Question: Here is the answer from part A that will help you answer this long question: your question asks you to use WACC from 1A which

Here is the answer from part A that will help you answer this long question: your question asks you to use WACC from 1A which is 12.0% so use that for your question. thank u!

![[A] Standalone Valuation. (5 points) Forecast pro-forma unlevered income statements for the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe6d4b1985e_15466fe6d4aaa86c.jpg)

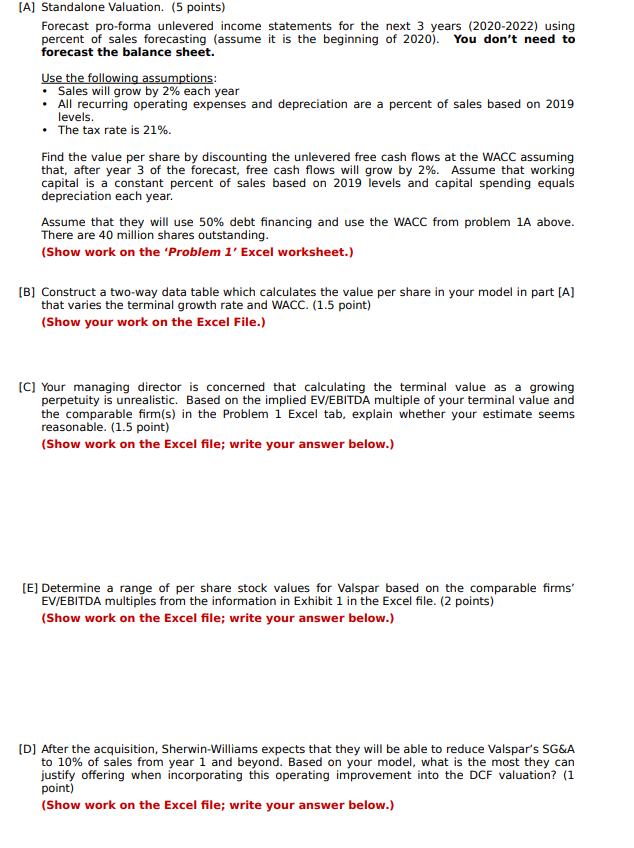

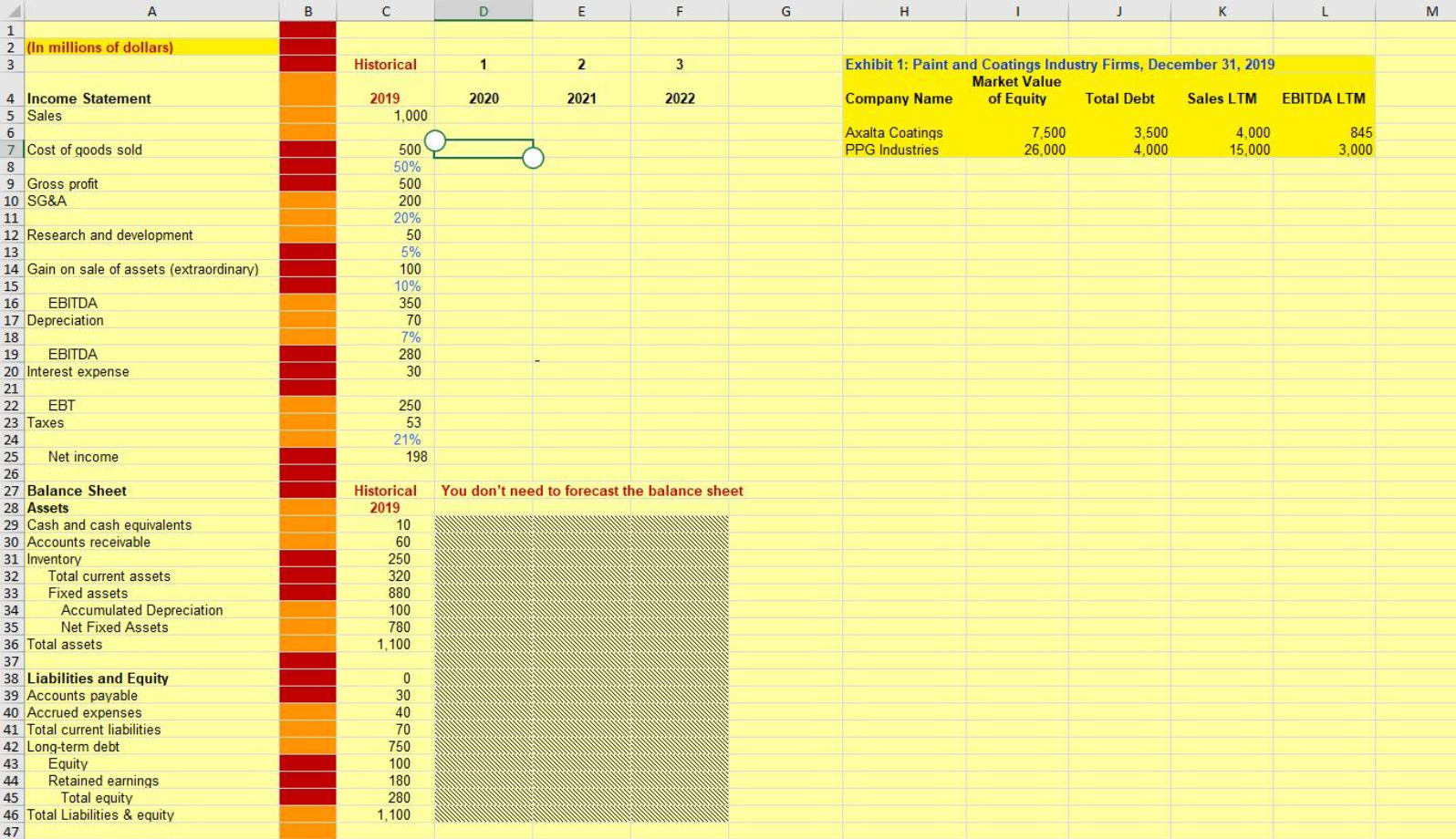

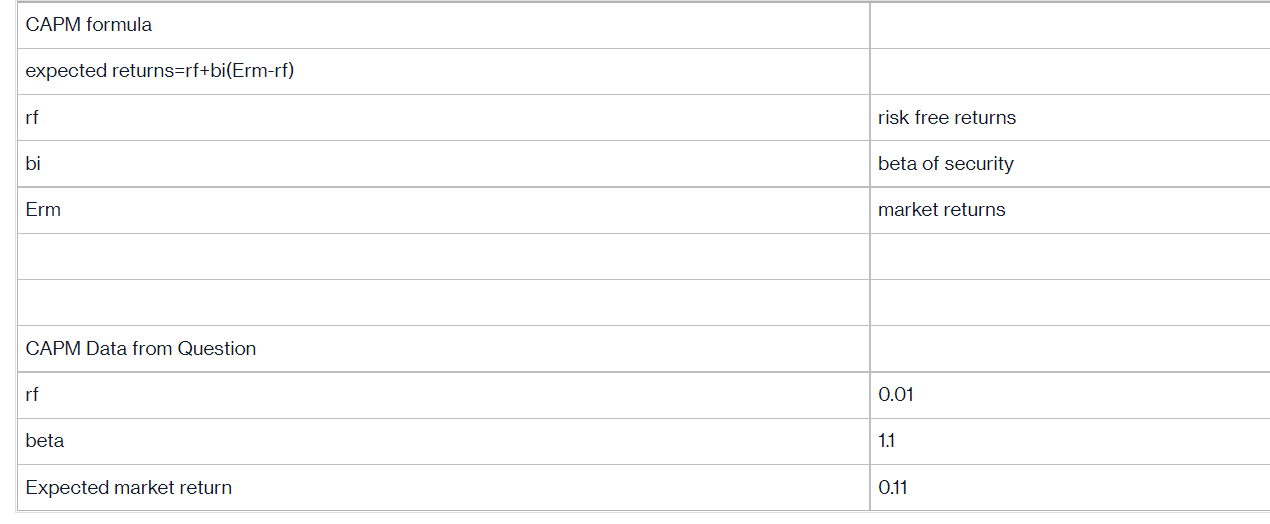

[A] Standalone Valuation. (5 points) Forecast pro-forma unlevered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You don't need to forecast the balance sheet. Use the following assumptions: Sales will grow by 2% each year All recurring operating expenses and depreciation are a percent of sales based on 2019 levels. The tax rate is 21%. Find the value per share by discounting the unlevered free cash flows at the WACC assuming that, after year 3 of the forecast, free cash flows will grow by 2%. Assume that working capital is a constant percent of sales based on 2019 levels and capital spending equals depreciation each year. Assume that they will use 50% debt financing and use the WACC from problem 1A above. There are 40 million shares outstanding. (Show work on the 'Problem 1' Excel worksheet.) [B] Construct a two-way data table which calculates the value per share in your model in part [A] that varies the terminal growth rate and WACC. (1.5 point) (Show your work on the Excel File.) [C] Your managing director is concerned that calculating the terminal value as a growing perpetuity is unrealistic. Based on the implied EV/EBITDA multiple of your terminal value and the comparable firm(s) in the Problem i Excel tab, explain whether your estimate seems reasonable. (1.5 point) (Show work on the Excel file; write your answer below.) [E] Determine a range of per share stock values for Valspar based on the comparable firms EV/EBITDA multiples from the information in Exhibit 1 in the Excel file. (2 points) (Show work on the Excel file; write your answer below.) [D] After the acquisition, Sherwin-Williams expects that they will be able to reduce Valspar's SG&A to 10% of sales from year 1 and beyond. Based on your model, what is the most they can justify offering when incorporating this operating improvement into the DCF valuation? (1 point) (Show work on the Excel file; write your answer below.) A B C D E F G H M 1 2 (in millions of dollars) 3 Historical 1 2 3 Exhibit 1: Paint and Coatings Industry Firms, December 31, 2019 Market Value Company Name of Equity Total Debt Sales LTM EBITDA LTM 2020 2021 2022 2019 1,000 Axalta Coatings PPG Industries 7,500 26,000 3,500 4,000 4,000 15,000 845 3.000 500 50% 500 200 20% 50 5% 100 10% 350 70 7% 280 30 250 53 21% 198 4 Income Statement 5 Sales 6 7 Cost of goods sold 8 9 Gross profit 10 SG&A 11 12 Research and development 13 14 Gain on sale of assets (extraordinary) 15 16 EBITDA 17 Depreciation 18 19 EBITDA 20 Interest expense 21 22 EBT 23 Taxes 24 25 Net income 26 27 Balance Sheet 28 Assets 29 Cash and cash equivalents 30 Accounts receivable 31 Inventory 32 Total current assets 33 Fixed assets 34 Accumulated Depreciation 35 Net Fixed Assets 36 Total assets 37 38 Liabilities and Equity 39 Accounts payable 40 Accrued expenses 41 Total current liabilities 42 Long-term debt 43 Equity 44 Retained earnings 45 Total equity 46 Total Liabilities & equity 47 You don't need to forecast the balance sheet Historical 2019 10 60 250 320 880 100 780 1,100 0 30 40 70 750 100 180 280 1,100 CAPM formula expected returns=rf+bi(Erm-rf) rf risk free returns bi beta of security Erm market returns CAPM Data from Question rf 0.01 beta 1.1 Expected market return 0.11 Part A answer Cost of Equity=rf+beta*(rm-rf) Cost of Equity=0.01+1.1*(0.11-0.01) Cost of Equity=0.12 or 12% for 100% equity finance WACC will be same as Cost of equity Part B answer Cost of equity will remain Same which we did in part A 12%. WACC=cost of equity x weight of equity + cost of debt weight of debt x(1-tax rate) WACC=0.12*0.5+0.5*(0.04)*(1-0.3) WACC=7.40% cost of WACC is lower when debt is used Explanation: market returns in cost of equity i have used S&P market index as it measures average performances. YTM is used by me as cost of debt for for sherwin because it is already available and best source of information as cost of deb [A] Standalone Valuation. (5 points) Forecast pro-forma unlevered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You don't need to forecast the balance sheet. Use the following assumptions: Sales will grow by 2% each year All recurring operating expenses and depreciation are a percent of sales based on 2019 levels. The tax rate is 21%. Find the value per share by discounting the unlevered free cash flows at the WACC assuming that, after year 3 of the forecast, free cash flows will grow by 2%. Assume that working capital is a constant percent of sales based on 2019 levels and capital spending equals depreciation each year. Assume that they will use 50% debt financing and use the WACC from problem 1A above. There are 40 million shares outstanding. (Show work on the 'Problem 1' Excel worksheet.) [B] Construct a two-way data table which calculates the value per share in your model in part [A] that varies the terminal growth rate and WACC. (1.5 point) (Show your work on the Excel File.) [C] Your managing director is concerned that calculating the terminal value as a growing perpetuity is unrealistic. Based on the implied EV/EBITDA multiple of your terminal value and the comparable firm(s) in the Problem i Excel tab, explain whether your estimate seems reasonable. (1.5 point) (Show work on the Excel file; write your answer below.) [E] Determine a range of per share stock values for Valspar based on the comparable firms EV/EBITDA multiples from the information in Exhibit 1 in the Excel file. (2 points) (Show work on the Excel file; write your answer below.) [D] After the acquisition, Sherwin-Williams expects that they will be able to reduce Valspar's SG&A to 10% of sales from year 1 and beyond. Based on your model, what is the most they can justify offering when incorporating this operating improvement into the DCF valuation? (1 point) (Show work on the Excel file; write your answer below.) A B C D E F G H M 1 2 (in millions of dollars) 3 Historical 1 2 3 Exhibit 1: Paint and Coatings Industry Firms, December 31, 2019 Market Value Company Name of Equity Total Debt Sales LTM EBITDA LTM 2020 2021 2022 2019 1,000 Axalta Coatings PPG Industries 7,500 26,000 3,500 4,000 4,000 15,000 845 3.000 500 50% 500 200 20% 50 5% 100 10% 350 70 7% 280 30 250 53 21% 198 4 Income Statement 5 Sales 6 7 Cost of goods sold 8 9 Gross profit 10 SG&A 11 12 Research and development 13 14 Gain on sale of assets (extraordinary) 15 16 EBITDA 17 Depreciation 18 19 EBITDA 20 Interest expense 21 22 EBT 23 Taxes 24 25 Net income 26 27 Balance Sheet 28 Assets 29 Cash and cash equivalents 30 Accounts receivable 31 Inventory 32 Total current assets 33 Fixed assets 34 Accumulated Depreciation 35 Net Fixed Assets 36 Total assets 37 38 Liabilities and Equity 39 Accounts payable 40 Accrued expenses 41 Total current liabilities 42 Long-term debt 43 Equity 44 Retained earnings 45 Total equity 46 Total Liabilities & equity 47 You don't need to forecast the balance sheet Historical 2019 10 60 250 320 880 100 780 1,100 0 30 40 70 750 100 180 280 1,100 CAPM formula expected returns=rf+bi(Erm-rf) rf risk free returns bi beta of security Erm market returns CAPM Data from Question rf 0.01 beta 1.1 Expected market return 0.11 Part A answer Cost of Equity=rf+beta*(rm-rf) Cost of Equity=0.01+1.1*(0.11-0.01) Cost of Equity=0.12 or 12% for 100% equity finance WACC will be same as Cost of equity Part B answer Cost of equity will remain Same which we did in part A 12%. WACC=cost of equity x weight of equity + cost of debt weight of debt x(1-tax rate) WACC=0.12*0.5+0.5*(0.04)*(1-0.3) WACC=7.40% cost of WACC is lower when debt is used Explanation: market returns in cost of equity i have used S&P market index as it measures average performances. YTM is used by me as cost of debt for for sherwin because it is already available and best source of information as cost of deb

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts