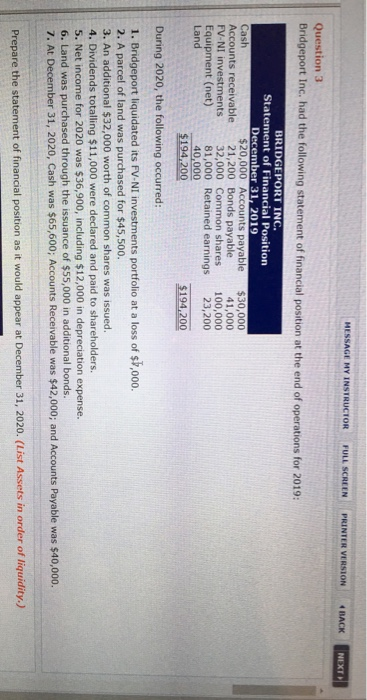

Question: HESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Question 3 Bridgeport Inc, had the following statement of financial position at the end of operations

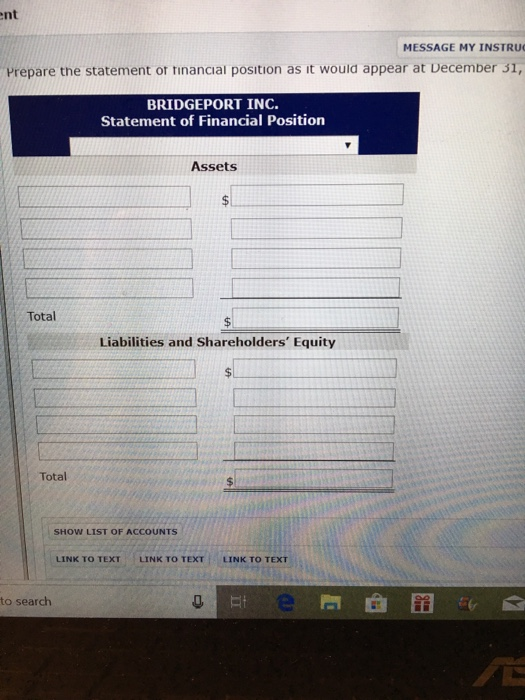

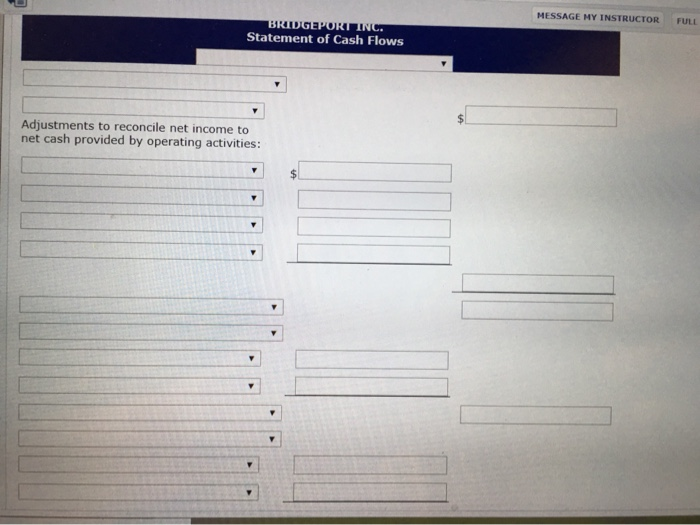

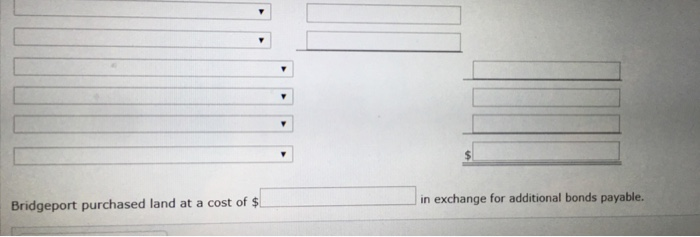

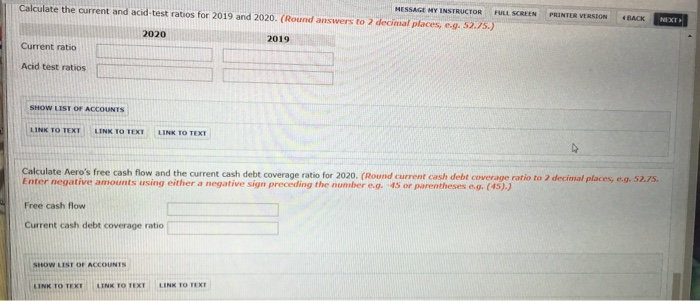

HESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Question 3 Bridgeport Inc, had the following statement of financial position at the end of operations for 2019: BRIDGEPORT INC. Statement of Financial Position December 31, 2019 Cash $20,000 Accounts payable $30,000 Accounts receivable 21,200 Bonds payable 41,000 FV-NI investments 32,000 Common shares 100,000 Equipment (net) 81,000 Retained earnings 23,200 Land 40,000 $194,200 $194,200 During 2020, the following occurred: 1. Bridgeport liquidated its FV-NI investments portfolio at a loss of $1,000. 2. A parcel of land was purchased for $45,500. 3. An additional $32,000 worth of common shares was issued. 4. Dividends totalling $11,000 were declared and paid to shareholders. 5. Net income for 2020 was $36,900, including $12,000 in depreciation expense. 6. Land was purchased through the issuance of $55,000 in additional bonds. 7. At December 31, 2020, Cash was $65,600; Accounts Receivable was $42,000; and Accounts Payable was $40,000. Prepare the statement of financial position as it would appear at December 31, 2020. (List Assets in order of liquidity.) ent MESSAGE MY INSTRU Prepare the statement of financial position as it would appear at December 31, BRIDGEPORT INC. Statement of Financial Position Assets Total Liabilities and Shareholders' Equity Total S SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT to search te @ MESSAGE MY INSTRUCTOR FULL BRIDGEPORT INC. Statement of Cash Flows Adjustments to reconcile net income to net cash provided by operating activities: Bridgeport purchased land at a cost of $ in exchange for additional bonds payable. Calculate the current and acid-test ratios for 2019 and 2020. (Round answers to MESSAGE HY INSTRUCTOR FULL SCREEN decimal places, c.g. 52.75.) PRINTER VERSION BACK NEXT 2020 2019 Current ratio Acid test ratios SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT Calculate Aero's free cash flow and the current cash debt coverage ratio for 2020. (Round current cash debt coverage ratio to 2 decimal places, eg. 52.75. Enter negative amounts using either a negative sign preceding the number 45 or parentheses (45).) Free cash flow Current cash debt coverage ratio SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts