Question: hevul payment om inte Devator tus ctober purchase, less return on October 11. Prepare entries in journal form to record the transactions, assuming the periodic

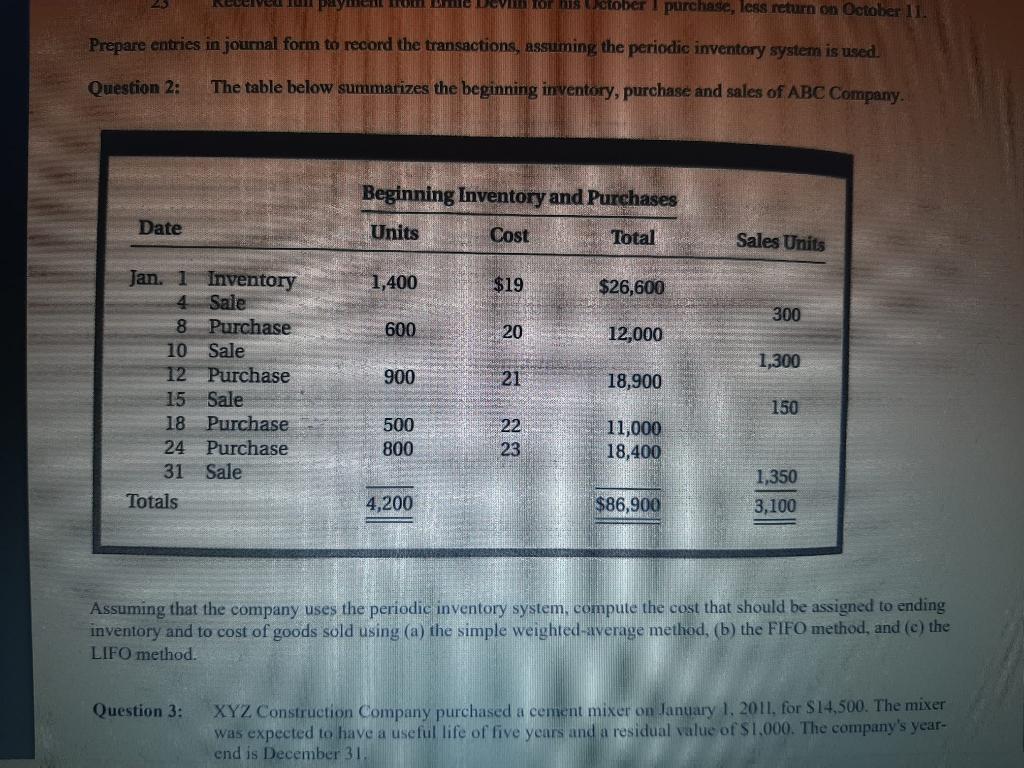

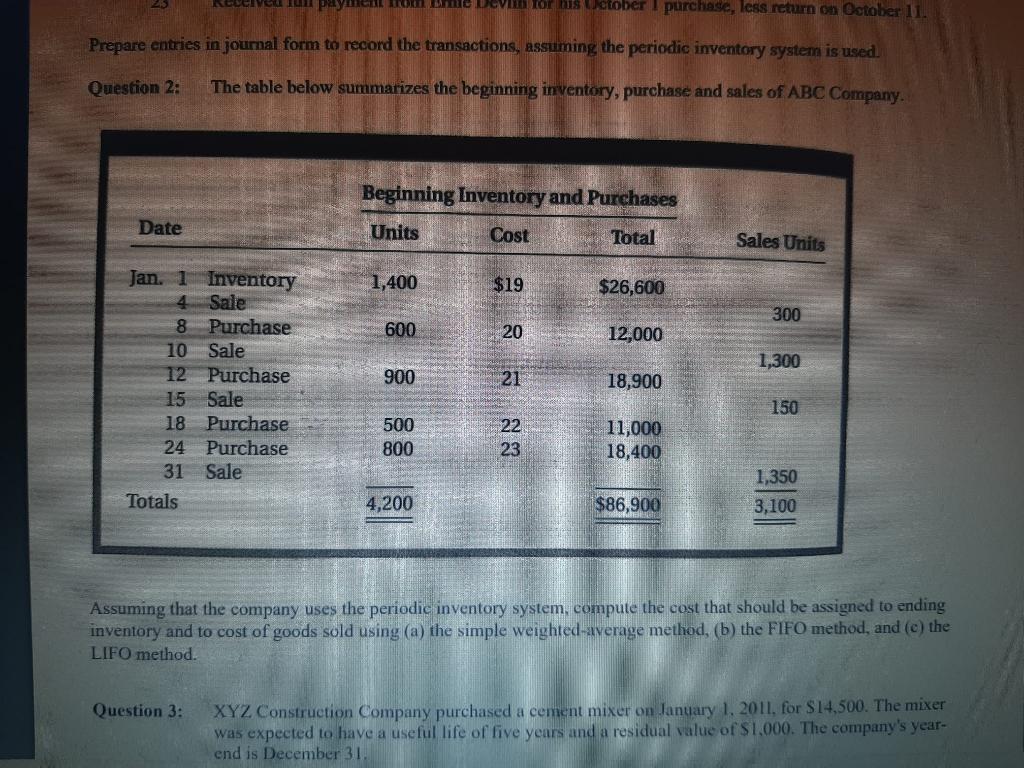

hevul payment om inte Devator tus ctober purchase, less return on October 11. Prepare entries in journal form to record the transactions, assuming the periodic inventory system is used. Question 2: The table below summarizes the beginning inventory, purchase and sales of ABC Company. Beginning Inventory and Purchases Date Units Cost Total Sales Units 1,400 $19 $26,600 300 600 20 12,000 1,300 900 Jan. 1 Inventory 4 Sale 8 Purchase 10 Sale 12 Purchase 15 Sale 18 Purchase 24 Purchase 31 Sale Totals 21 18,900 150 500 22 23 800 11,000 18,400 1,350 3,100 4,200 $86,900 Assuming that the company uses the periodic inventory system, compute the cost that should be assigned to ending inventory and to cost of goods sold using (a) the simple weighted average method, (b) the FIFO method, and (c) the LIFO method. Question 3: XYZ Construction Company purchased a cement mixer on January 1, 2011, for $14,500. The mixer was expected to have a useful life of five years and a residual value of $1,000. The company's year- end is December 31 hevul payment om inte Devator tus ctober purchase, less return on October 11. Prepare entries in journal form to record the transactions, assuming the periodic inventory system is used. Question 2: The table below summarizes the beginning inventory, purchase and sales of ABC Company. Beginning Inventory and Purchases Date Units Cost Total Sales Units 1,400 $19 $26,600 300 600 20 12,000 1,300 900 Jan. 1 Inventory 4 Sale 8 Purchase 10 Sale 12 Purchase 15 Sale 18 Purchase 24 Purchase 31 Sale Totals 21 18,900 150 500 22 23 800 11,000 18,400 1,350 3,100 4,200 $86,900 Assuming that the company uses the periodic inventory system, compute the cost that should be assigned to ending inventory and to cost of goods sold using (a) the simple weighted average method, (b) the FIFO method, and (c) the LIFO method. Question 3: XYZ Construction Company purchased a cement mixer on January 1, 2011, for $14,500. The mixer was expected to have a useful life of five years and a residual value of $1,000. The company's year- end is December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts