Question: Here is your first assignment. You are given a balance sheet and an income statement. You are asked to find the financial ratios. You will

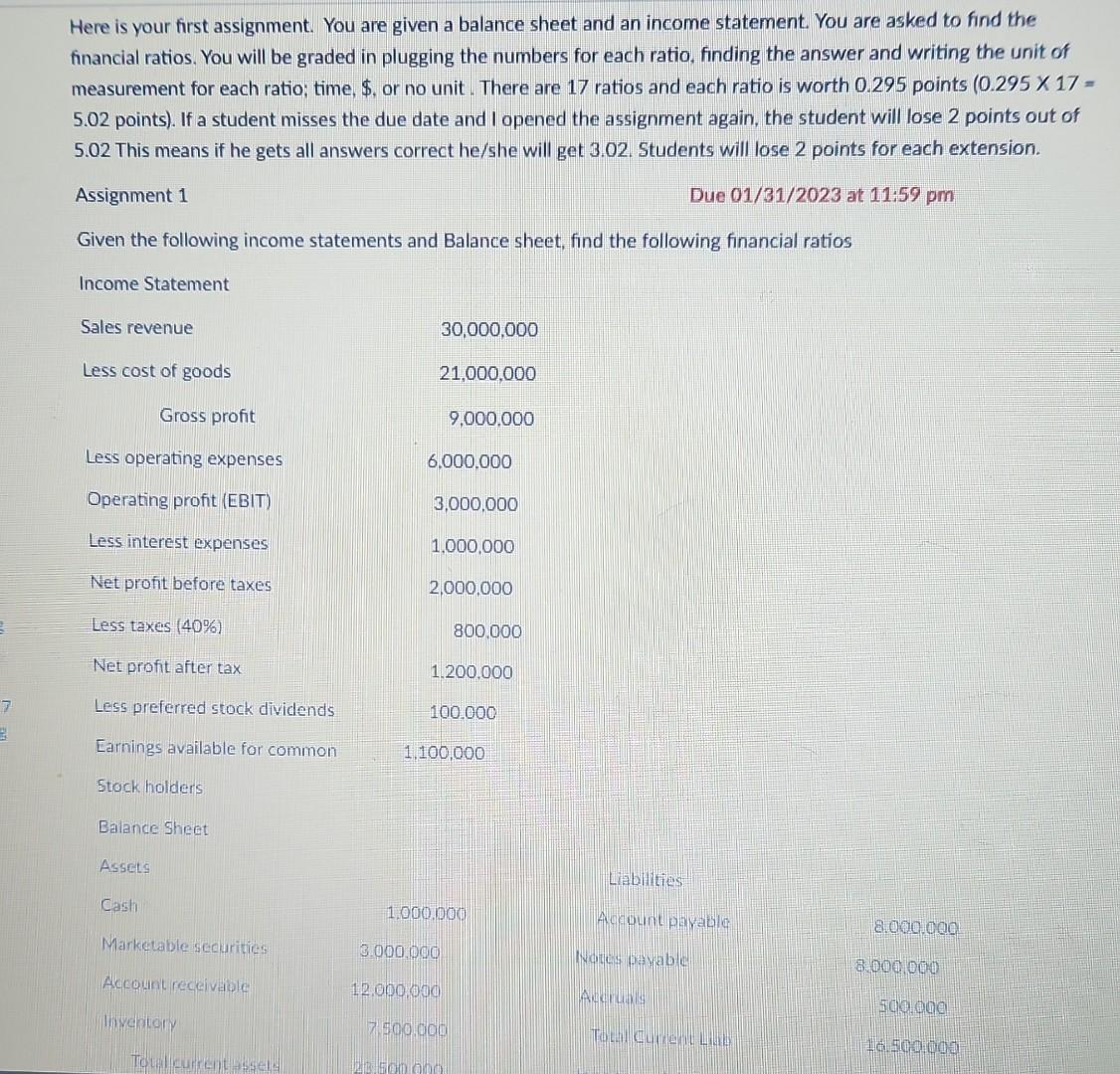

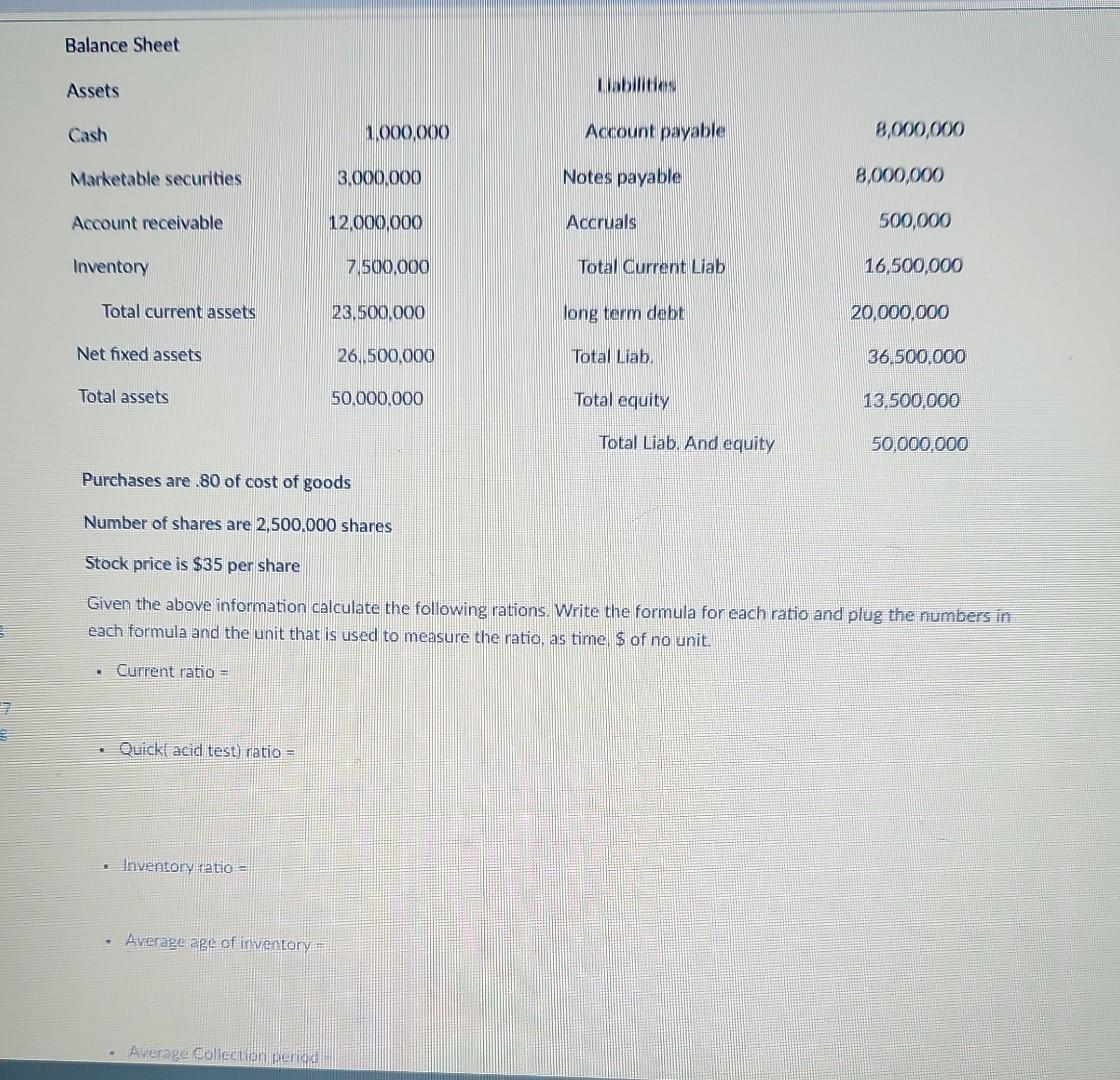

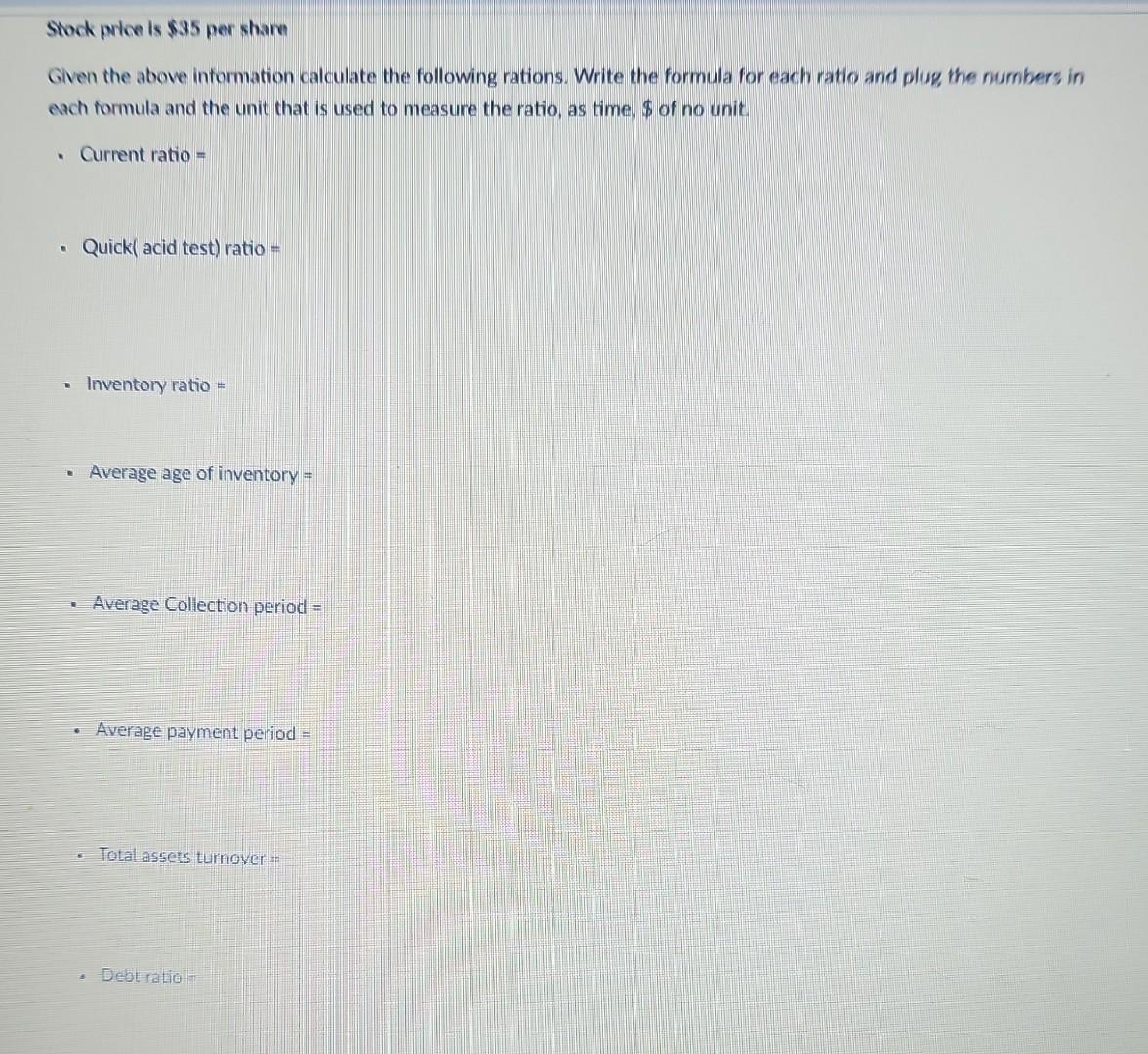

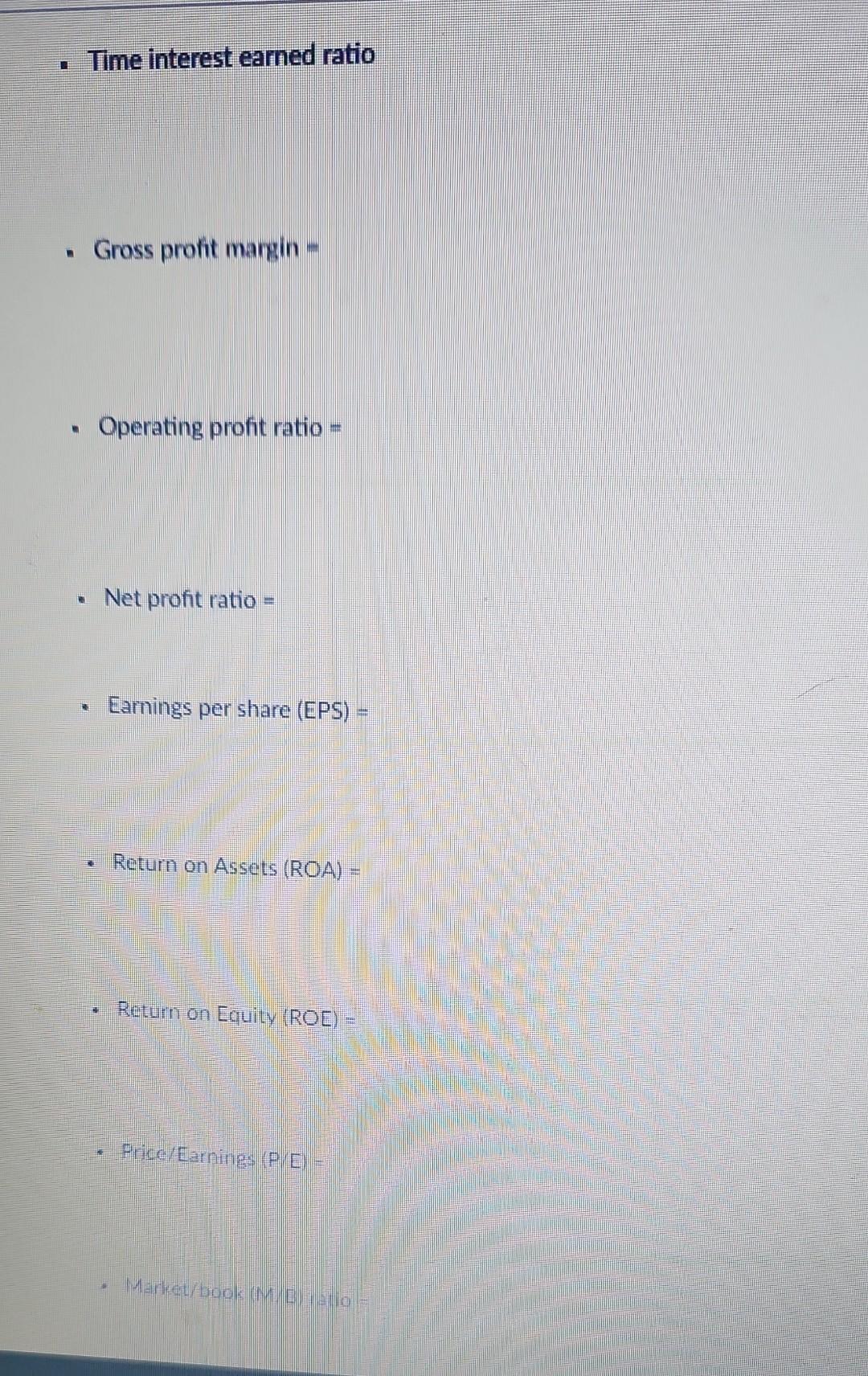

Here is your first assignment. You are given a balance sheet and an income statement. You are asked to find the financial ratios. You will be graded in plugging the numbers for each ratio, finding the answer and writing the unit of measurement for each ratio; time, $, or no unit. There are 17 ratios and each ratio is worth 0.295 points (0.295 17= 5.02 points). If a student misses the due date and I opened the assignment again, the student will lose 2 points out of 5.02 This means if he gets all answers correct he/she will get 3.02. Students will lose 2 points for each extension. Balance Sheet Assets Labilities. Cash 1,000,000 Account payable 3,000,000 Notes payable 8,000,000 Account receivable 12,000,000 Accruals Inventory 7.500,000 Total Current Liab 23,500,000 long term debt 26.,500,000 Total Liab. 50.000,000 Total equity 500,000 Total assets Total Liab. And equity 50,000,000 Purchases are .80 of cost of goods Number of shares are 2,500.000 shares Stock price is $35 per share Given the above information calculate the following rations. Write the formula for each ratio and plug the numbers in each formula and the unit that is used to measure the ratio, as time. $ of no unit. - Current ratio = - Quickl acid test) ratio = - Inventory ratio = - Average age of irventory = - Average Collection perijt Stock price is $35 per share Given the above information calculate the following rations. Write the formula for each ratio and plug the numbers in each formula and the unit that is used to measure the ratio, as time, $ of no unit. - Current ratio = - Quick( acid test) ratio = - Inventory ratio = - Average age of inventory = - Average Collection period = - Average payment period = - Total assets turnover = - Debtratio a - Time interest earned ratio - Gross profit margin = - Operating profit ratio = - Net profit ratio = - Earnings per share (EPS) = - Return on Assets (ROA) = - Return on Equity (ROE) = - Price/Earnings (P/E) = - Market/book Miniel latio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts