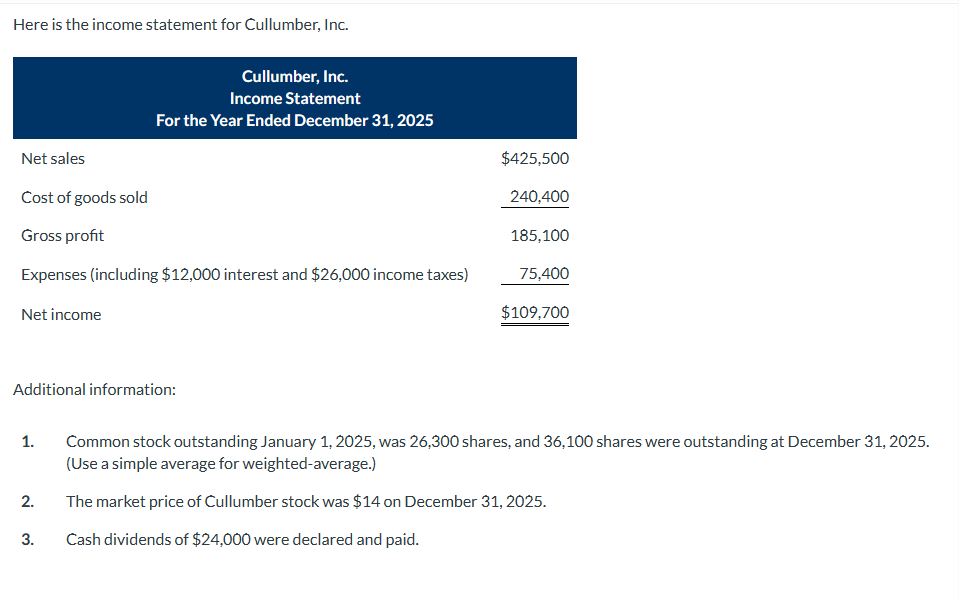

Question: Here is the income statement for Cullumber, Inc. Additional information: 1. Common stock outstanding January 1,2025 , was 26,300 shares, and 36,100 shares were outstanding

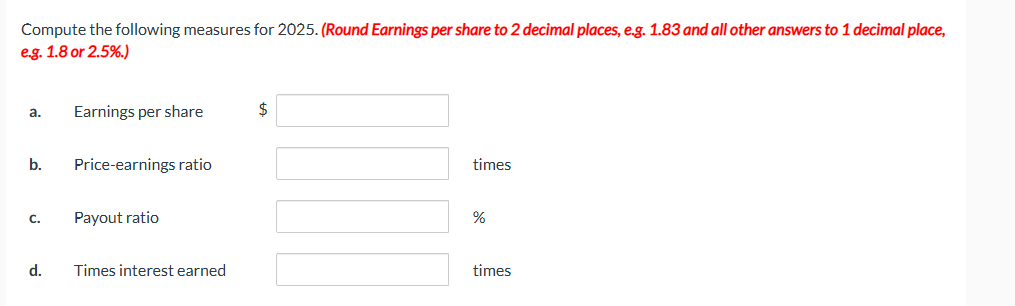

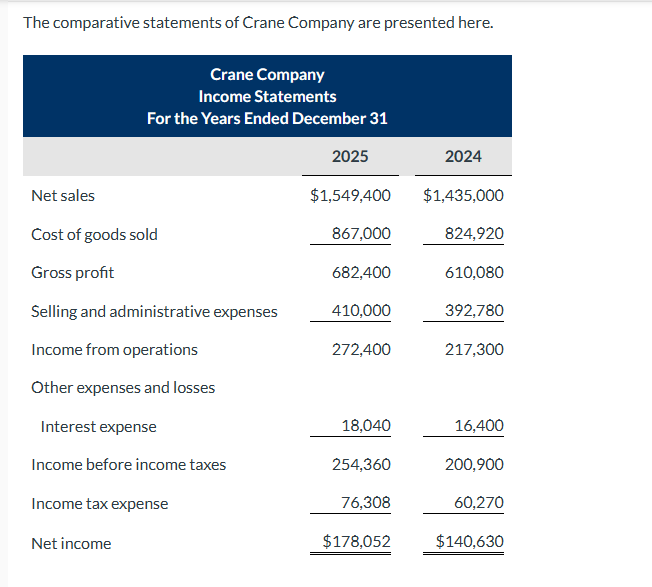

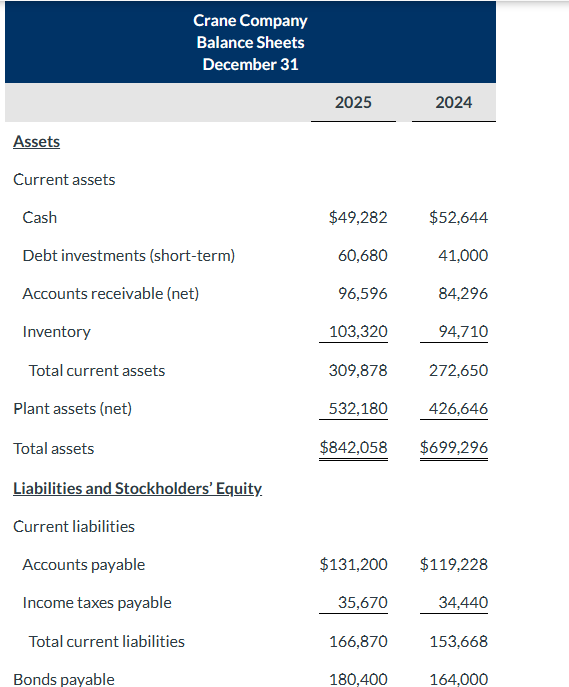

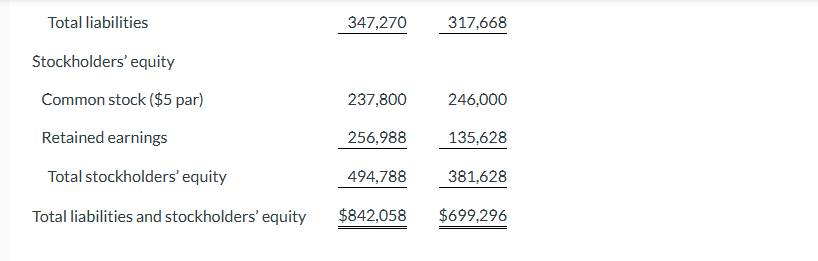

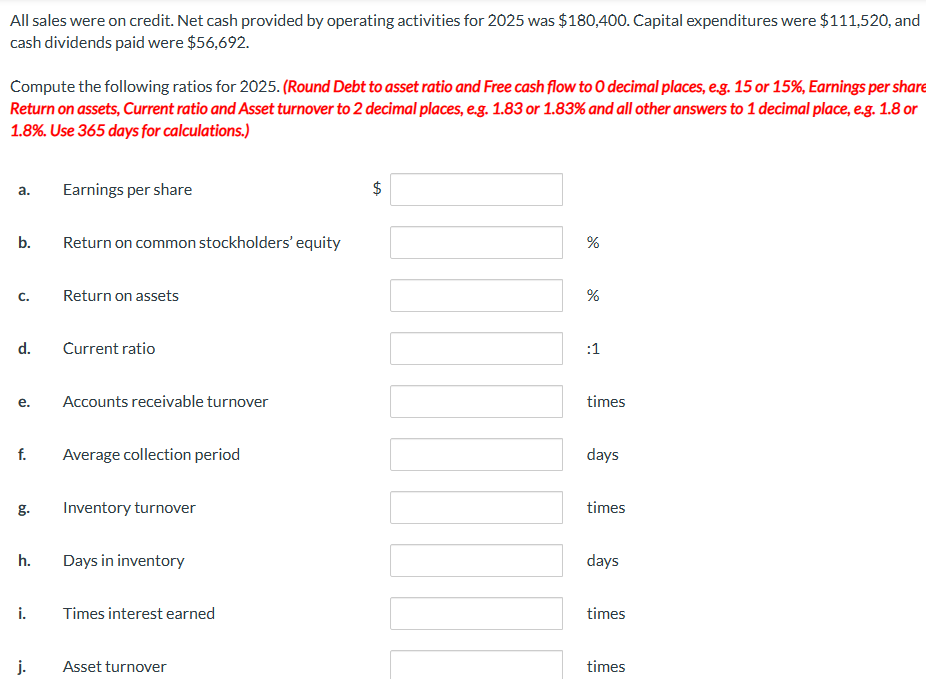

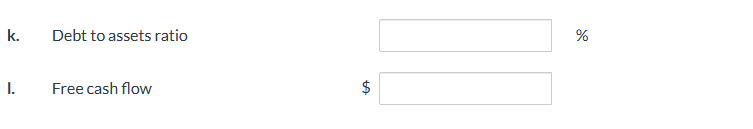

Here is the income statement for Cullumber, Inc. Additional information: 1. Common stock outstanding January 1,2025 , was 26,300 shares, and 36,100 shares were outstanding at December 31,2025. (Use a simple average for weighted-average.) 2. The market price of Cullumber stock was $14 on December 31, 2025. 3. Cash dividends of $24,000 were declared and paid. Compute the following measures for 2025. (Round Earnings per share to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) a. Earnings per share $ b. Price-earnings ratio times c. Payout ratio % d. Times interest earned times The comparative statements of Crane Company are presented here. Crane Company Balance Sheets December 31 2025 Assets Current assets Cash Debt investments (short-term) Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Liabilities and Stockholders' Equity. Current liabilities Accounts payable $131,200$119,228 Bonds payable 180,400164,000 Total liabilities Stockholders' equity Common stock ( $5 par) 347,270317,668 Retained earnings Total stockholders' equity All sales were on credit. Net cash provided by operating activities for 2025 was $180,400. Capital expenditures were $111,520, and cash dividends paid were $56,692. Compute the following ratios for 2025. (Round Debt to asset ratio and Free cash flow to 0 decimal places, e.g. 15 or 15\%, Earnings per share Return on assets, Current ratio and Asset turnover to 2 decimal places, e.g. 1.83 or 1.83% and all other answers to 1 decimal place, e.g. 1.8 or 1.8%. Use 365 days for calculations.) k. Debt to assets ratio % I. Free cash flow $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts