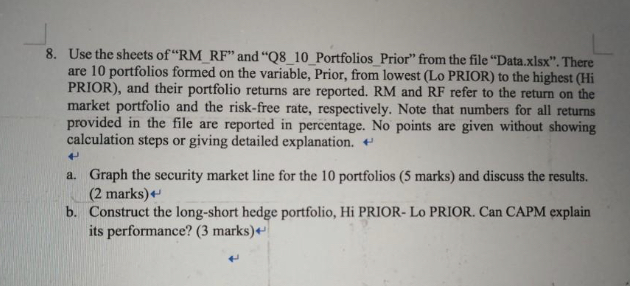

Question: Here is the excel link, https://docs.google.com/spreadsheets/d/1pba8nBPSkogGwJBmzBeckIXwBbXRIfZrf7hbADBS8iw/htmlview 8. Use the sheets of RM RF and (8_10_Portfolios Prior from the file Data.xlsx. There are 10 portfolios formed

Here is the excel link, https://docs.google.com/spreadsheets/d/1pba8nBPSkogGwJBmzBeckIXwBbXRIfZrf7hbADBS8iw/htmlview

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts