Question: Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): 2021 Current assets $ 2,000 Net fixed assets 3,000 Total

Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): 2021 Current assets $ 2,000 Net fixed assets 3,000 Total assets $ 5,000 Accounts payable and accruals $ 900 Short-term debt 200 Long-term debt 1,350 Preferred stock (15,000 shares) 400 Common stock (50,000 shares) 1,050 Retained earnings 1,100 Total common equity $ 2,150 Total liabilities and equity $ 5,000 Skye's earnings per share last year were $3.50. The common stock sells for $45.00, last year's dividend (D0) was $2.50, and a flotation cost of 12% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of $3.60 per share, and its preferred stock sells for $30.00 per share. The firm's before-tax cost of debt is 12%, and its marginal tax rate is 25%. The firm's currently outstanding 12% annual coupon rate, long-term debt sells at par value. The market risk premium is 4%, the risk-free rate is 5%, and Skye's beta is 1.552. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.55 million.

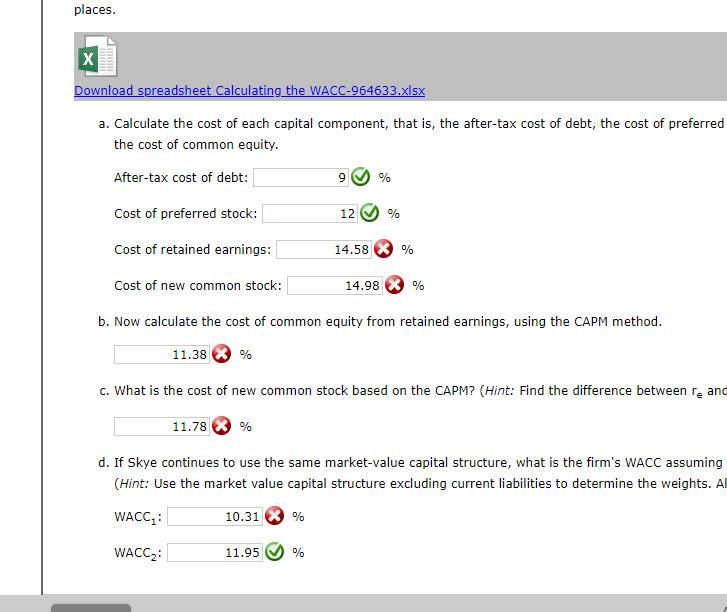

places. Download spreadsheet Calculating the WACC-964633.xIsx a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred the cost of common equity. After-tax cost of debt: % Cost of preferred stock: % Cost of retained earnings: % Cost of new common stock: % b. Now calculate the cost of common equity from retained earnings, using the CAPM method. % c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re an % d. If Skye continues to use the same market-value capital structure, what is the firm's WACC assuming (Hint: Use the market value capital structure excluding current liabilities to determine the weights. A WACC 1 : % WACC 2 : %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts