Question: Hershey ( HSY ) values the majority of U . S . inventories under the LIFO method and its international business using the FIFO method.

Hershey HSY values the majority of US inventories under the LIFO method and its international business using the FIFO method. Using the information below from HSYs footnote, what adjustments are needed to convert the NOA and NOPAT from LIFO to asif FIFO? Assume the statutory tax rate is percent.

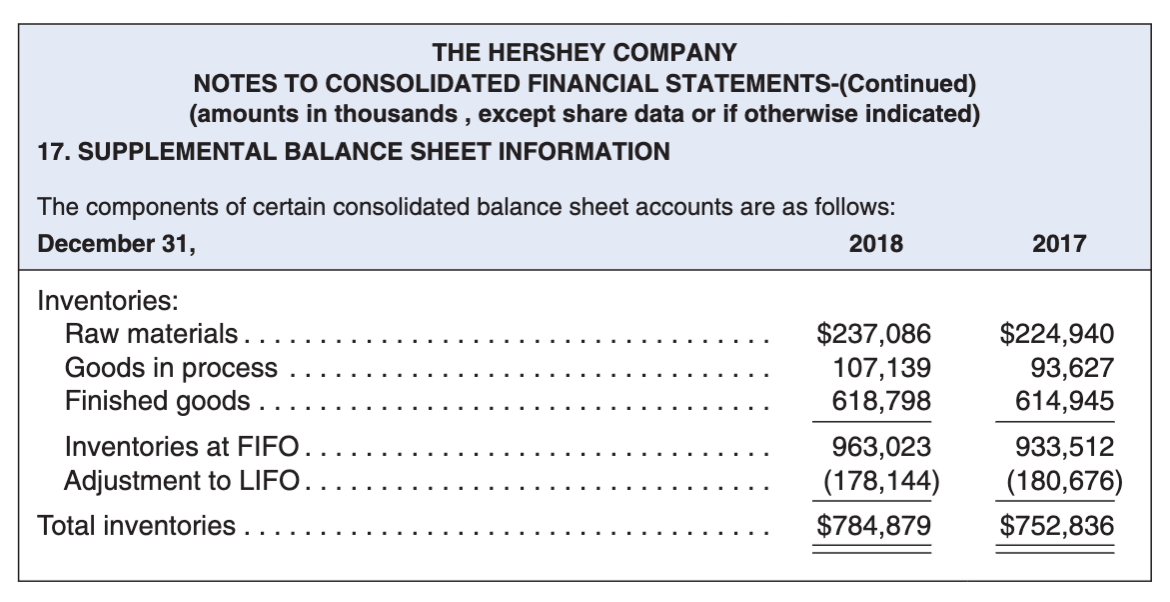

THE HERSHEY COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (amounts in thousands, except share data or if otherwise indicated) 17. SUPPLEMENTAL BALANCE SHEET INFORMATION The components of certain consolidated balance sheet accounts are as follows: December 31, Inventories: Raw materials. Goods in process Finished goods. Inventories at FIFO. Adjustment to LIFO. Total inventories. 2018 2017 $237,086 $224,940 107,139 93,627 618,798 614,945 963,023 933,512 (178,144) (180,676) $784,879 $752,836

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

ANSWER To convert Hersheys 2018 NOA and NOPAT from LIFO to asif FIFO we need to make the following a... View full answer

Get step-by-step solutions from verified subject matter experts