Question: Here is the calculation for MIRR when given the discount rate of 11.2%. Please explain how -$2.94 is calculated by discounting the year 4 negative

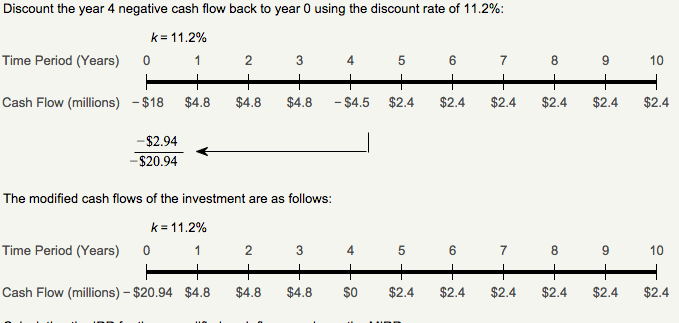

Here is the calculation for MIRR when given the discount rate of 11.2%. Please explain how -$2.94 is calculated by discounting the year 4 negative cash flow back to zero.

Discount the year 4 negative cash flow back to year 0 using the discount rate of 11.2%; k-11.2% Time Period (Years) 01 2 345 6 7 8 910 Cash Flow (millions)-$18 $4.8 $4.8 $4.8 $4.5 $2.4 $2.4 $2.4 $2.4 $%2.4 $2.4 $2.94 $20.94 The modified cash flows of the investment are as follows: k-11.2% Time Period (Years) 01 2 3 45 6 78 90 Cash Flow (millions)- $20.94 $4.8 $4.8 $4.8 S0 $2.4 $2.4 $2.4 $2.4 $%2.4 $2.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts