Question: HEY I NEED HELP. QUESTION ONE HAS AN EXCELL AND I HAVE TAKEN A PIC OF THE EXCELL, HELP 1. The table below shows the

HEY I NEED HELP. QUESTION ONE HAS AN EXCELL AND I HAVE TAKEN A PIC OF THE EXCELL, HELP

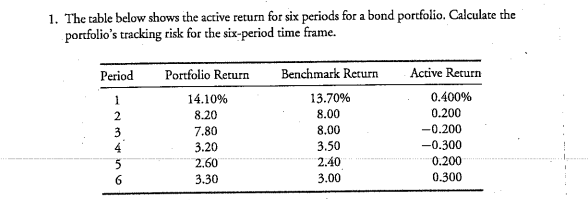

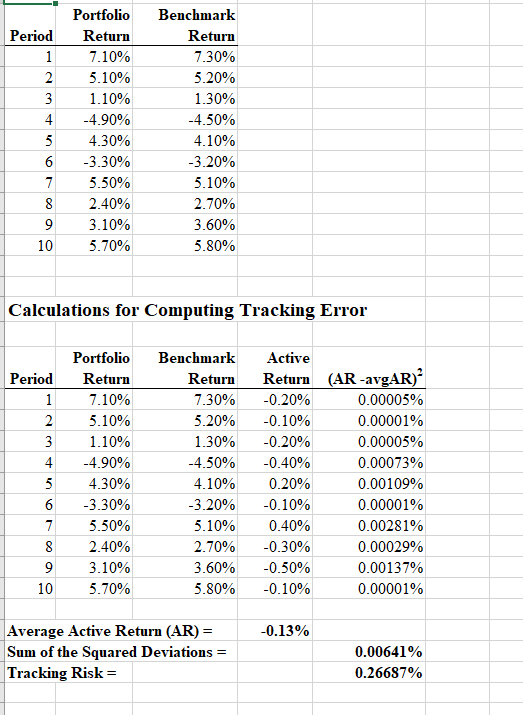

1. The table below shows the active return for six periods for a bond portfolio. Calculate the portfolio's tracking risk for the six-period time frame. Period 1 2 3 4 5 6 Portfolio Return 14.10% 8.20 7.80 3.20 2.60 3.30 Benchmark Return 13.70% 8.00 8.00 3.50 2.40 3.00 Active Return 0.400% 0.200 -0.200 -0.300 0.200 0.300 Period 1 2 3 4 5 6 7 8 9 10 Portfolio Return 7.10% 5.10% 1.10% -4.90% 4.30% -3.30% 5.50% 2.40% 3.10% 5.70% Benchmark Return 7.30% 5.20% 1.30% -4.50% 4.10% -3.20% 5.10% 2.70% 3.60% 5.80% Calculations for Computing Tracking Error Period 1 2 3 4 5 6 7 8 9 10 Portfolio Return 7.10% 5.10% 1.10% -4.90% 4.30% -3.30% 5.50% 2.40% 3.10% 5.70% Benchmark Return 7.30% 5.20% 1.30% -4.50% 4.10% -3.20% 5.10% 2.70% 3.60% 5.80% Active Return (AR-avgAR)? -0.20% 0.00005% -0.10% 0.00001% -0.20% 0.00005% -0.40% 0.00073% 0.20% 0.00109% -0.10% 0.00001% 0.40% 0.00281% -0.30% 0.00029% -0.50% 0.00137% -0.10% 0.00001% -0.13% Average Active Return (AR) = Sum of the Squared Deviations = Tracking Risk = 0.00641% 0.26687% 1. The table below shows the active return for six periods for a bond portfolio. Calculate the portfolio's tracking risk for the six-period time frame. Period 1 2 3 4 5 6 Portfolio Return 14.10% 8.20 7.80 3.20 2.60 3.30 Benchmark Return 13.70% 8.00 8.00 3.50 2.40 3.00 Active Return 0.400% 0.200 -0.200 -0.300 0.200 0.300 Period 1 2 3 4 5 6 7 8 9 10 Portfolio Return 7.10% 5.10% 1.10% -4.90% 4.30% -3.30% 5.50% 2.40% 3.10% 5.70% Benchmark Return 7.30% 5.20% 1.30% -4.50% 4.10% -3.20% 5.10% 2.70% 3.60% 5.80% Calculations for Computing Tracking Error Period 1 2 3 4 5 6 7 8 9 10 Portfolio Return 7.10% 5.10% 1.10% -4.90% 4.30% -3.30% 5.50% 2.40% 3.10% 5.70% Benchmark Return 7.30% 5.20% 1.30% -4.50% 4.10% -3.20% 5.10% 2.70% 3.60% 5.80% Active Return (AR-avgAR)? -0.20% 0.00005% -0.10% 0.00001% -0.20% 0.00005% -0.40% 0.00073% 0.20% 0.00109% -0.10% 0.00001% 0.40% 0.00281% -0.30% 0.00029% -0.50% 0.00137% -0.10% 0.00001% -0.13% Average Active Return (AR) = Sum of the Squared Deviations = Tracking Risk = 0.00641% 0.26687%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts