Question: hey can you please help me solve this question? with steps explained? thank you!! 8. From the following transaction situations, calculate the expense or revenue

hey can you please help me solve this question? with steps explained? thank you!!

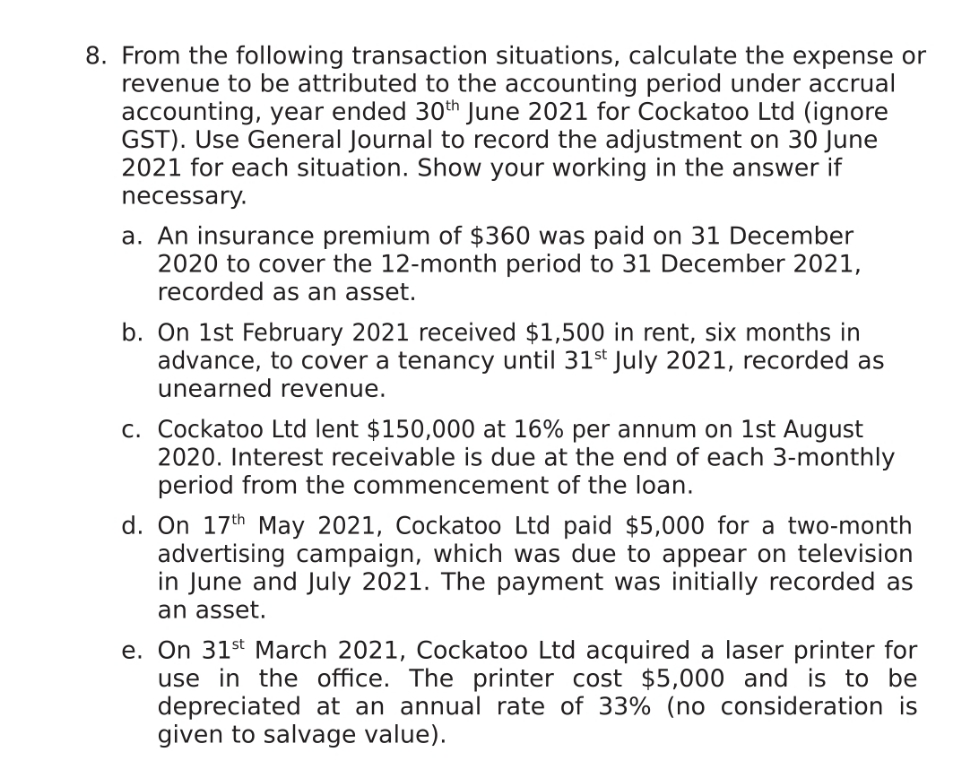

8. From the following transaction situations, calculate the expense or revenue to be attributed to the accounting period under accrual accounting, year ended 30th June 2021 for Cockatoo Ltd (ignore GST). Use General Journal to record the adjustment on 30June 2021 for each situation. Show your working in the answer if necessary. a. An insurance premium of $360 was paid on 31 December 2020 to cover the 12-month period to 31 December 2021, recorded as an asset. 0n lst February 2021 received $1,500 in rent, six months in advance, to cover a tenancy until 315ijuly 2021, recorded as unearned revenue. . Cockatoo Ltd lent $150,000 at 16% per annum on lst August 2020. Interest receivable is due at the end of each 3-monthly period from the commencement of the loan. . On 17th May 2021, Cockatoo Ltd paid $5,000 for a twomonth advertising campaign, which was due to appear on television in June and July 2021. The payment was initially recorded as an asset. . On 315t March 2021, Cockatoo Ltd acquired a laser printer for use in the ofce. The printer cost $5,000 and is to be depreciated at an annual rate of 33% (no consideration is given to salvage value}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts