Question: Hey! Could you please answer this question correctly. Please do bit send back the sane question that us on here type it and do it

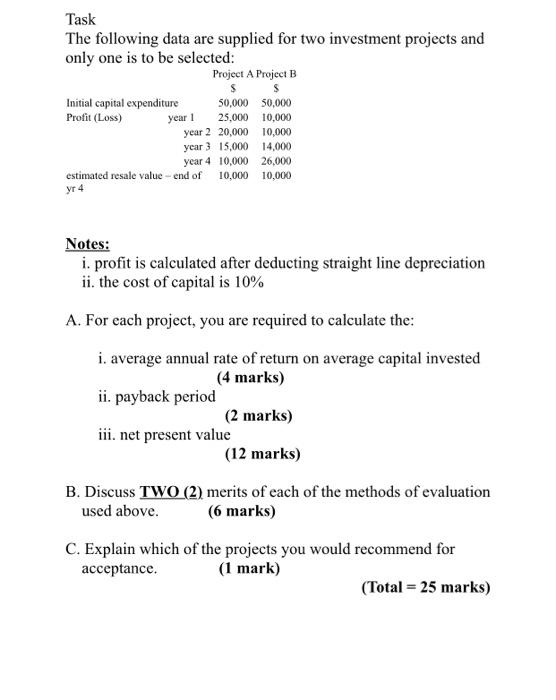

Task The following data are supplied for two investment projects and only one is to be selected: Project A Project B $ $ 50,000 50,000 Initial capital expenditure Profit (Loss) 25,000 10,000 year 2 20,000 10,000 year 3 15,000 14,000 year 4 10,000 26,000 estimated resale value - end of 10,000 10,000 yr 4 Notes: i. profit is calculated after deducting straight line depreciation ii. the cost of capital is 10% A. For each project, you are required to calculate the: i. average annual rate of return on average capital invested (4 marks) ii. payback period (2 marks) iii. net present value (12 marks) B. Discuss TWO (2) merits of each of the methods of evaluation used above. (6 marks) C. Explain which of the projects you would recommend for acceptance. (1 mark) (Total = 25 marks) year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts