Question: here's the information from the previous question only solve question 40 6-39 COMPREHENSIVE PROBLEM WITH ABC COSTING. Animal Gear Company makes two pet carriers, the

here's the information from the previous question

only solve question 40

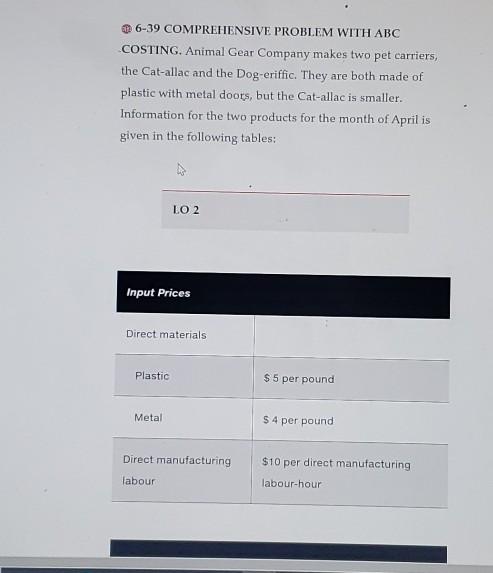

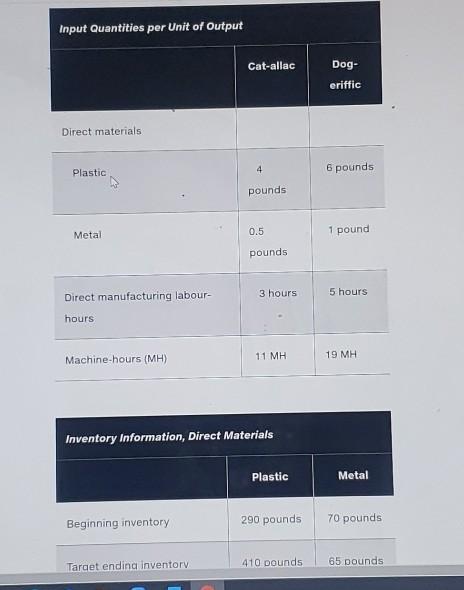

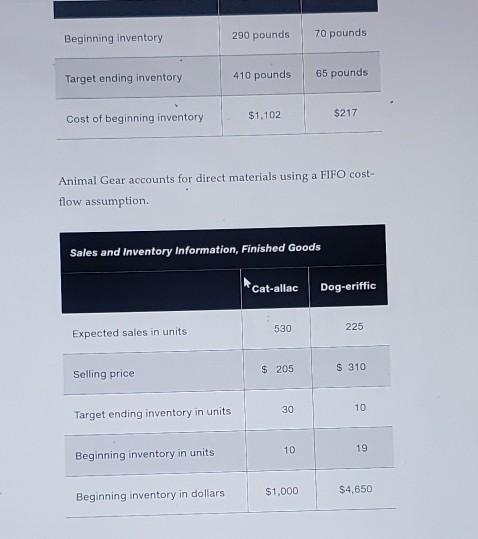

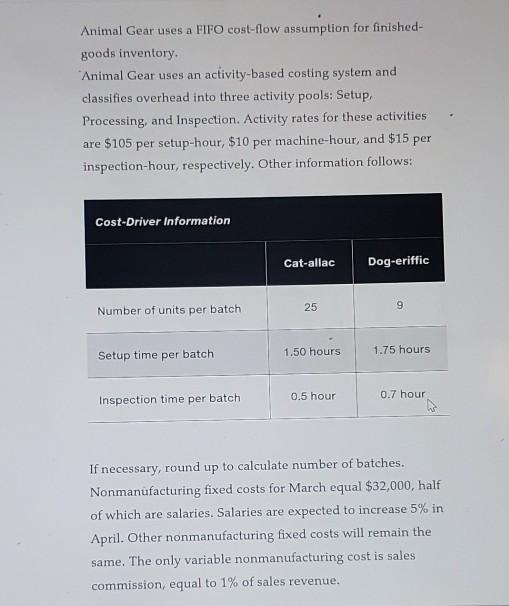

6-39 COMPREHENSIVE PROBLEM WITH ABC COSTING. Animal Gear Company makes two pet carriers, the Cat-allac and the Dog-eriffic. They are both made of plastic with metal doors, but the Cat-allac is smaller. Information for the two products for the month of April is given in the following tables: LO 2 Input Prices Direct materials Plastic $5 per pound Metal $ 4 per pound Direct manufacturing labour $10 per direct manufacturing labour-hour Input Quantities per Unit of Output Cat-allac Dog- eriffic Direct materials Plastic 4 6 pounds pounds Metal 0. 1 pound pounds 3 hours 5 hours Direct manufacturing labour- hours Machine-hours (MH) 11 MH 19 MH Inventory Information, Direct Materials Plastic Metal Beginning inventory 290 pounds 70 pounds Target ending inventory 410 pounds 65 pounds Beginning inventory 290 pounds 70 pounds Target ending inventory 410 pounds 65 pounds $1.102 $217 Cost of beginning inventory Animal Gear accounts for direct materials using a FIFO cost- flow assumption Sales and Inventory Information, Finished Goods Cat-allac Dog-eriffic 530 225 Expected sales in units $ 205 S 310 Selling price 30 10 Target ending inventory in units 10 19 Beginning inventory in units $1,000 $4,650 Beginning inventory in dollars Animal Gear uses a FIFO cost-flow assumption for finished- goods inventory Animal Gear uses an activity-based costing system and classifies overhead into three activity pools: Setup, Processing, and Inspection. Activity rates for these activities are $105 per setup-hour, $10 per machine-hour, and $15 per inspection-hour, respectively. Other information follows: Cost-Driver Information Cat-allac Dog-eriffic 25 9 Number of units per batch Setup time per batch 1.50 hours 1.75 hours Inspection time per batch 0.5 hour 0.7 hour If necessary, round up to calculate number of batches. Nonmanufacturing fixed costs for March equal $32,000, half of which are salaries. Salaries are expected to increase 5% in April. Other nonmanufacturing fixed costs will remain the same. The only variable nonmanufacturing cost is sales commission, equal to 1% of sales revenue. Required Prepare the following for April: Revenues budget Production budget in units Direct material usage budget and direct material purchases budget Direct manufacturing labour cost budget Manufacturing overhead cost budgets for each of the three activities Budgeted unit cost of ending finished-goods inventory and ending inventories budget Cost of goods sold budget Nonmanufacturing costs budget Budgeted income statement (ignore income taxes) How does preparing the budget help Animal Gear's management team better manage the company? V 06-40 CASH BUDGET (continuation of 6-390). LO 3 Assume the following: Animal Gear (AG) does not make any sales on credit. AG sells only to the public and accepts cash and credit cards: 90% of its sales are to customers using credit 6-39 COMPREHENSIVE PROBLEM WITH ABC COSTING. Animal Gear Company makes two pet carriers, the Cat-allac and the Dog-eriffic. They are both made of plastic with metal doors, but the Cat-allac is smaller. Information for the two products for the month of April is given in the following tables: LO 2 Input Prices Direct materials Plastic $5 per pound Metal $ 4 per pound Direct manufacturing labour $10 per direct manufacturing labour-hour Input Quantities per Unit of Output Cat-allac Dog- eriffic Direct materials Plastic 4 6 pounds pounds Metal 0. 1 pound pounds 3 hours 5 hours Direct manufacturing labour- hours Machine-hours (MH) 11 MH 19 MH Inventory Information, Direct Materials Plastic Metal Beginning inventory 290 pounds 70 pounds Target ending inventory 410 pounds 65 pounds Beginning inventory 290 pounds 70 pounds Target ending inventory 410 pounds 65 pounds $1.102 $217 Cost of beginning inventory Animal Gear accounts for direct materials using a FIFO cost- flow assumption Sales and Inventory Information, Finished Goods Cat-allac Dog-eriffic 530 225 Expected sales in units $ 205 S 310 Selling price 30 10 Target ending inventory in units 10 19 Beginning inventory in units $1,000 $4,650 Beginning inventory in dollars Animal Gear uses a FIFO cost-flow assumption for finished- goods inventory Animal Gear uses an activity-based costing system and classifies overhead into three activity pools: Setup, Processing, and Inspection. Activity rates for these activities are $105 per setup-hour, $10 per machine-hour, and $15 per inspection-hour, respectively. Other information follows: Cost-Driver Information Cat-allac Dog-eriffic 25 9 Number of units per batch Setup time per batch 1.50 hours 1.75 hours Inspection time per batch 0.5 hour 0.7 hour If necessary, round up to calculate number of batches. Nonmanufacturing fixed costs for March equal $32,000, half of which are salaries. Salaries are expected to increase 5% in April. Other nonmanufacturing fixed costs will remain the same. The only variable nonmanufacturing cost is sales commission, equal to 1% of sales revenue. Required Prepare the following for April: Revenues budget Production budget in units Direct material usage budget and direct material purchases budget Direct manufacturing labour cost budget Manufacturing overhead cost budgets for each of the three activities Budgeted unit cost of ending finished-goods inventory and ending inventories budget Cost of goods sold budget Nonmanufacturing costs budget Budgeted income statement (ignore income taxes) How does preparing the budget help Animal Gear's management team better manage the company? V 06-40 CASH BUDGET (continuation of 6-390). LO 3 Assume the following: Animal Gear (AG) does not make any sales on credit. AG sells only to the public and accepts cash and credit cards: 90% of its sales are to customers using credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts