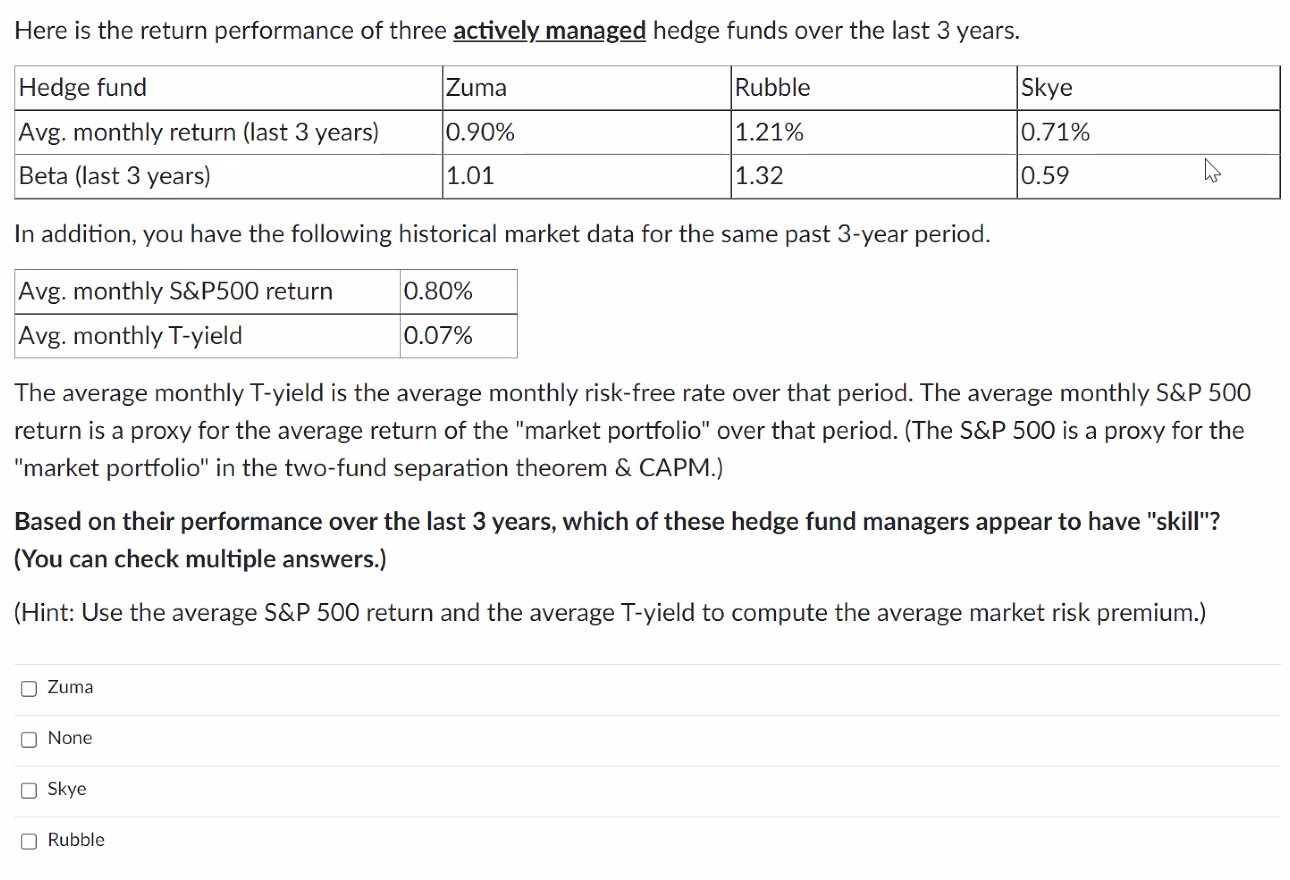

Question: Here is the return performance of three actively managed hedge funds over the last 3 years. Zuma Rubble Skye Hedge fund Avg. monthly return (last

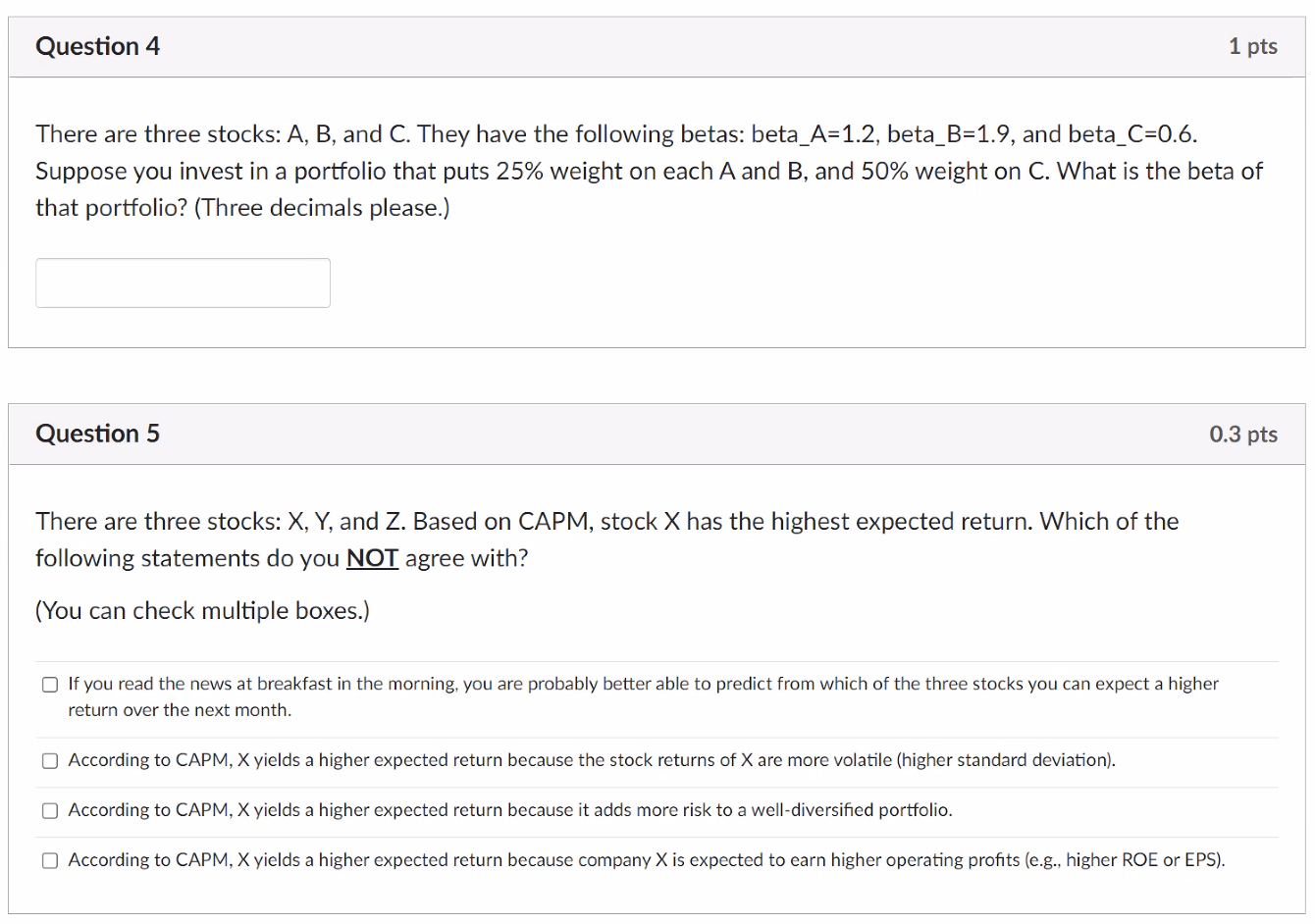

Here is the return performance of three actively managed hedge funds over the last 3 years. Zuma Rubble Skye Hedge fund Avg. monthly return (last 3 years) Beta (last 3 years) 0.90% 1.21% 0.71% 1.01 1.32 0.59 In addition, you have the following historical market data for the same past 3-year period. 0.80% Avg. monthly S&P500 return Avg. monthly T-yield 0.07% The average monthly T-yield is the average monthly risk-free rate over that period. The average monthly S&P 500 return is a proxy for the average return of the "market portfolio" over that period. (The S&P 500 is a proxy for the "market portfolio" in the two-fund separation theorem & CAPM.) Based on their performance over the last 3 years, which of these hedge fund managers appear to have "skill"? (You can check multiple answers.) (Hint: Use the average S&P 500 return and the average T-yield to compute the average market risk premium.) 0 Zuma O None O Skye O Rubble Question 4 1 pts There are three stocks: A, B, and C. They have the following betas: beta_A=1.2, beta_B=1.9, and beta_C=0.6. Suppose you invest in a portfolio that puts 25% weight on each A and B, and 50% weight on C. What is the beta of that portfolio? (Three decimals please.) Question 5 0.3 pts There are three stocks: X, Y, and Z. Based on CAPM, stock X has the highest expected return. Which of the following statements do you NOT agree with? (You can check multiple boxes.) If you read the news at breakfast in the morning, you are probably better able to predict from which of the three stocks you can expect a higher return over the next month. According to CAPM, X yields a higher expected return because the stock returns of X are more volatile (higher standard deviation). According to CAPM, X yields a higher expected return because it adds more risk to a well-diversified portfolio. According to CAPM, X yields a higher expected return because company X is expected to earn higher operating profits (e.g., higher ROE or EPS). Here is the return performance of three actively managed hedge funds over the last 3 years. Zuma Rubble Skye Hedge fund Avg. monthly return (last 3 years) Beta (last 3 years) 0.90% 1.21% 0.71% 1.01 1.32 0.59 In addition, you have the following historical market data for the same past 3-year period. 0.80% Avg. monthly S&P500 return Avg. monthly T-yield 0.07% The average monthly T-yield is the average monthly risk-free rate over that period. The average monthly S&P 500 return is a proxy for the average return of the "market portfolio" over that period. (The S&P 500 is a proxy for the "market portfolio" in the two-fund separation theorem & CAPM.) Based on their performance over the last 3 years, which of these hedge fund managers appear to have "skill"? (You can check multiple answers.) (Hint: Use the average S&P 500 return and the average T-yield to compute the average market risk premium.) 0 Zuma O None O Skye O Rubble Question 4 1 pts There are three stocks: A, B, and C. They have the following betas: beta_A=1.2, beta_B=1.9, and beta_C=0.6. Suppose you invest in a portfolio that puts 25% weight on each A and B, and 50% weight on C. What is the beta of that portfolio? (Three decimals please.) Question 5 0.3 pts There are three stocks: X, Y, and Z. Based on CAPM, stock X has the highest expected return. Which of the following statements do you NOT agree with? (You can check multiple boxes.) If you read the news at breakfast in the morning, you are probably better able to predict from which of the three stocks you can expect a higher return over the next month. According to CAPM, X yields a higher expected return because the stock returns of X are more volatile (higher standard deviation). According to CAPM, X yields a higher expected return because it adds more risk to a well-diversified portfolio. According to CAPM, X yields a higher expected return because company X is expected to earn higher operating profits (e.g., higher ROE or EPS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts