Question: Hey I just really require some help on how to begin this case study Required I am seeking assistance for an expected cash flow and

Hey I just really require some help on how to begin this case study

Required

I am seeking assistance for an expected cash flow and a sensitivity analysis

STONE ROCK GOLF & COUNTRY CLUB: WEDDING BELLS

In 2016, Ivey Business School graduate Jordan Roberts, general manager of Stone Rock Golf & Country Club (SRGCC), recognized a potential opportunity for further growth in the club's weddings and special events business. He was considering the possibility of subsidizing the SRGCC, which was facing struggles like others in the golf industry, by setting a goal to become the destination of choice for uniquely special events in Southwestern Ontario. Roberts looked around his facility and decided that he had an idea, rustic, yet elegant wedding venue opportunity right in the maintenance area of the clubhouse. His quick calculations indicated a likely capital investment of close to CA$1 million1 for the required renovations. Roberts knew that he would have to approach his banker for financing as well as convince his board of directors to take this leap! He began mapping out a plan to build his business case for the new space.

CANADIAN GOLF INDUSTRY

In 1999, the international golf industry saw significant growth due to the popularity of Tiger Woods. However, the 2008 recession ended the "Tiger-Boom" that the golf industry had been experiencing as golf?typically driven by membership revenues and green fees?was seen as too expensive, too difficult, and too time-consuming for the average Canadian.2 Many courses across Ontario and the rest of North America were forced into bankruptcy and foreclosed on loans due to the rapid decline in the number of golfers. Over a decade, Canada saw 158 courses closed.3 According to Statistics Canada, Canada had an estimated 2,400 golf courses and 1.5 million golfers?among the highest per capita numbers globally.4

Many courses in Southwestern Ontario could not survive the recession, and many courses had to close their doors. However, many survived the recession through a solution that swept the industry: consolidation of courses. GolfNorth, for example, purchased numerous mid-tier golf courses that would have otherwise been forced to close throughout Southern Ontario.5

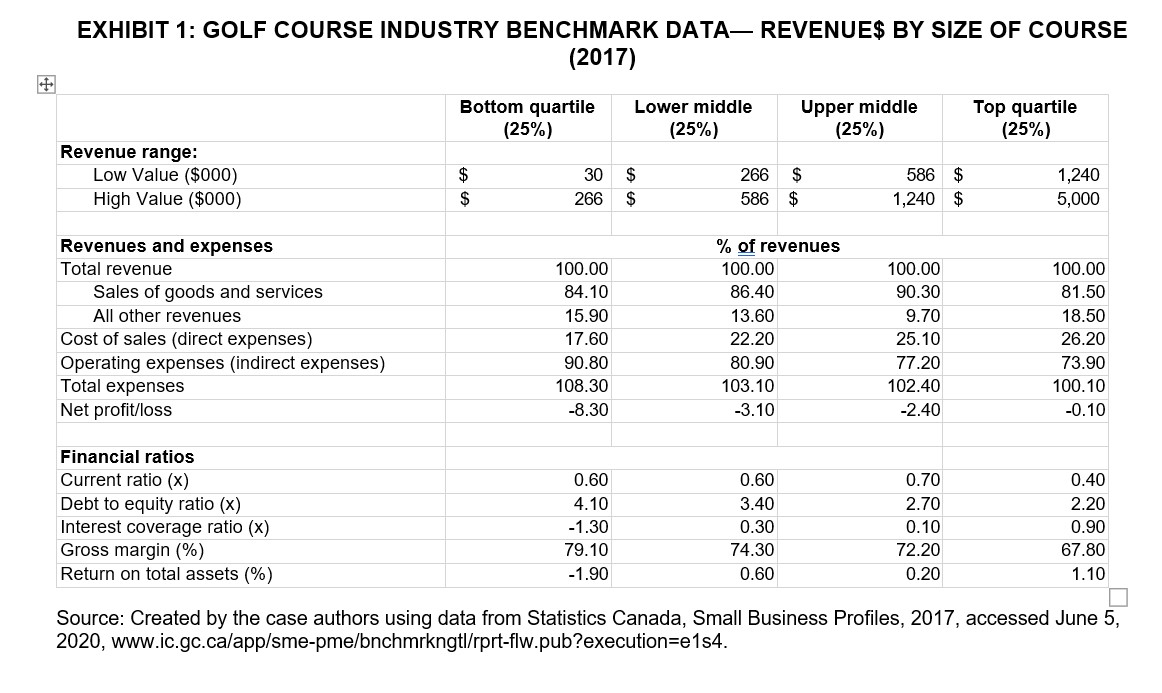

The golf industry responded to the decline in the number of golfers by reducing green fees, adding more nine-hole courses, changing the landscape design of holes to reduce playtime, and marketing other games such as footgolf (a combination of soccer and golf).6 Courses also slashed operating expenses by reducing maintenance and turning off their sprinklers.7 In 2015, the Canadian golf industry was estimated to be worth more than $14.3 billion and had started to rebound, with Canadians playing more golf than in the years before8 (see Exhibit 1).

STONE ROCK GOLF & COUNTRY CLUB (SRGCC)

SRGCC, located in the small town of Ainslie, Ontario, began operations in 1931 with a nine-hole golf course. The course had been privately owned since 1993, and the owners reinvested in meticulous maintenance. While maintaining the difficulty that had existed in the original course, SRGCC had expanded to a full 18 holes, taking advantage of the natural landscape, including ponds and creeks. The course was also upgraded to include cart paths, additional trees, a waterfall, and revitalized sand traps. The course quickly became one of the most revered semi-private facilities in Southwestern Ontario; it was highly rated in various articles and hosted many Ontario Golf Association events.

The four local families who owned and operated SRGCC ran the business according to their family values and their sense of loyalty and pride in their community. As a result, SRGCC was known for its high focus on customer service and love of golf. The four families were represented on the board of directors, and many family members had roles within the daily operations of the golf club.

Roberts was a board member and the son of the chair of the board; after completing his honors and master of business administration degrees at the Ivey Business School and gaining experience in the retail industry, Roberts joined SRGCC full time as the president and general manager in 2016.

Weddings at SRGCC

Roberts knew that hosting weddings was not a new idea for SRGCC. The club had been hosting weddings for years; however, these wedding customers were usually children of the golf club's members, and they had chosen the venue based on convenience rather than elegance. He suspected that the existing banquet hall in the clubhouse, with its dated dcor and minimal natural light, was more appealing to golfers than to brides and grooms. However, in 2012, Roberts was surprised to discover that a hotel in Ainslie had been hosting, on average, 22 weddings annually?significantly more than the six SRGCC typically hosted. Roberts also knew that the record-breaking numbers in 2012, when SRGCC hosted 12 weddings, had likely been because superstitious couples wanted to avoid getting married in 2013.

Roberts knew that the board had been reluctant to make the wedding business a priority but had definitely been swayed by the positive financial results from the 2012 wedding season. In the 20 years prior, the owners had never drawn a dividend from the company. The venture had clearly become a project of passion rather than a business. Each of the board members, as well as the general manager and superintendent, had worked in the golf

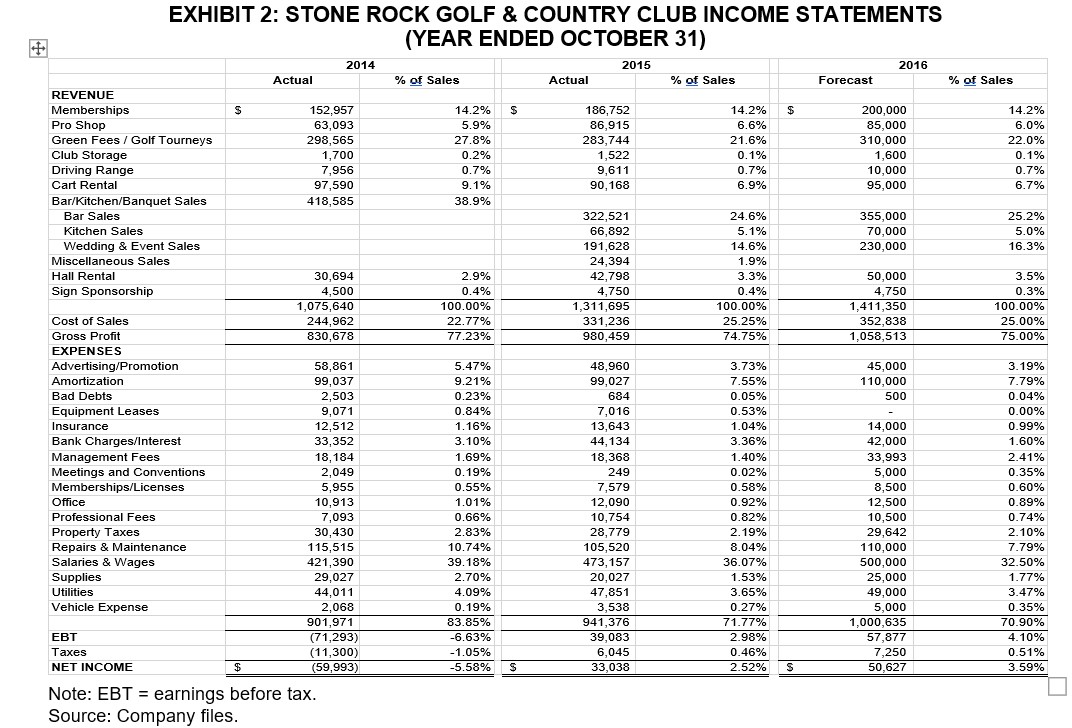

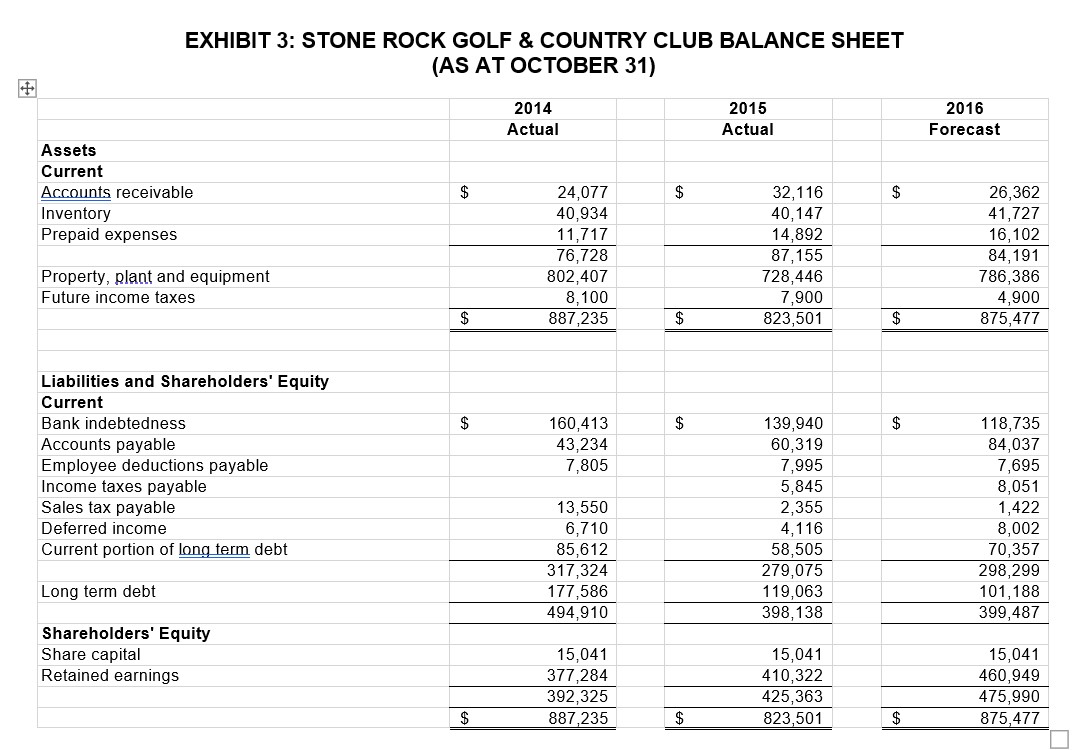

industry for over 30 years; they were worried that shifting the focus away from golf would jeopardize the golf business. Eventually, the board recognized the financial potential in weddings and special events and drafted a business plan to request financing for a 2014 renovation project despite knowing that banks had been reluctant to lend money to the golf industry. SRGCC received the financing and, in spring 2014, completed renovations to the banquet hall, kitchen, and washrooms and added a bridal suite and an on-site ceremony location. When the downturn in the golf industry continued into 2014, SRGCC suffered a loss of $60,000 that year, debt financing became tight, and the bank was questioning SRGCC's future.

Reluctantly, the board realized that pursuing the weddings and special events business was critical to becoming profitable again. SRGCC shifted its focus away from selling the golf course to selling "golf-course weddings" and built a team dedicated to weddings, including a full-time wedding planner and manager. Roberts's wife, Anne Kelly, took on the role and quickly focused on building a wedding website?separate from the golf site?and a marketing plan focused on weddings. After facing considerable resistance from the board members, Roberts and Kelly, with the rest of the wedding team, led SRGCC to become a leader in the weddings and special events industry in Southwestern Ontario, particularly in Ainslie and the surrounding area. As word spread about the facilities and customer service provided at SRGCC, weddings, and special events customers came from as far as 100 kilometers away. The wedding numbers quickly grew to 27 in 2015 and 29 in 2016. Due to the growth, Kelly was promoted to director of special events and used her passion for special events, attention to detail, and compassionate personality, to deliver high-quality events to her clients. As well, she recruited a dedicated weddings and special events manager, to focus on delivering everything the clients dreamed of, and a highly experienced executive chef and sous chef, who offered 40 years of combined experience.

Despite the positive financial results that the wedding business brought, golf course revenues continued to remain stagnant and management was still unsure about the long-term potential of the wedding business for SRGCC. After joining the company full time in 2016, Roberts had remained focused on his goal to provide the best golf, wedding, and special event experience. That year, SRGCC increased its revenues to over $1.4 million?an increase of roughly 30 percent or $330,000 over fiscal year (FY) 2014. As well, 2016 earnings before interest, taxes, depreciation, and amortization (EBITDA) jumped approximately 500 percent over FY 2014 (see Exhibits 2 and 3).

To expand SRGCC's reach, Kelly also continued pursuing her goal of attracting customers from outside the Ainslie area. She focused her efforts on impactful visual branding, estimating that 60 percent of the SRGCC's wedding customers found SRGCC through social media marketing. SRGCC also offered competitive pricing on its wedding packages to attract couples from larger markets who were looking to find the best value. The venue itself offered views of the lush golf-course property and included the separate ceremony and reception spaces, with large windows in the indoor spaces designed to bring the outside in. The results were positive! The wedding business continued to grow, and SRGCC anticipated hosting over 30 weddings in 2017. However, with the increased popularity of the SRGCC brand, Roberts and Kelly observed that they were selling out the prime wedding dates of June to September 40 percent earlier than they had for the summer before. By March 2016, Kelly noted that the prime wedding dates for the summer of 2017 had already sold out; she had no choice but to turn away potential clients. The special events business grew along with the number of weddings for a combined 70 events overall in 2016, increasing from 35 in 2014.

Impact on Golf at SRGCC

The substantial growth in the weddings and special events side of the business offered an increase in cash flow for SRGCC, which ameliorated the effects of the decline in the golf industry and allowed Roberts to continue to invest in maintaining the golf facilities. While the majority of the golf industry cut costs to survive the decline in sales, Roberts focused on revenue growth and concentrated on his core customer.

He reinvested in the property, responded to industry changes and technology, and continued to provide the leading golf experience. Focusing on the core values of SRGCC, he turned the club into a community asset by providing an enjoyable experience for everyone.

Roberts's revamped focus on the golf business, which targeted the non-avid golfer, increased sales at a time when the rest of the industry saw a decline. Though golf memberships remained flat between 2015 and 2016, game packs (a pre-purchased set number of rounds for the season), private tournaments with golf and meal packages, green fees (single-round purchasing), junior golf, and golf lessons saw substantial increases.

THE CANADIAN WEDDING INDUSTRY

According to a 2015 survey, Canadian weddings were anticipated to cost just over $30,000, with an average of 129 attendees, and three-quarters of brides anticipated spending more than they budgeted.9 Just over 160,000 Canadian weddings were estimated to occur in 2015.10 More than three-quarters of Canadian weddings occurred in the summer months or peak season?between June and September?with the majority of weddings occurring in August.11 Of the weddings that occurred outside of peak season, a quarter of them were destination weddings;12 a total of 14 percent of all Canadian weddings occurred out of the country.13 The vast majority of brides claimed that social media platforms such as Facebook, Instagram, and Pinterest were influential in their wedding planning decisions.14

The 2015 and 2016 wedding seasons saw an increase in demand for unique, industrial, and rustic wedding venues.15 While traditional spaces such as hotel ballrooms and barns remained popular, many brides and grooms sought out unique venues that could be decorated either as chic wedding spaces that included chandeliers or in a minimalistic style that let the exposed brick and rustic wood features shine.16

THE EXPANSION PLAN

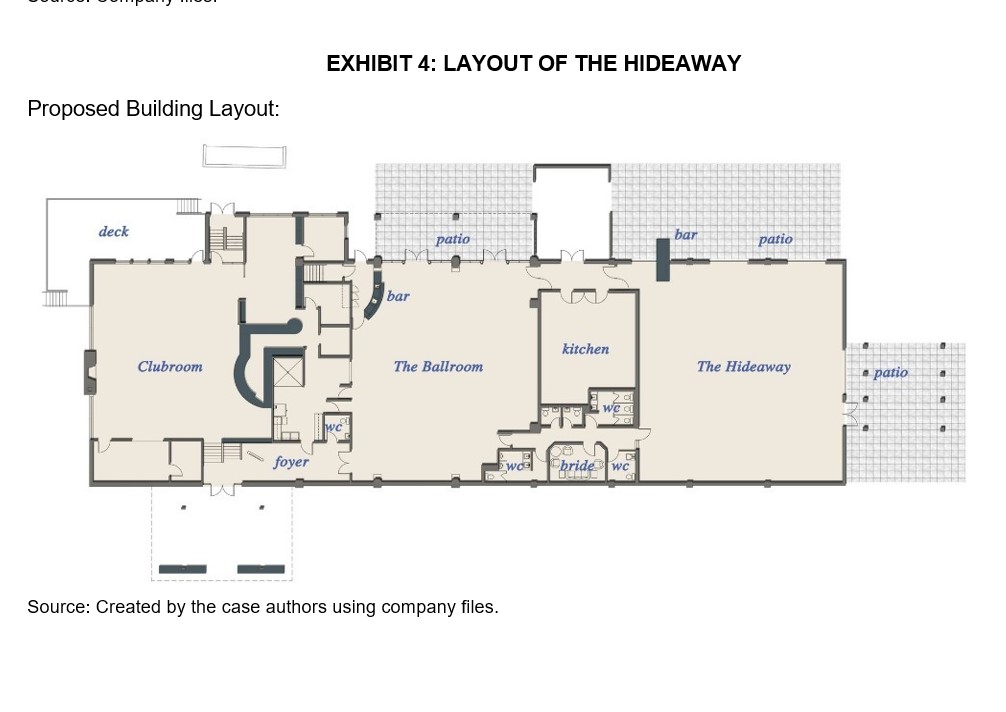

In the summer of 2016, Roberts and Kelly were considering an indoor ceremony option for days with unfavorable weather. While the couple led their architect on a tour through the club's facilities, he pointed out the unique beauty of the exposed wood-beam ceiling in the golf maintenance shop. Recognizing the opportunity this venue presented, Roberts and Kelly realized that the current maintenance shop in the clubhouse could be the perfect new space for weddings and special events.

The golf maintenance space, part of the original clubhouse, was built in 1963 and had a rustic, industrial atmosphere, with the original, exposed wood ceilings; rustic wood beams and trusses; various wood features; exposed brick; and industrial-style cement floors. The space aligned perfectly with the current trends in event and restaurant spaces, which favored rustic-elegant design. The couple's vision was to add large glass garage doors to increase natural light and airflow in the space while giving guests views of the golf course. Through the addition of elegant decorations and lighting, such as large chandeliers and stylish furniture, Roberts and Kelly felt they could create the perfect new space. They knew that SRGCC had to

invest in a second, complementary wedding facility to sustain the business in the long-term and that a second venue would provide financial benefits for the club.

The Hideaway

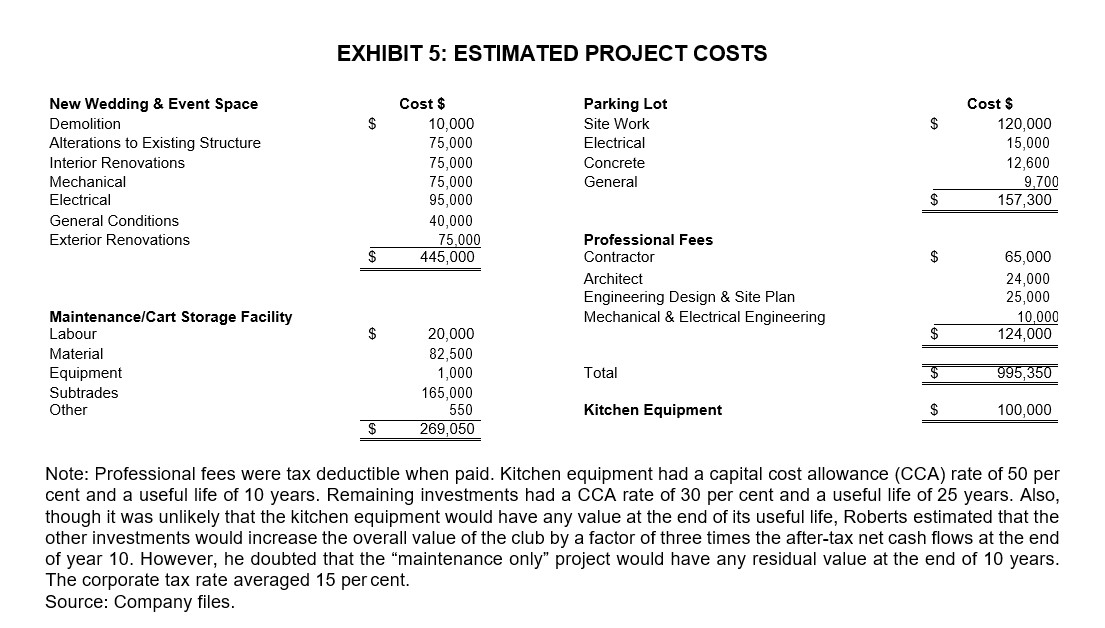

Roberts and Kelly named the converted maintenance facility?the potential new venue space?the Hideaway to differentiate it from the existing Ballroom. To operate both spaces at the same time, Roberts knew they needed to expand the existing kitchen and provide access from the kitchen to both spaces and purchase an additional $100,000 in kitchen equipment. Further, a grand entrance to space was needed as well as outdoor space for cocktail receptions overlooking the golf course. Other renovations to the current space included washroom additions, a bridal suite, and a generator to provide backup power for both the Ballroom and the Hideaway (see Exhibit 4). Roberts estimated that the renovations to transform the maintenance facility into the Hideaway would be $445,000.

To keep the renovation and operating costs of the space lower and to add to the industrial feel, the Hideaway renovations would not include insulating or heating the space for winter use. Therefore, Roberts and Kelly planned to host weddings in the space during the peak wedding season and the warmer months?from May through to October. Estimated sales per wedding would be slightly higher than the current averages for the Ballroom at $13,500 for Saturday weddings and $10,500 for Sunday to Friday weddings, as the Hideaway would have a capacity of 210 guests for a seated meal or 250 guests for a standing cocktail reception; the Ballroom had a capacity of 180 guests seated and 200 standing. Kelly estimated that 65 percent of the weddings and special events would be seated meals and the remaining 35 percent standing cocktail receptions.

Kelly predicted that, in 2017, the Hideaway would host 15 Saturday weddings, at $13,500 each, and another three weddings on other days of the week, at $10,500 each. Since the Ballroom was already nearly sold out for prime dates in the 2017 wedding season, Kelly was confident the club could achieve this projection based on the waiting list and number of potential clients who had already been turned away. By the second year of operating both spaces, Kelly projected the Hideaway would host 18 Saturday and five non-Saturday weddings. Finally, in 2019, the Hideaway would host the full capacity of 21 Saturday weddings and another seven non-Saturday weddings. Each year, Kelly planned to increase the price per wedding by 2 percent. In addition to weddings, Kelly estimated other opportunities to rent out space would generate an additional $15,000 in revenue in 2017, $25,000 in 2018, and $35,000 in 2019. Again, she estimated a steady increase thereafter of 2 percent.

Kelly also recognized that to deliver two weddings at the same time, the number of kitchen and wait staff would have to increase significantly, and both wedding timelines would have to be perfectly aligned to keep the kitchens running smoothly. Staffing the now-double wedding operation would be a challenge in such a small town. She expected to be able to hire temporary foreign workers to help with the kitchen and service requirements of the peak season. However, Kelly and Roberts would have to research how this process worked and consult with the board about this plan.

New Maintenance Facility

Roberts knew that if the current maintenance space were to be converted into a wedding venue, the club would be short on room for its maintenance work. SRGCC had two separate spaces for maintenance facilities and storage. The east side of the clubhouse was primarily used for summer operations such as golf carts and off-season storage of equipment. The second space was an aging barn that was used for off-season storage and seasonal material storage such as fertilizer, mulch, lawn tractors, and bunker rakes. The barn was well beyond its useful life and needed to be replaced; Roberts felt this might be the optimal time to review how to make the best use of a capital outlay to not only house maintenance activities and equipment but also make the maintenance operations more efficient. He planned to consolidate the equipment and operations from the barn and the east side of the clubhouse to free the space for the Hideaway and to construct a purpose-built space for maintenance away from the public spaces. The new maintenance facility would be 8,100 square feet (752 square meters), to support the increased demand for maintenance, and would include storage for all of the equipment from the two previous spaces and a dedicated space for staff facilities, including an office, lunchroom, and washrooms. The total cost to build the new maintenance facility was $269,050. He estimated that considering utilities and personnel, the new facility would result in a net annual savings of $55,000 a year, increasing at a rate of 2 percent per year.

Parking Lot Expansion

To support the growth on both sides of the business, Roberts anticipated that SRGCC would need another 100 parking spots. The existing lot was already fully occupied for large events, weddings, and busy golf days; he estimated the cost for the additional 100 spots was $157,300, which included all of the site work, electrical, concrete, and other expenses to complete the work.

Finally, as Roberts pondered the long list of investments required (see Exhibit 5) and the memo Kelly sent him regarding the costs of running the expanded weddings and special events business (see Exhibit 6), he wondered if SRGCC should just go ahead and invest in insulation and heating for the Hideaway to have it functional year-round. This option would significantly increase the insurance and heating cost, by

$18,000 per year, but Roberts knew the industry statistics indicated that the majority of weddings occurred between June and September. He was not sure how many weddings he should estimate hosting in the off-season at SRGCC, but he assumed that he would have to offer a discounted rate for weddings in the off-season. How deeply he could discount the rate without affecting his profit was uncertain. He estimated that a 25 percent discount would be required but was eager to see what the numbers would look like. He did not think he would secure any non-Saturday weddings at all in the off-season nor did he think that the special events business would increase significantly in the off-season. The Ballroom was available for those events. Roberts was concerned about how he could staff special events in the off-season, given the transient nature of much of the labor in Ainslie in the fall and winter months.

DECISION

Roberts had to convince both the bank and the four families who made up the board of directors that this expansion was the future for SRGCC. He knew the families would be reluctant to put more capital into the business and that SRGCC's overall cost of capital was currently close to 8 percent. He wondered if he should play it safe and focus only on the immediate capital needs of the barn and maintenance facility and hold off on the Hideaway and increased parking. Alternatively, he could just go all out and propose the entire project. If he mentioned winterizing, he knew he would be asked how much busier the club would need to be in the off-season to justify that option. Roberts knew that he would also have to convince the bank that the club was financially stable both before and after any expansion. He knew that he needed to determine the impact of both the increased debt and the returns on the project on SRGCC. Roberts also questioned whether Ainslie, a town of 7,500 people, could support another wedding venue for the summer season or the full year. With the golf industry slowing and the barn deteriorating, he knew SRGCC had to act quickly and prudently to maintain its reputation.

Exhibit 1-5

EXHIBIT 6: MEMO FROM ANNE KELLY RE-COSTING

To:Jordan Roberts, General Manager From Anne Kelly, Director of Special Events Re:The Hideaway Projected Costs

Hi Jordan. I've spoken with my team and here's what we're thinking.

Based on our current weddings held in the Ballroom, we're comfortable with my original estimate that 65 percent of all functions will be sit-down meals and the remaining cocktail functions. I know we've estimated our capacity as 210 and 250, respectively, for these two types of events, and I certainly see our events almost always at capacity in the Ballroom currently. I think we're okay estimating full capacity. By the way, we've included some projected revenues for other events. Just a reminder that these events typically are rental income only?that is, we don't provide any food or alcohol at those events.

As you know, it's much more expensive to serve a full meal. I've checked with the chef and, based on our current offerings, I think we can estimate using our current full meal cost of $25 per person. Cocktails and appetizers are, of course, less expensive, and I think we're safe to say $8.00 there per person. I would assume a rate of increase of 2 percent on these costs?similar to our expected pricing increases. And just a reminder that we shouldn't have to factor in alcohol as we permit our clients to bring in their own wine, beer, and spirits.

Based on how we currently staff the Ballroom events, I estimate that we'll need 14 serving staff members per event. I typically have the staff here for set-up through to tear-down, which usually means a 12-hour shift. Current hourly rates are, on average, $16.50, but we should count on a 2 percent increase on this rate. Plus, I know the Ontario government has been talking about increasing minimum hourly rates. I'm not sure how that will impact all of the business here at SRGCC.

I'm assuming we'll see increases in our insurance and utilities bills with this expansion. Without heat, we'll just be paying for power, and so I'm guessing that the utility bill increase will be fairly minor, say $15,000. Insurance?I asked our broker. She's suggested we think about $25,000 (total) as a likely increase for both property and liability coverage. Both of these will likely increase at a 2 percent rate as well.

I'm also thinking that we'll need to increase our supplies of linens, ceremony chairs, etc. to have enough inventory on hand for the extra functions. I think we should count on spending $10,000 on these sorts of supplies.

Finally, we think we can manage the extra workload between myself and our manager of weddings and events, though I believe the Hideaway will take up 40 percent of our manager's time. Her current total compensation is $65,000, as you know.

This is exciting! Let me know if I've missed anything. Anne

Source: Created by case writers.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts