Question: Hey i need help with this problem! If you can provide an explanation on how you got the answer thatd help me a lot! Consider

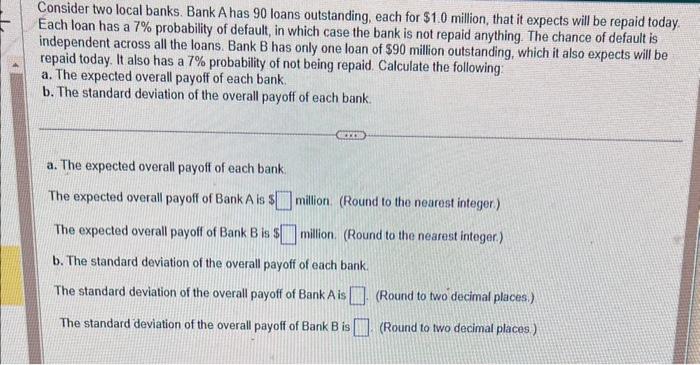

Consider two local banks. Bank A has 90 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 7% probability of default, in which case the bank is not repaid anything. The chance of default is independent across all the loans. Bank B has only one loan of $90 million outstanding, which it also expects will be repaid today. It also has a 7% probability of not being repaid. Calculate the following: a. The expected overall payoff of each bank. b. The standard deviation of the overall payoff of each bank. a. The expected overall payoff of each bank: The expected overall payoff of Bank A is $ million. (Round to the nearest integer) The expected overall payoff of Bank B is $ million. (Round to the nearest integer.) b. The standard deviation of the overall payoff of each bank. The standard deviation of the overall payoff of Bank A is (Round to two decimal places.) The standard deviation of the overall payoff of Bank B is (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts