Question: Hey can someome help me out with this problem i need parts 1-6 for this one. can you also show work please and thank you!

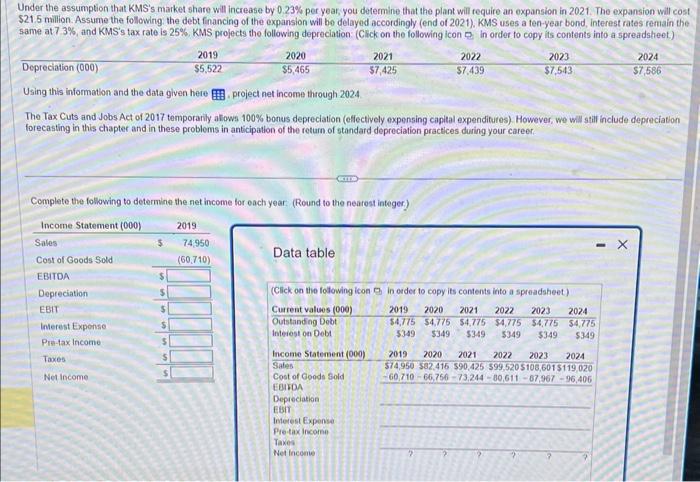

Under the assumption that KMS's market share will increase by 0.23% per year you determine that the plant will require an expansion in 2021 . The expansion will cost \$21.5 million. Assume the following the debt fnancing of the expansion wil bo delayed accordingly (end of 2021). KMS uses a ten-year bond, interest rates remain the same at 7.3\%, and KMS's tax rate is 25\%. KMS projects the following depreciation: (Cick on the following icon on in ordet to copy its contents into a spreadsheet) Using this information and the data given here project net income through 2024 The Tax Cuts and Jobs Act of 2017 temporanily alows 100% bonus depreciation (ellectively expensing capital expenditures) However, we will stif include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Complete the following to determine the net income for each year. (Round to the nearest integer) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts