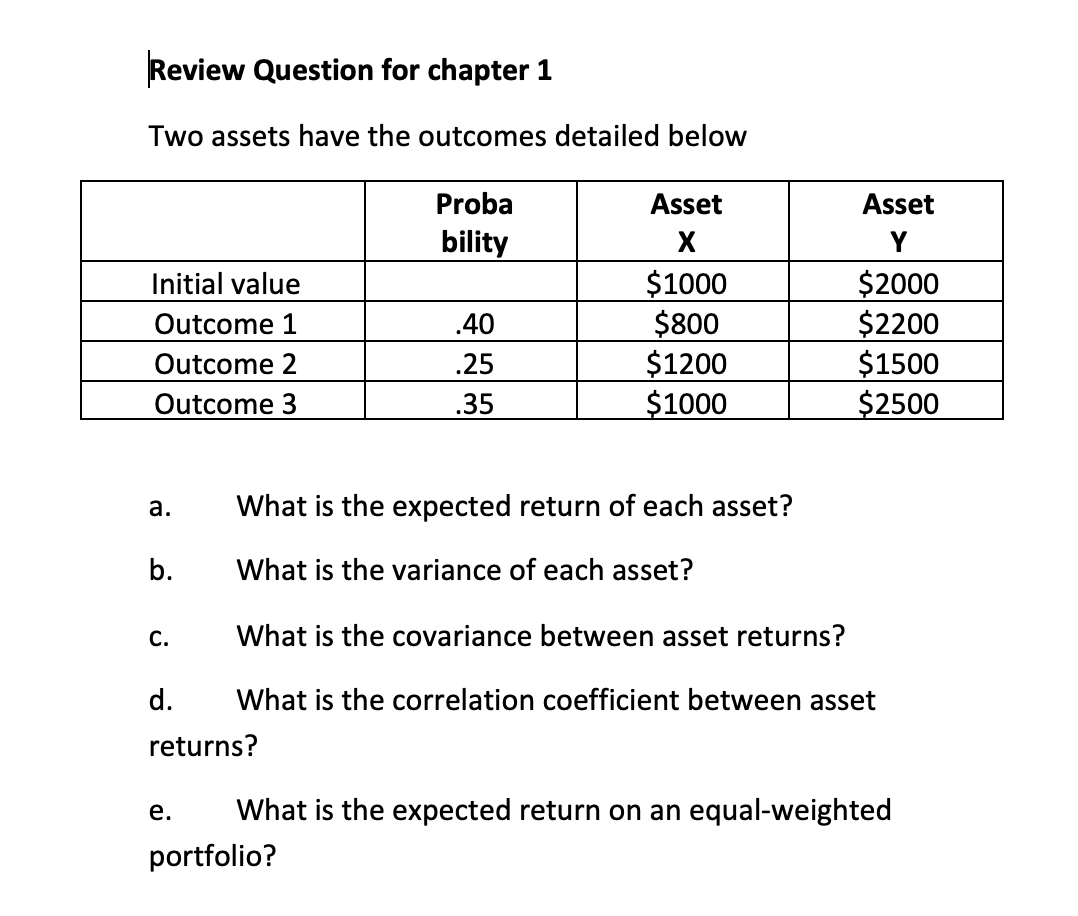

Question: heview Question for chapter 1 Two assets have the outcomes detailed below Proba Asset bility Y Initial value $1000 $2000 ._ $800 52200 $1200 $1500

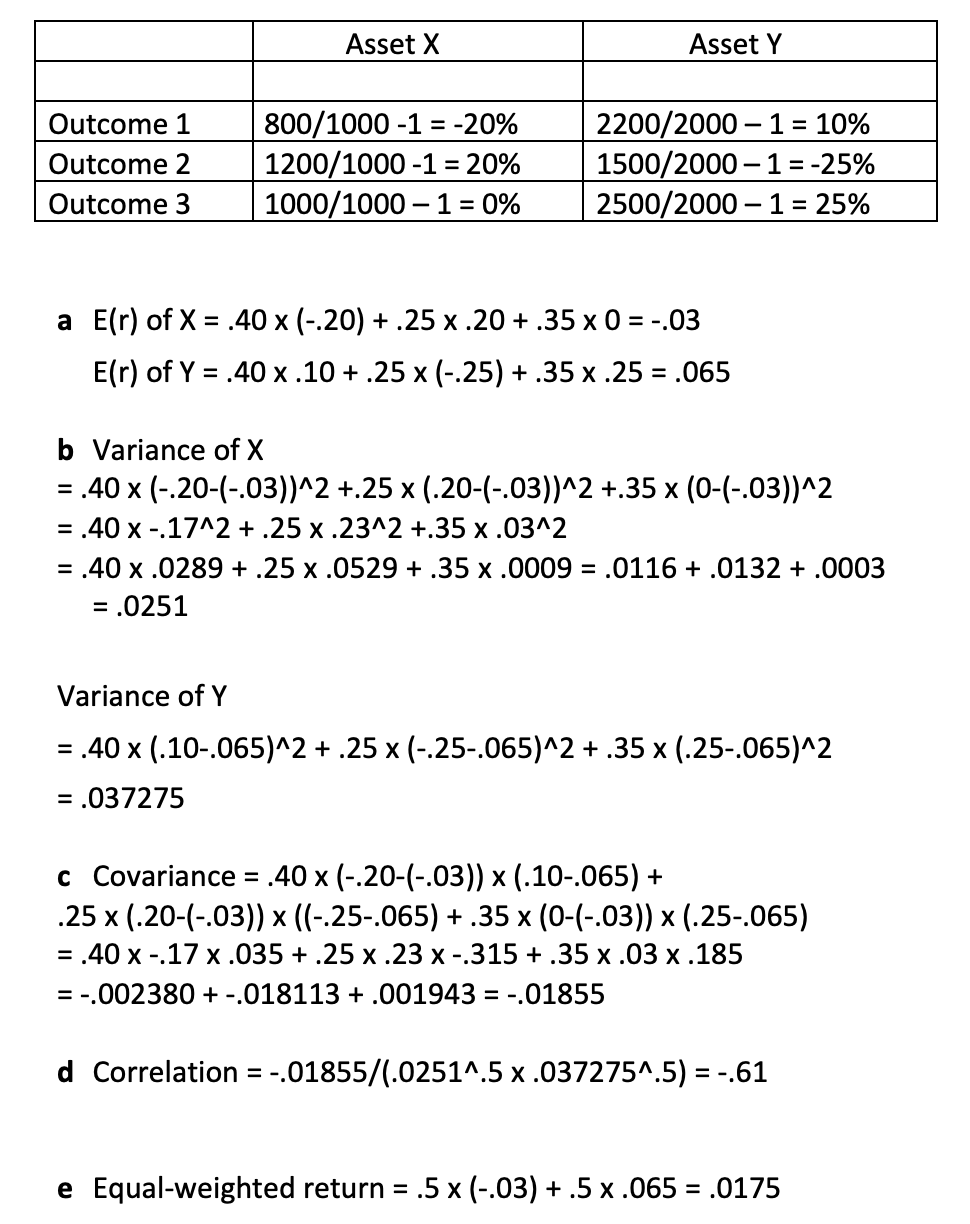

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts