Question: Hey, help me solve the question and provide me with explanations and calculations. Thank you! Question 9 If the yields on one-year government bonds in

Hey, help me solve the question and provide me with explanations and calculations. Thank you!

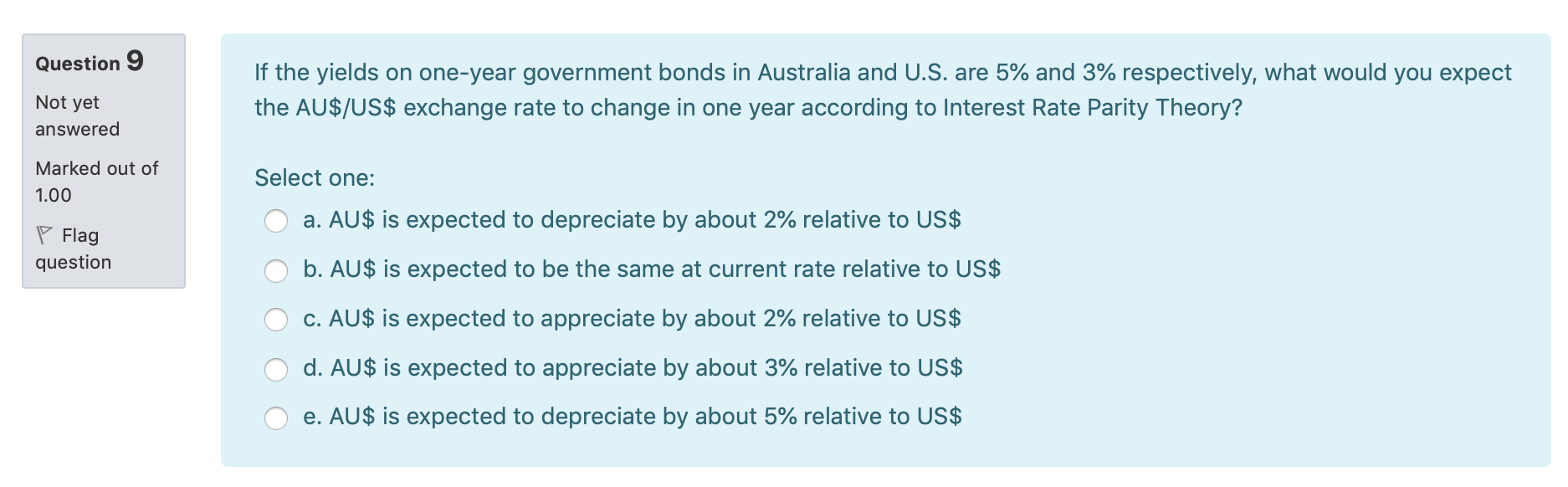

Question 9 If the yields on one-year government bonds in Australia and U.S. are 5% and 3% respectively, what would you expect the AU$/US$ exchange rate to change in one year according to Interest Rate Parity Theory? Not yet answered Marked out of 1.00 P Flag question Select one: O a. AU$ is expected to depreciate by about 2% relative to US$ O b. AU$ is expected to be the same at current rate relative to US$ O C. AU$ is expected to appreciate by about 2% relative to US$ O d. AU$ is expected to appreciate by about 3% relative to US$ o e. AU$ is expected to depreciate by about 5% relative to US$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts