Question: Here we consider two companies, Phil Co. and Billy Co. Both of these companies are exactly alike except Phil Co. has outstanding debt of $2.711

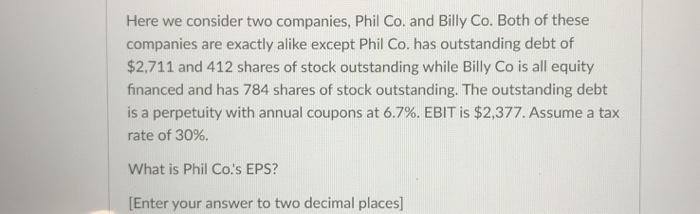

Here we consider two companies, Phil Co. and Billy Co. Both of these companies are exactly alike except Phil Co. has outstanding debt of $2.711 and 412 shares of stock outstanding while Billy Co is all equity financed and has 784 shares of stock outstanding. The outstanding debt is a perpetuity with annual coupons at 6.7%. EBIT is $2,377. Assume a tax rate of 30% What is Phil Co.'s EPS? [Enter your answer to two decimal places] You have a required return of 12%. A project that you are considering offers an IRR of 10.97%. Should you accept or reject this project? O Accept Reject

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock