Question: Hey could you explain what method you use to solve this problem? Parvis Ind. wants to calculate its cost of equity. The company paid a

Hey could you explain what method you use to solve this problem?

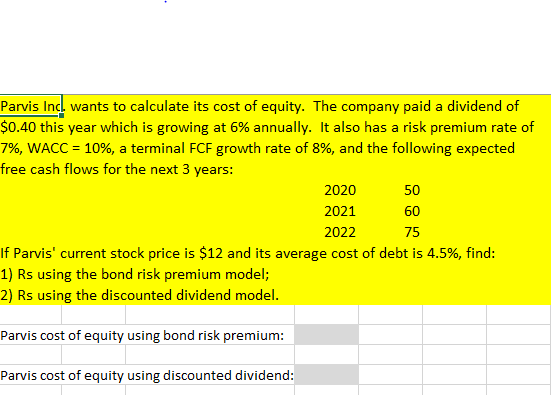

Parvis Ind. wants to calculate its cost of equity. The company paid a dividend of 0.40 this year which is growing at 6% annually. It also has a risk premium rate of 796, WACC-10%, a terminal FCF growth rate of 8%, and the following expected free cash flows for the next 3 years: 2020 2021 2022 50 60 75 If Paris' current stock price is $12 and its average cost of debt is 4.5%, find 1) Rs using the bond risk premium model; 2) Rs using the discounted dividend model Parvis cost of equity using bond risk premium Parvis cost of equity using discounted dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts