Question: Hey, can someone solve this problem? It is about options strategy and the payoff diagram. Problem 4. (20 points) You have a portfolio that consists

Hey, can someone solve this problem?

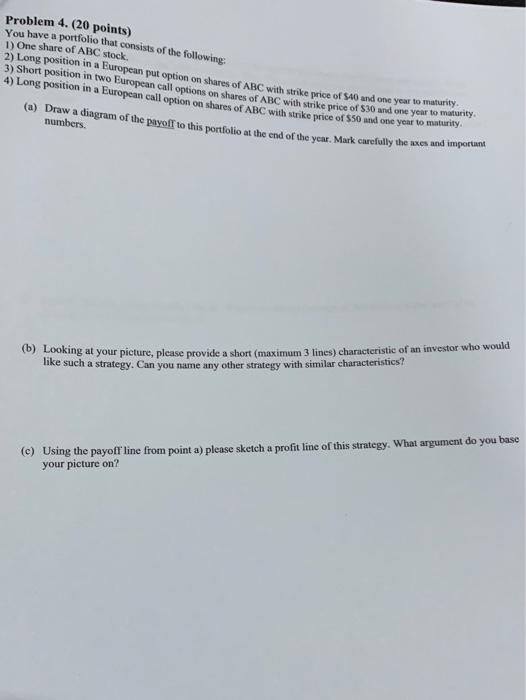

Hey, can someone solve this problem?Problem 4. (20 points) You have a portfolio that consists of the following: 1) One share of ABC stock 2) Long position in a European put option on shares of ABC with strike price of $40 and one year to maturity 3) Short position in two European call options on shares of ABC with Strike price of $30 and one year to modernity 4) Long position in a European call option on shares of ABC with strike price of $50 and one year wo maturity (a) Draw a diagram of the payoff to this portfolio at the end of the year. Mark carefully the axes and important numbers (b) Looking at your picture, please provide a short (maximum 3 lines) characteristic of an investor who would like such a strategy. Can you name any other strategy with similar characteristics? (c) Using the payoffline from point a) please sketch a profit line of this strategy. What argument do you base your picture on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts