Question: here is the question. I need 12% over 10 years, 12% over 15 years, AND 12% over 20 years PLEASE!!! HERE IS AN EXAMPLE. i

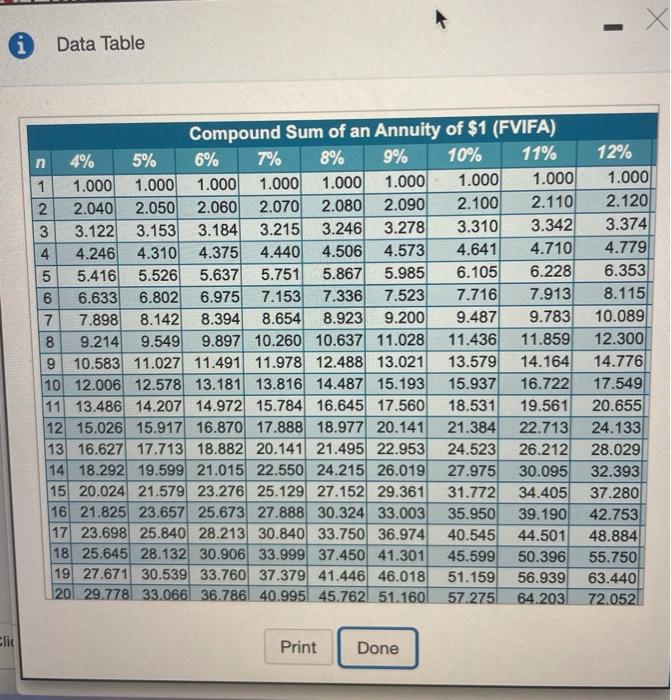

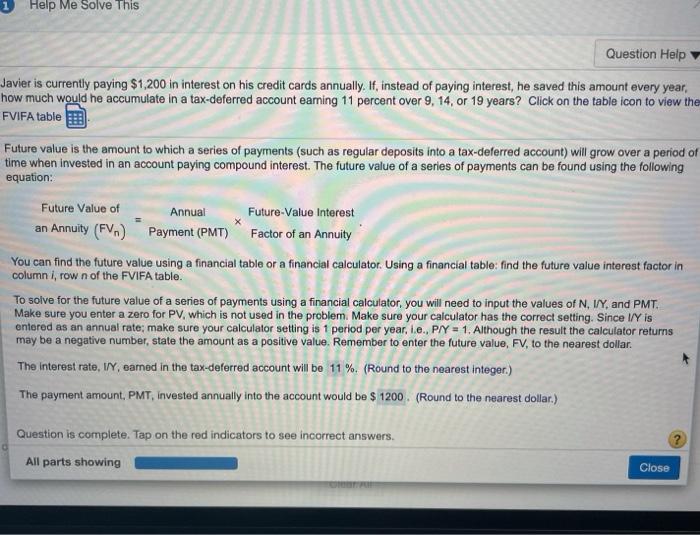

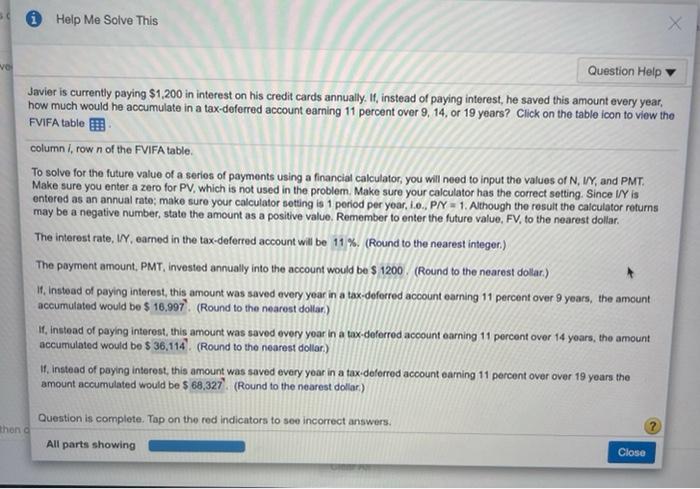

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account earning 12 percent over 10, 15, or 20 years? Click on the table icon to view the FVIFA table If, instead of paying interest, this amount was saved every year in a tax-deferred account earning 12 percent over 10 years, the amount accumulated would be $ (Round to the nearest dollar.) x - Data Table Compound Sum of an Annuity of $1 (FVIFA) 4% n 5% 6% 7% 8% 9% 10% 11% 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 3 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 4 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 5 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 7 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 8 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 9 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 10 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 11 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 12 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 13 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 14 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 15 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 16 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 17 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 18 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 19 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 20 29.778 33,066 36.786 40.995l 45.762 51.160 57.275 64.203 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 42.753 48.884 55.750 63.440 72.052 Clic Print Done Help Me Solve This Question Help Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account earning 11 percent over 9, 14, or 19 years? Click on the table icon to view the FVIFA table Future value is the amount to which a series of payments (such as regular deposits into a tax-deferred account will grow over a period of time when invested in an account paying compound interest. The future value of a series of payments can be found using the following equation: Future Value of Annual Future-Value Interest an Annuity (FV.) Payment (PMT) Factor of an Annuity You can find the future value using a financial table or a financial calculator. Using a financial table: find the future value interest factor in column i, row n of the FVIFA table. To solve for the future value of a series of payments using a financial calculator, you will need to input the values of N. 1/Y, and PMT. Make sure you enter a zero for PV, which is not used in the problem. Make sure your calculator has the correct setting. Since I/Y is entered as an annual rate; make sure your calculator setting is 1 period per year, i.e., PIY = 1, Although the result the calculator returns may be a negative number, state the amount as a positive value. Remember to enter the future value, FV, to the nearest dollar The interest rate, 1/4, eamed in the tax-deferred account will be 11 %. (Round to the nearest Integer.) The payment amount, PMT, invested annually into the account would be $ 1200. (Round to the nearest dollar.) Question is complete. Tap on the red indicators to see incorrect answers. All parts showing Close Help Me Solve This ve Question Help Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account earning 11 percent over 9, 14, or 19 years? Click on the table icon to view the FVIFA table columni, row n of the FVIFA table. To solve for the future value of a series of payments using a financial calculator, you will need to input the values of N, 1/Y, and PMT. Make sure you enter a zero for PV, which is not used in the problem. Make sure your calculator has the correct setting. Since I/Y is entered as an annual rate; make sure your calculator setting is 1 period per year. i.o., PNY - 1. Although the result the calculator returns may be a negative number, state the amount as a positive value. Remember to enter the future value, FV, to the nearest dollar. The interest rate, WY, earned in the tax-deferred account will be 11 %. (Round to the nearest integer) The payment amount, PMT, invested annually into the account would be $ 1200. (Round to the nearest dollar) 1. Instead of paying interest, this amount was saved every year in a tax-deferred account earning 11 percent over 9 years, the amount accumulated would be $ 16,997' (Round to the nearest dollar) M. instead of paying Interest, this amount was saved every year in a tax-deferred account earning 11 percent over 14 years, the amount accumulated would be $ 36,114. (Round to the nearest dollar) 1. Instead of paying interest, this amount was saved every year in a tax-deferred account carning 11 percent over over 19 years the amount accumulated would be $ 68,327). (Round to the nearest dollar) Question is complete. Tap on the red indicators to see incorrect answers. thond All parts showing Close

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts