Question: hework 2 work . Due in 10 hours 0 8/10 answered Question 8 Homework Unanswered You are interested in buying a house and renting it

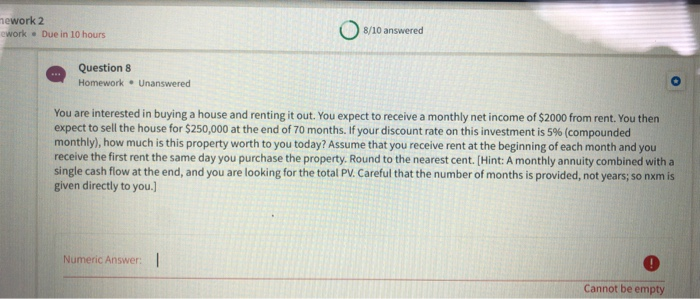

hework 2 work . Due in 10 hours 0 8/10 answered Question 8 Homework Unanswered You are interested in buying a house and renting it out. You expect to receive a monthly net income of $2000 from rent. You then expect to sell the house for $250,000 at the end of 70 months. If your discount rate on this investment is 5% (compounded monthly), how much is this property worth to you today? Assume that you receive rent at the beginning of each month and you receive the first rent the same day you purchase the property. Round to the nearest cent. (Hint: A monthly annuity combined with a single cash flow at the end, and you are looking for the total PV. Careful that the number of months is provided, not years; so nxm is given directly to you.) Numeric Answer: 1 Cannot be empty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts