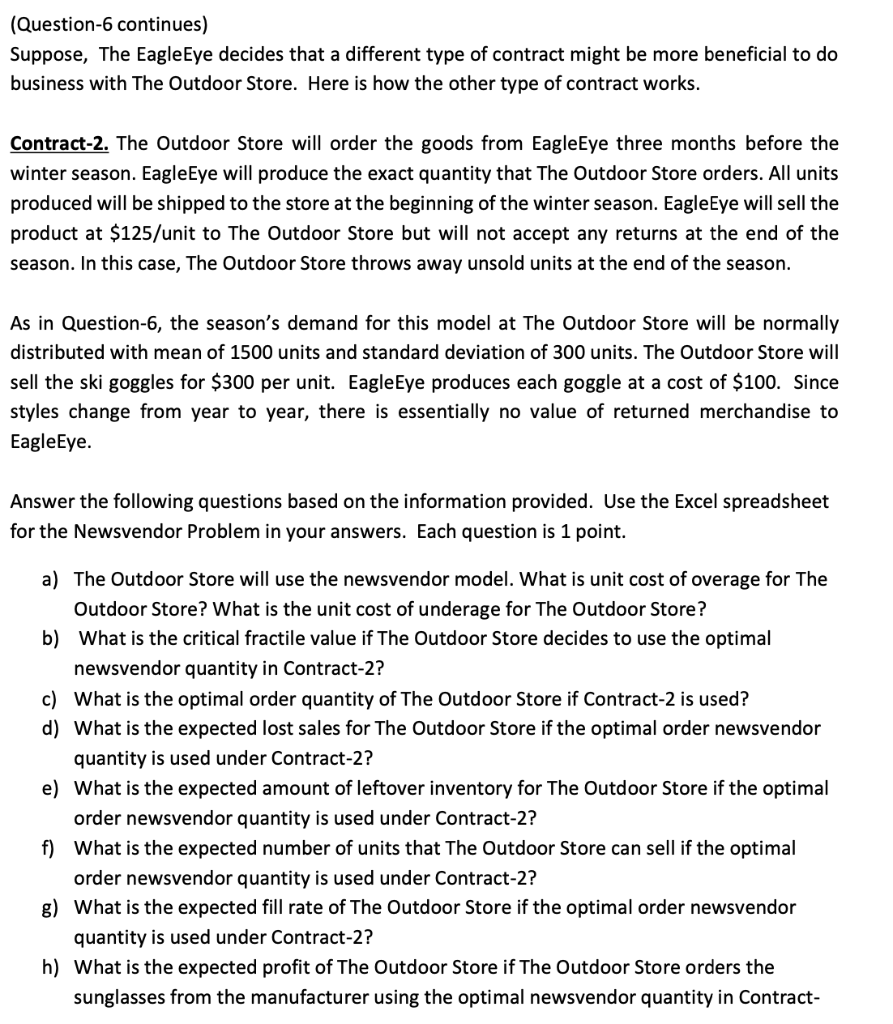

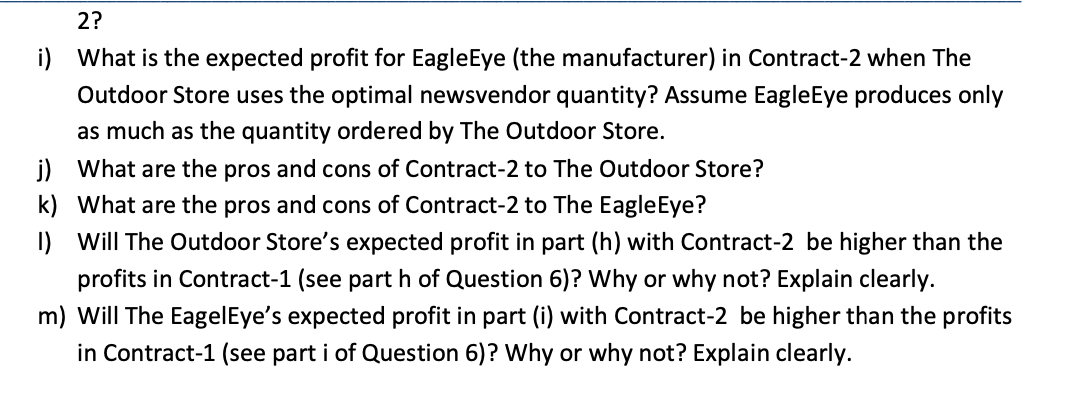

(Question-6 continues) Suppose, The EagleEye decides that a different type of contract might be more beneficial to do business with The Outdoor Store. Here is how the other type of contract works. Contract-2. The Outdoor Store will order the goods from EagleEye three months before the winter season. EagleEye will produce the exact quantity that The Outdoor Store orders. All units produced will be shipped to the store at the beginning of the winter season. EagleEye will sell the product at $125/unit to The Outdoor Store but will not accept any returns at the end of the season. In this case, The Outdoor Store throws away unsold units at the end of the season. As in Question-6, the season's demand for this model at The Outdoor Store will be normally distributed with mean of 1500 units and standard deviation of 300 units. The Outdoor Store will sell the ski goggles for $300 per unit. EagleEye produces each goggle at a cost of $100. Since styles change from year to year, there is essentially no value of returned merchandise to EagleEye. Answer the following questions based on the information provided. Use the Excel spreadsheet for the Newsvendor Problem in your answers. Each question is 1 point. a) The Outdoor Store will use the newsvendor model. What is unit cost of overage for The Outdoor Store? What is the unit cost of underage for The Outdoor Store? b) What is the critical fractile value if The Outdoor Store decides to use the optimal newsvendor quantity in Contract-2? c) What is the optimal order quantity of The Outdoor Store if Contract-2 is used? d) What is the expected lost sales for The Outdoor Store if the optimal order newsvendor quantity is used under Contract-2? e) What is the expected amount of leftover inventory for The Outdoor Store if the optimal order newsvendor quantity is used under Contract-2? f) What is the expected number of units that The Outdoor Store can sell if the optimal order newsvendor quantity is used under Contract-2? g) What is the expected fill rate of The Outdoor Store if the optimal order newsvendor quantity is used under Contract-2? h) What is the expected profit of The Outdoor Store if The Outdoor Store orders the sunglasses from the manufacturer using the optimal newsvendor quantity in Contract- 2? i) What is the expected profit for EagleEye (the manufacturer) in Contract-2 when The Outdoor Store uses the optimal newsvendor quantity? Assume EagleEye produces only as much as the quantity ordered by The Outdoor Store. j) What are the pros and cons of Contract-2 to The Outdoor Store? k) What are the pros and cons of Contract-2 to The EagleEye? 1) Will The Outdoor Store's expected profit in part (h) with Contract-2 be higher than the profits in Contract-1 (see part h of Question 6)? Why or why not? Explain clearly. m) Will The EagelEye's expected profit in part (i) with Contract-2 be higher than the profits in Contract-1 (see part i of Question 6)? Why or why not? Explain clearlyStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts