Question: Hey! I'm having GREAT difficulty with this unit. I keep mixing up what goes where and can't figure out how to solve these :(. Please

Hey! I'm having GREAT difficulty with this unit. I keep mixing up what goes where and can't figure out how to solve these :(. Please help 8-10 & 11ac are the questions I need to do.

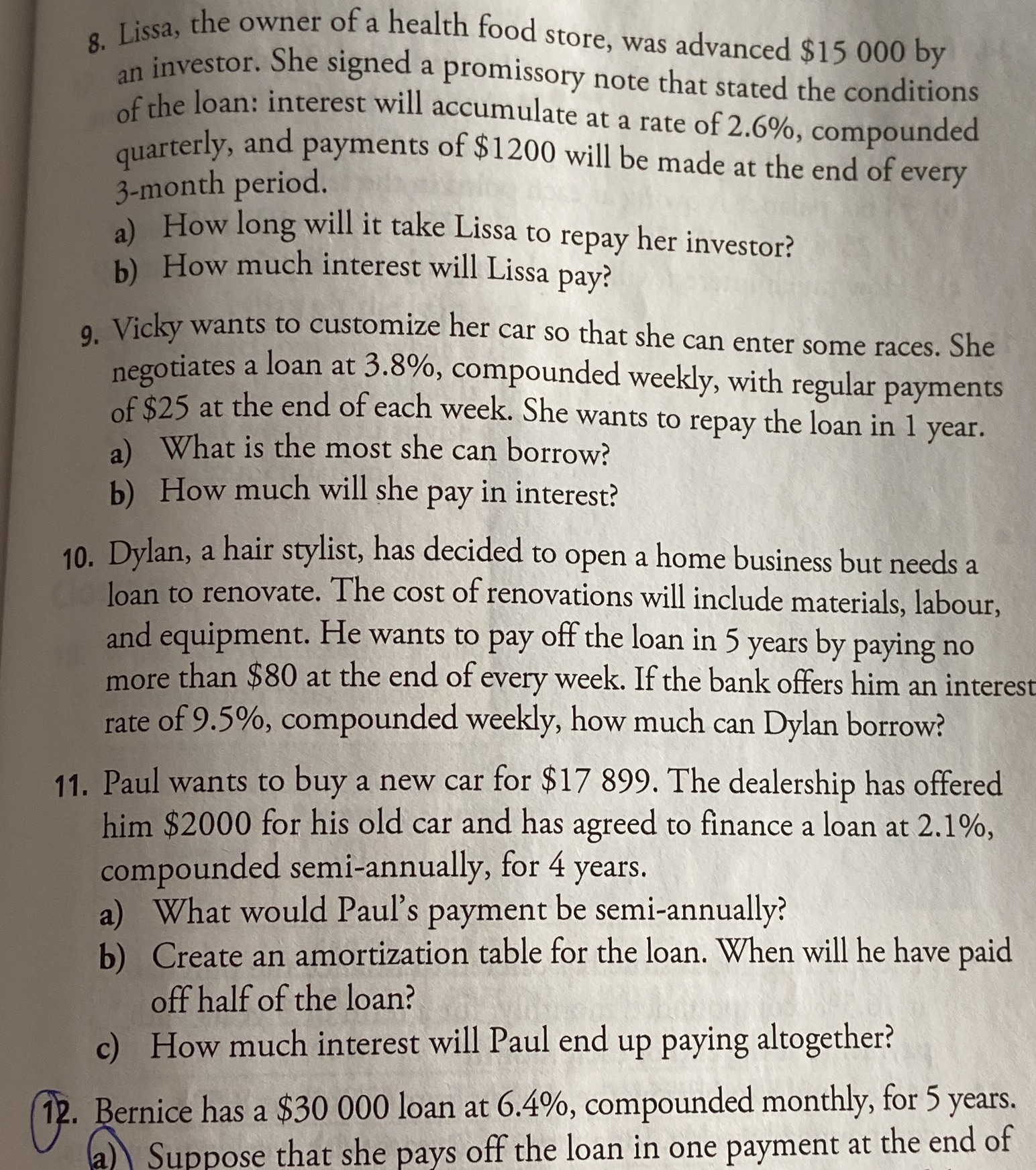

8. Lissa, the owner of a health food store, was advanced $15 000 by an investor. She signed a promissory note that stated the conditions of the loan: interest will accumulate at a rate of 2.6%, compounded quarterly, and payments of $1200 will be made at the end of every 3-month period. a) How long will it take Lissa to repay her investor? b) How much interest will Lissa pay? 9. Vicky wants to customize her car so that she can enter some races. She negotiates a loan at 3.8%, compounded weekly, with regular payments of $25 at the end of each week. She wants to repay the loan in 1 year. a) What is the most she can borrow? b) How much will she pay in interest? 10. Dylan, a hair stylist, has decided to open a home business but needs a loan to renovate. The cost of renovations will include materials, labour, and equipment. He wants to pay off the loan in 5 years by paying no more than $80 at the end of every week. If the bank offers him an interest rate of 9.5%, compounded weekly, how much can Dylan borrow? 11. Paul wants to buy a new car for $17 899. The dealership has offered him $2000 for his old car and has agreed to finance a loan at 2.1%, compounded semi-annually, for 4 years. a) What would Paul's payment be semi-annually? b) Create an amortization table for the loan. When will he have paid off half of the loan? c) How much interest will Paul end up paying altogether? 12. Bernice has a $30 000 loan at 6.4%, compounded monthly, for 5 years. a) Suppose that she pays off the loan in one payment at the end of