Question: Hey can someone help me solve this problem 2-13A the trial balance to prepare an income statement and statement of changes in equity for the

Hey can someone help me solve this problem

2-13A

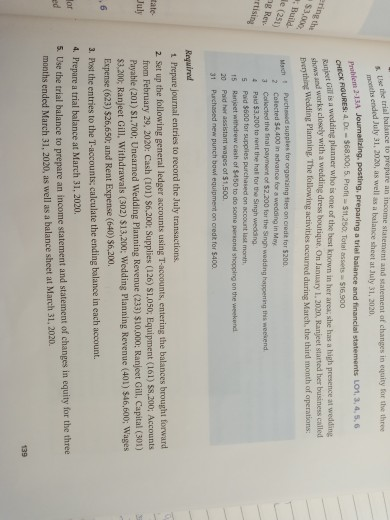

the trial balance to prepare an income statement and statement of changes in equity for the three did July 31, 2020, as well as a balance sheet at July 31, 3020. Use the trial bala mots ended July Problem 2-3A Jou CHECK OURES: 4. DE $68100 Ranjeet all is a wedding plan en 2-13A Joumanang pong, preparing a trial balance and financial statements 101.3.4.5.6 FIGURES: 4. DL-368.100: 5. Proht - $11.250 Total assets $16.900 Gill is a wedding planner who is one of the best known in her area; she has a high presence a wedding ws and works closy with a wedding dress boutique. On January 1, 2000. Ranjeet started her business called thing Wedding P o wing activities occurred during March, the third month of operations ering the $3.000 Bild le (251) ng Re trtising Macht Purch suppres for organingfles on credit for 5200 Colected $4.400 in advance for a wedding in May 7 Collected the final payment of $2.200 for the Singh wedding haponing is weekend + Paid $3,200 to rent the halfort Singh wedding 5 Paid $600 for supplies purchased on account last month 15 Ranjeet withdrew cash or $450 to do some personal shopping on the weekend 20 Paid her assistant wages of $1,500 31 Purchased new punch bowl equipment on credit for $400. Required 1 Prepare journal entries to record the July transactions. 2. Set up the following general ledger accounts using T-accounts, entering the balances brought forward from February 29, 2020: Cash (101) S6,200, Supplies (126) S1,050; Equipment (161) 58.200; Accounts Payable (201) 51.700; Unearned Wedding Planning Revenue (233) $10.000: Ranjeet Gill, Capital (301) $3,200, Ranjeet Gill, Withdrawals (302) $13,200: Wedding Planning Revenue (401) $46,600; Wages Expense (623) $26,650; and Rent Expense (640) 56,200. 3. Post the entries to the T-accounts, calculate the ending balance in each account. 4. Prepare a trial balance at March 31, 2020. 5. Use the trial balance to prepare an income statement and statement of changes in equity for the three months ended March 31, 2020, as well as a balance sheet at March 31, 2020. for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts