Question: HERE IS THE QUESTION AND SPREADSHEET DATA SCREENSHOT. FOR QUESTION A IT REFERS TO THE Op costs=Revenue*(1-EBITDA margin) WHICH IS $1,134,570,920. The screenshot are of

HERE IS THE QUESTION AND SPREADSHEET DATA SCREENSHOT. FOR QUESTION A IT REFERS TO THE "Op costs=Revenue*(1-EBITDA margin)" WHICH IS $1,134,570,920. The screenshot are of Telstra's financial snapshot

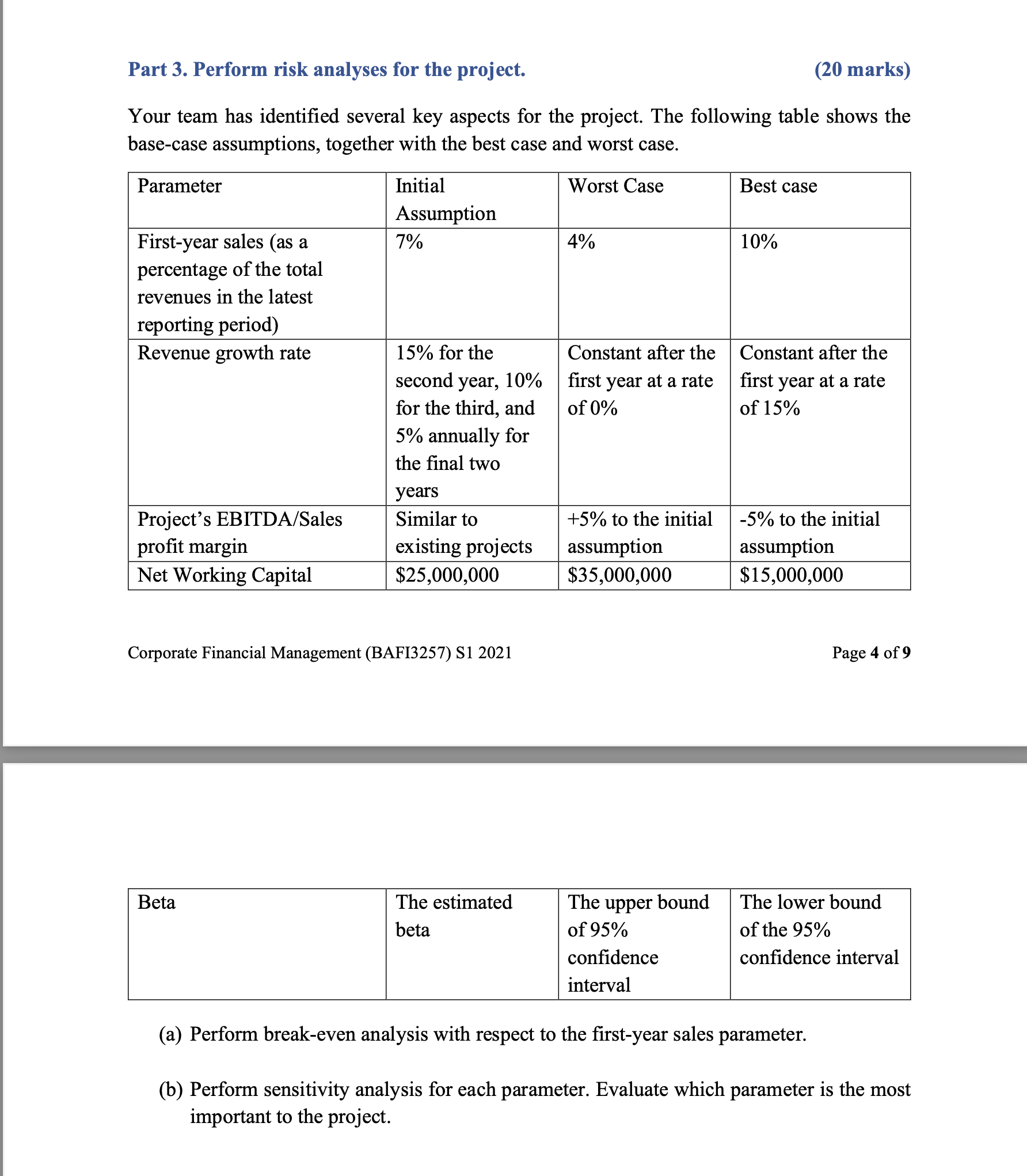

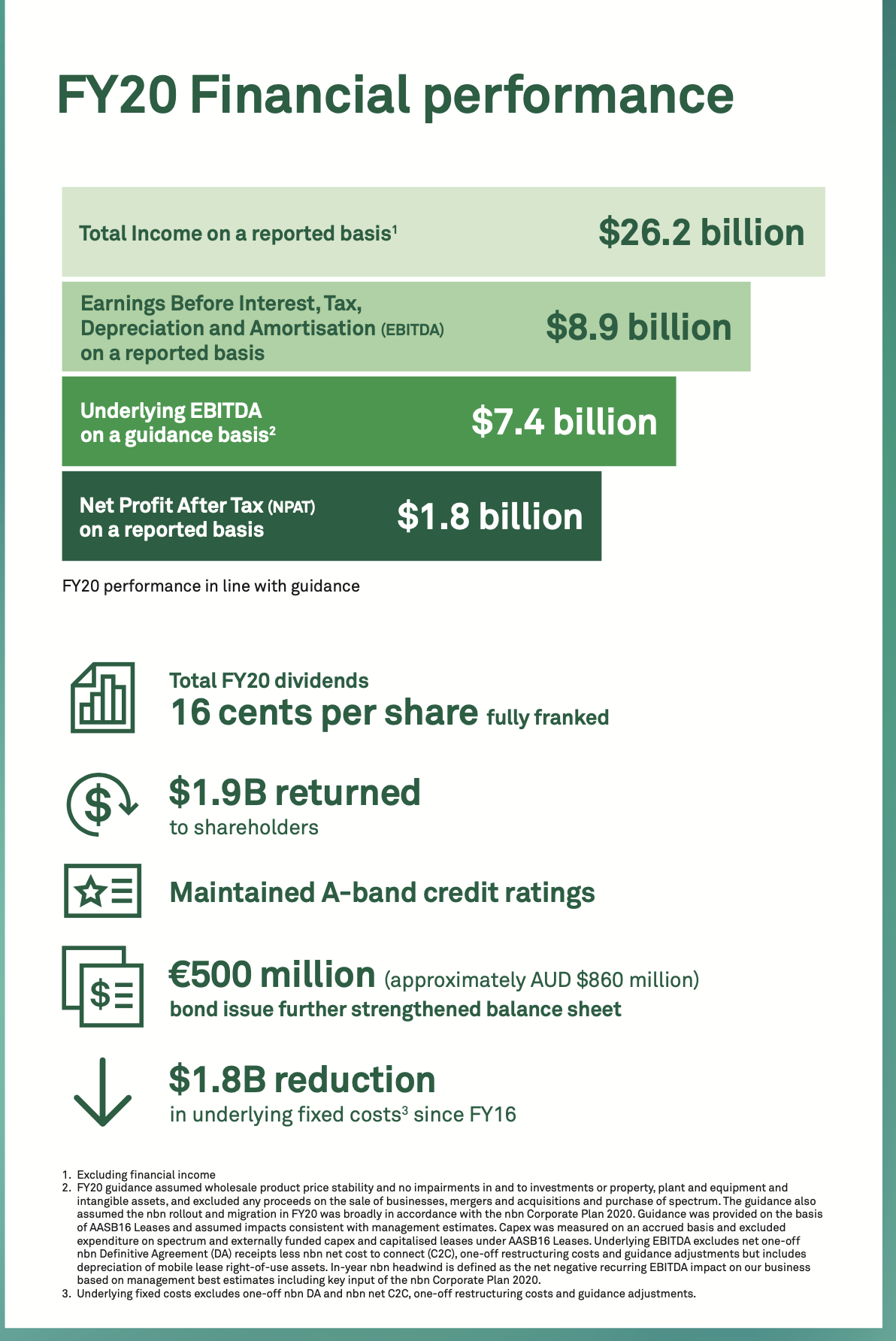

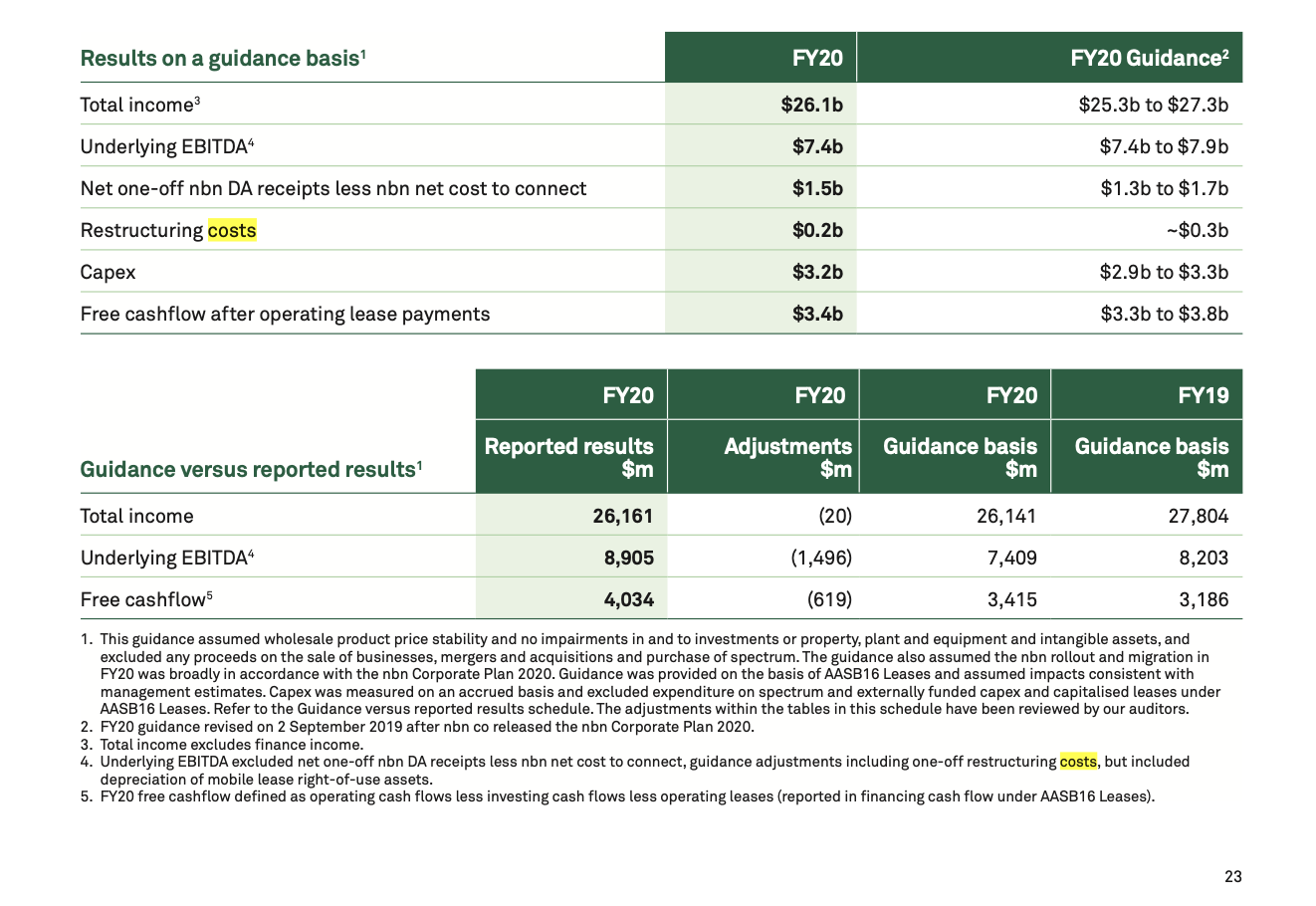

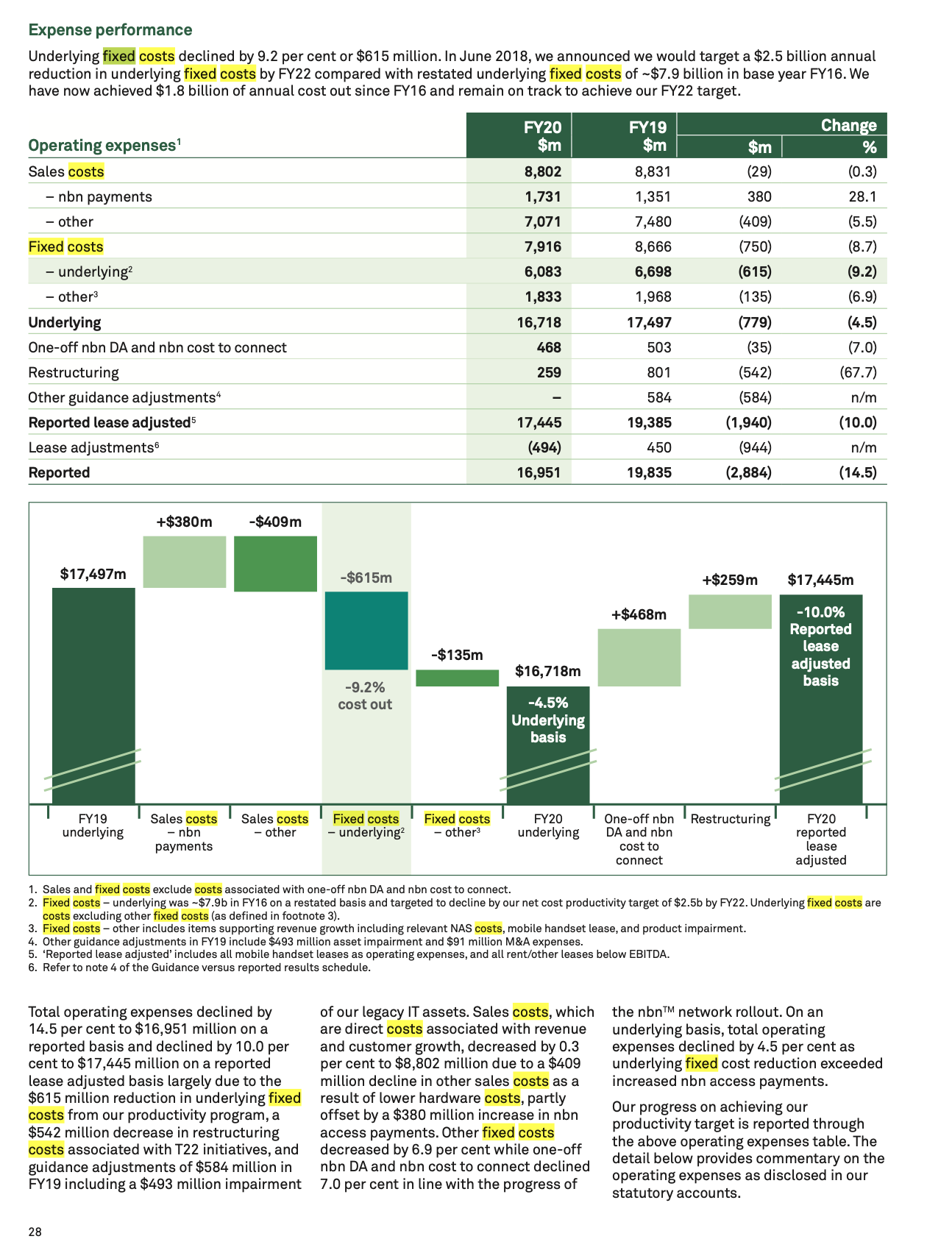

Part 3. Perform risk analyses for the project. (20 marks) Your team has identified several key aspects for the project. The following table shows the base-case assumptions, together with the best case and worst case. Parameter Initial Worst Case Best case Assumption First-year sales (as a 7% 4% 10% percentage of the total revenues in the latest reporting period Revenue growth rate 15% for the Constant after the Constant after the second year, 10% first year at a rate first year at a rate for the third, and of 0% of 15% 5% annually for the final two years Project's EBITDA/Sales Similar to +5% to the initial -5% to the initial profit margin existing projects assumption assumption Net Working Capital $25,000,000 $35,000,000 $15,000,000 Corporate Financial Management (BAFI3257) S1 2021 Page 4 of 9 Beta The estimated The upper bound The lower bound beta of 95% of the 95% confidence confidence interval interval (a) Perform break-even analysis with respect to the first-year sales parameter. (b) Perform sensitivity analysis for each parameter. Evaluate which parameter is the most important to the project.FY20 Financial performance Total Income on a reported basis $26.2 billion Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) $8.9 billion on a reported basis Underlying EBITDA on a guidance basis? $7.4 billion Net Profit After Tax (NPAT) on a reported basis $1.8 billion FY20 performance in line with guidance Total FY20 dividends 16 cents per share fully franked $1.9B returned to shareholders Maintained A-band credit ratings $= E500 million (approximately AUD $860 million) bond issue further strengthened balance sheet $1.8B reduction in underlying fixed costs? since FY16 1. Excluding financial income 2. FY20 guidance assumed wholesale product price stability and no impairments in and to investments or property, plant and equipment and intangible assets, and excluded any proceeds on the sale of businesses, mergers and acquisitions and purchase of spectrum. The guidance also assumed the non rollout and migration in FY20 was broadly in accordance with the non Corporate Plan 2020. Guidance was provided on the basis of AASB16 Leases and assumed impacts consistent with management estimates. Capex was measured on an accrued basis and excluded expenditure on spectrum and externally funded capex and capitalised leases under AASB 16 Leases. Underlying EBITDA excludes net one-off non Definitive Agreement (DA) receipts less non net cost to connect (C2C), one-off restructuring costs and guidance adjustments but includes depreciation of mobile lease right-of-use assets. In-year non headwind is defined as the net negative recurring EBITDA impact on our business based on management best estimates including key input of the non Corporate Plan 2020. 3. Underlying fixed costs excludes one-off non DA and non net C2C, one-off restructuring costs and guidance adjustments.Results on a guidance basis FY20 FY20 Guidance Total income3 $26.1b $25.3b to $27.3b Underlying EBITDA" $7.4b $7.4b to $7.9b Net one-off non DA receipts less non net cost to connect $1.5b $1.3b to $1.7b Restructuring costs $0.2b ~$0.3b Capex $3.2b $2.9b to $3.3b Free cashflow after operating lease payments $3.4b $3.3b to $3.8b FY20 FY20 FY20 FY19 Reported results Adjustments Guidance basis Guidance basis Guidance versus reported results $m $m $m $m Total income 26, 161 (20) 26, 141 27,804 Underlying EBITDA" 8,905 (1,496) 7,409 8,203 Free cashflow5 4,034 (619) 3,415 3, 186 1. This guidance assumed wholesale product price stability and no impairments in and to investments or property, plant and equipment and intangible assets, and excluded any proceeds on the sale of businesses, mergers and acquisitions and purchase of spectrum. The guidance also assumed the non rollout and migration in FY20 was broadly in accordance with the non Corporate Plan 2020. Guidance was provided on the basis of AASB16 Leases and assumed impacts consistent with management estimates. Capex was measured on an accrued basis and excluded expenditure on spectrum and externally funded capex and capitalised leases under AASB16 Leases. Refer to the Guidance versus reported results schedule. The adjustments within the tables in this schedule have been reviewed by our auditors. 2. FY20 guidance revised on 2 September 2019 after non co released the non Corporate Plan 2020. 3. Total income excludes finance income. 4. Underlying EBITDA excluded net one-off non DA receipts less non net cost to connect, guidance adjustments including one-off restructuring costs, but included depreciation of mobile lease right-of-use assets. 5. FY20 free cashflow defined as operating cash flows less investing cash flows less operating leases (reported in financing cash flow under AASB16 Leases). 23Expense performance Underlying fixed costs declined by 9.2 per cent or $615 million. In June 2018, we announced we would target a $2.5 billion annual reduction in underlying fixed costs by FY22 compared with restated underlying fixed costs of ~$7.9 billion in base year FY16. We have now achieved $1.8 billion of annual cost out since FY16 and remain on track to achieve our FY22 target. FY20 FY19 Change Operating expenses $m $m $m Sales costs 8,802 8,831 (29) (0.3) - non payments 1,731 1,351 380 28.1 - other 7,071 7,480 (409) (5.5) Fixed costs 7,916 8,666 (750 (8.7) - underlying2 6,083 6,698 (615) (9.2) - other3 1,833 1,968 (135) (6.9) Underlying 16,718 17,497 (779) (4.5) One-off non DA and non cost to connect 468 503 (35) (7.0) Restructuring 259 801 (542) (67.7) Other guidance adjustments" 584 (584) n/m Reported lease adjusted5 17,445 19,385 (1,940) (10.0) Lease adjustments (494) 450 (944) n/m Reported 16,951 19,835 (2,884) (14.5) +$380m -$409m $17,497m -$615m +$259m $17,445m +$468m -10.0% Reported -$135m lease $16,718m adjusted -9.2% basis cost out -4.5% Underlying basis FY19 Sales costs Sales costs Fixed costs Fixed costs FY20 One-off non Restructuring FY20 underlying - non - other - underlying - other3 underlying DA and non reported payments cost to lease connect adjusted . Sales and fixed costs exclude costs associated with one-off non DA and non cost to connect. 2. Fixed costs - underlying was ~$7.9b in FY16 on a restated basis and targeted to decline by our net cost productivity target of $2.5b by FY22. Underlying fixed costs are costs excluding other fixed costs (as defined in footnote 3). 3. Fixed costs - other includes items supporting revenue growth including relevant NAS costs, mobile handset lease, and product impairment. 4. Other guidance adjustments in FY19 include $493 million asset impairment and $91 million M&A expenses. 5. 'Reported lease adjusted' includes all mobile handset leases as operating expenses, and all rent/other leases below EBITDA. 6. Refer to note 4 of the Guidance versus reported results schedule. Total operating expenses declined by of our legacy IT assets. Sales costs, which the nonTM network rollout. On an 14.5 per cent to $16,951 million on a are direct costs associated with revenue underlying basis, total operating reported basis and declined by 10.0 per and customer growth, decreased by 0.3 expenses declined by 4.5 per cent as cent to $17,445 million on a reported per cent to $8,802 million due to a $409 underlying fixed cost reduction exceeded lease adjusted basis largely due to the million decline in other sales costs as a increased non access payments. $615 million reduction in underlying fixed result of lower hardware costs, partly costs from our productivity program, a offset by a $380 million increase in non Our progress on achieving our $542 million decrease in restructuring access payments. Other fixed costs productivity target is reported through costs associated with T22 initiatives, and decreased by 6.9 per cent while one-off the above operating expenses table. The guidance adjustments of $584 million in non DA and non cost to connect declined detail below provides commentary on the FY19 including a $493 million impairment 7.0 per cent in line with the progress of operating expenses as disclosed in our statutory accounts