Question: Hey Coursehero Tutor please use these graphs to answer the question below it. These graphs are the correct way to answer the question. Thank you.

Hey Coursehero Tutor please use these graphs to answer the question below it. These graphs are the correct way to answer the question. Thank you.

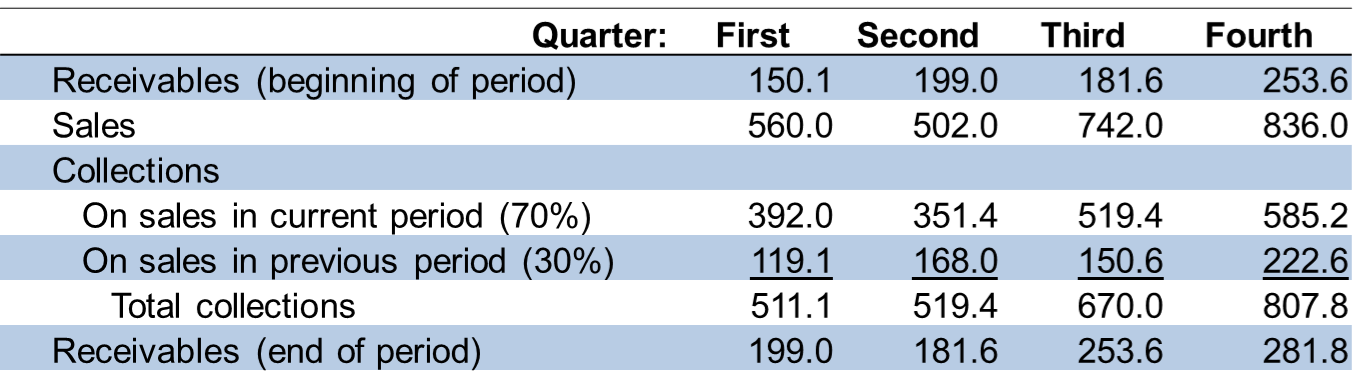

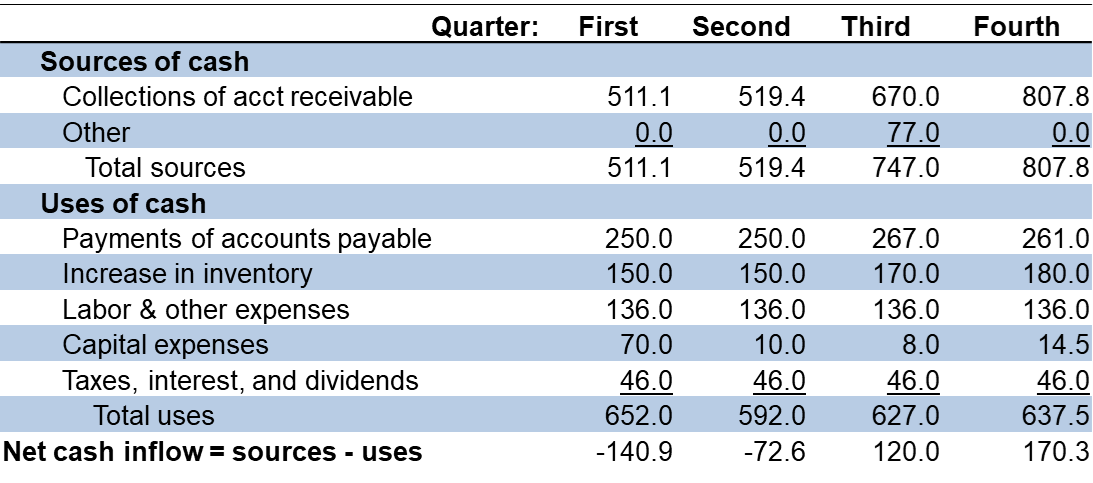

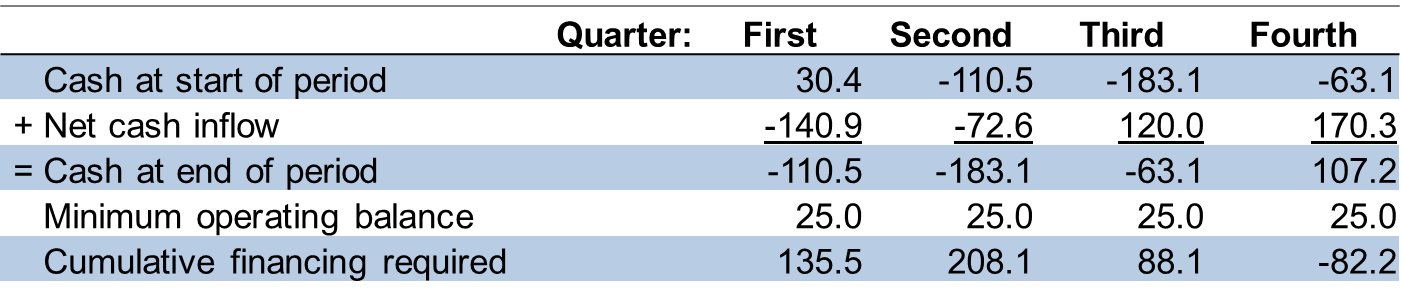

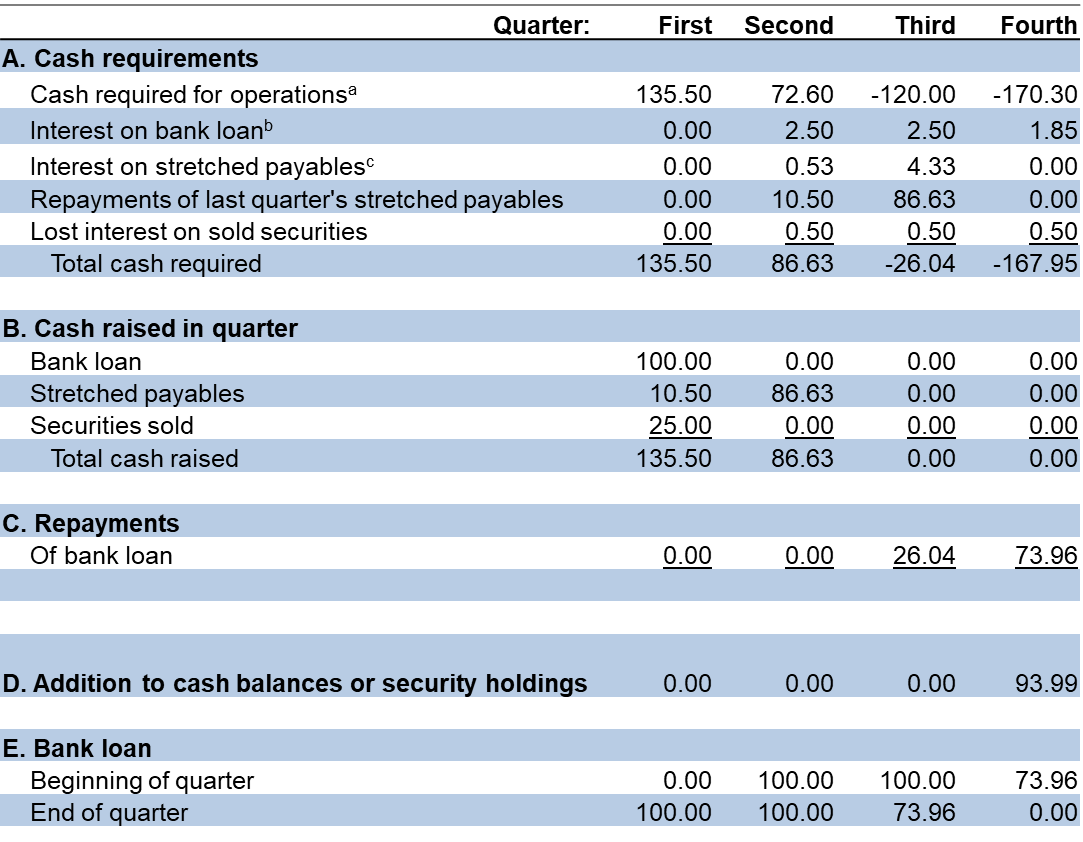

*GRAPHS TO GUIDE YOU COURSEHERO TUTOR*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts