Question: here the question after that is thw example. i need everything after the 165.89 # for the real question. PLEASE HELP ASAP example: Shirley, a

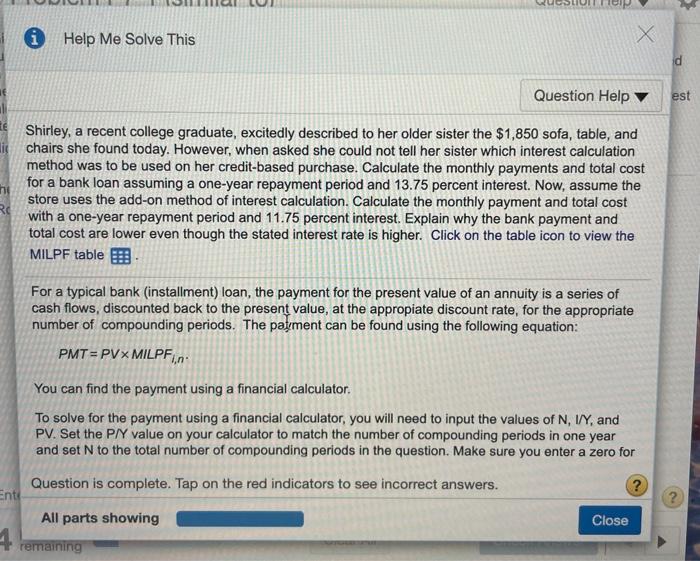

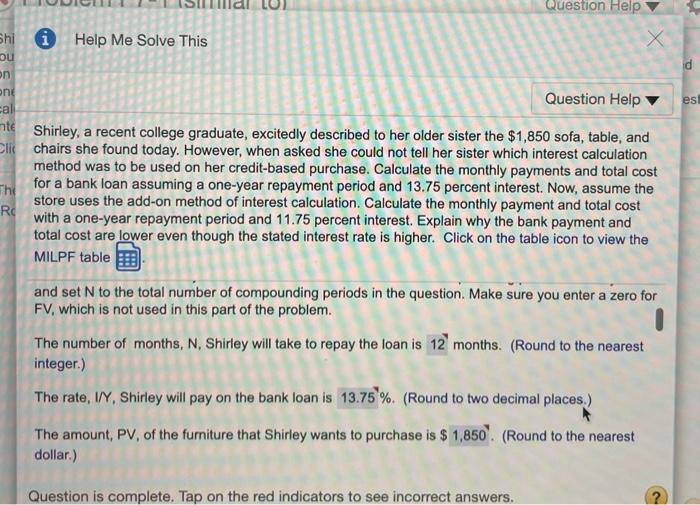

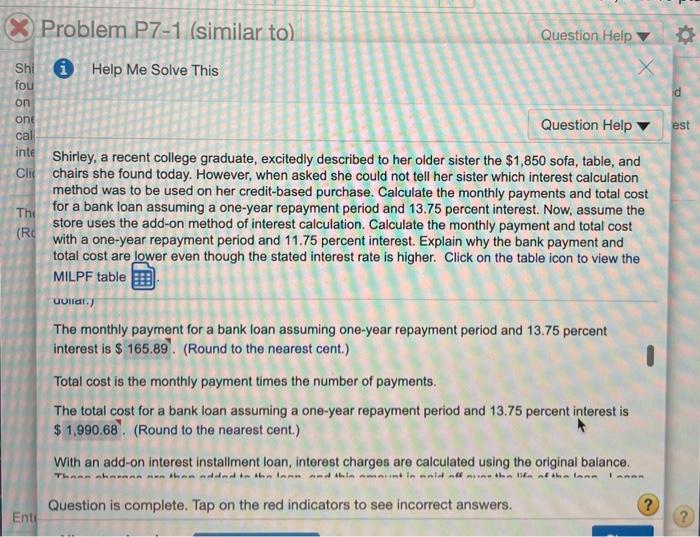

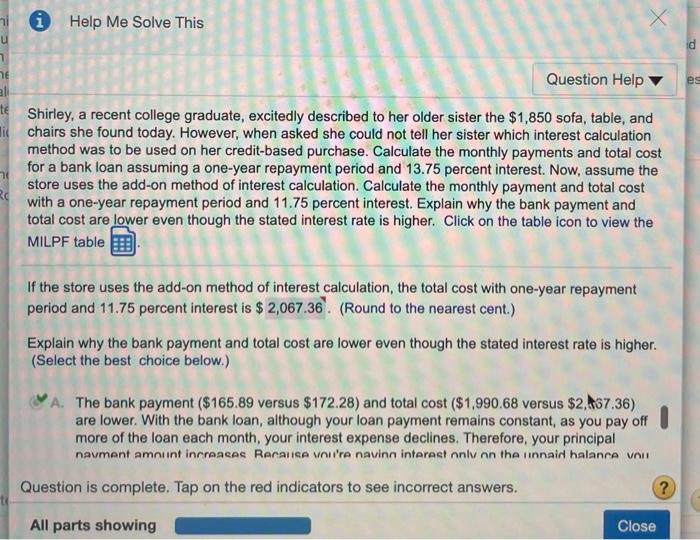

Shirley, a recent college graduate, excitedly described to her older sister the $1,500 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.25 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.25 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table The monthly payment for a bank loan assuming one-year repayment period and 13.25 percent interest is $0 (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. ? 4 parts remaining Clear All Check Answer 0 Help Me Solve This 16 Question Help est TE Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and lie chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table 1 For a typical bank (installment) loan, the payment for the present value of an annuity is a series of cash flows, discounted back to the present value, at the appropiate discount rate, for the appropriate number of compounding periods. The payment can be found using the following equation: PMT=PV MILPF, You can find the payment using a financial calculator. To solve for the payment using a financial calculator, you will need to input the values of N, 1/Y, and PV. Set the P/Y value on your calculator to match the number of compounding periods in one year and set N to the total number of compounding periods in the question. Make sure you enter a zero for ? Question is complete. Tap on the red indicators to see incorrect answers. Ents All parts showing remaining Close X es Question Help Shi Help Me Solve This ou on ong Question Help cal nte Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and El chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost The for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost RC with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table and set N to the total number of compounding periods in the question. Make sure you enter a zero for FV, which is not used in this part of the problem. The number of months, N, Shirley will take to repay the loan is 12 months. (Round to the nearest integer.) The rate, I/Y, Shirley will pay on the bank loan is 13.75%. (Round to two decimal places.) The amount, PV, of the furniture that Shirley wants to purchase is $ 1,850. (Round to the nearest dollar) Question is complete. Tap on the red indicators to see incorrect answers. X Problem P7-1 (similar to) Question Help id est Shi Help Me Solve This fou on ond Question Help cal inte Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and Clic chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost The for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost (RG with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table Dolla.) The monthly payment for a bank loan assuming one-year repayment period and 13.75 percent interest is $ 165.89". (Round to the nearest cent.) Total cost is the monthly payment times the number of payments. The total cost for a bank loan assuming a one-year repayment period and 13.75 percent interest is $ 1,990.68. (Round to the nearest cent.) With an add-on interest installment loan, interest charges are calculated using the original balance. intin-nide the Hafth Inne Inn Question is complete. Tap on the red indicators to see incorrect answers. ? Ents TLAR ARARAMA the IRR thin estion Help ci Help Me Solve This X d Question Help est Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table These charges are then added to the loan, and this amount is paid ort over the life or the loan. Loans using the add-on method can be quite costly. Even though the amount of outstanding principal keeps decreasing as you pay back the loan, you still pay interest on the amount you originally borrowed. To calculate the interest, use the following formula: Interest - Principal Interest rate x Time. where Principal is the original loan amount, Interest rate is the annual (quoted) rate on the loan, and Time is time in years. The rate, 1/4, Shirley will pay on the in-store loan is 11.75%. (Round to two decimal places.) ? ? Question is complete. Tap on the red indicators to see incorrect answers. All parts showing remaining Close on help X d est Shi Help Me Solve This fou on one Question Help cal inte Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and Che chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost Th for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost (Ro with a one-year repayment period and 11.75 percent interest, Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table The amount of total interest Shirley would pay for the add-on loan through the store is $ 217.38 (Round to the nearest cent.) Then add the total interest payments to the principal to determine the total repayment amount. The total repayment amount on the store loan is $ 2,067.38" (Round to the nearest cent.) The monthly payment for an add-on loan is the total repayment amount divided by the number of months over which the loan is to be repaid: Drinrinal + interaet Question is complete. Tap on the red indicators to see incorrect answers. ? Enti All parts showing Close 4 remaining X Problem P7-1 (similar to) Question Help Shi fou Help Me Solve This id on est on Question Help cal inte Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and Clic chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost Thi for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost (RC with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table Principal + Interest Monthly payment = Number of month for repayment If the store uses the add-on method of interest calculation, the monthly payment with one-year repayment period and 11.75 percent interest is $ 172.28. (Round to the nearest cent.) Total cost is the monthly payment times the number of payments. For an add-on loan, this is the total repayment amount (any difference is due to rounding). If the store uses the add-on method of interest calculation, the total cost with one-year repayment marind and 44 76 narrant internetin e 7 Dound to the name aant Question is complete. Tap on the red indicators to see incorrect answers. ? Enti ? All parts showing Close i Help Me Solve This u id es 7 Question Help al t Shirley, a recent college graduate, excitedly described to her older sister the $1,850 sofa, table, and di chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.75 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.75 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table If the store uses the add-on method of interest calculation, the total cost with one-year repayment period and 11.75 percent interest is $ 2,067.36 (Round to the nearest cent.) Explain why the bank payment and total cost are lower even though the stated interest rate is higher. (Select the best choice below.) A. The bank payment ($165.89 versus $172.28) and total cost ($1,990.68 versus $2, A37.36) are lower. With the bank loan, although your loan payment remains constant, as you pay off more of the loan each month, your interest expense declines. Therefore, your principal navment amount increases Recanice nu're navinn interest only on the unnaid halance vou Question is complete. Tap on the red indicators to see incorrect answers. ? All parts showing Close

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts