Question: Hey, I'm having trouble with this textbook problem - if someone could provide the steps and solution it would be greatly appreciated. :) 21. You

Hey, I'm having trouble with this textbook problem - if someone could provide the steps and solution it would be greatly appreciated. :)

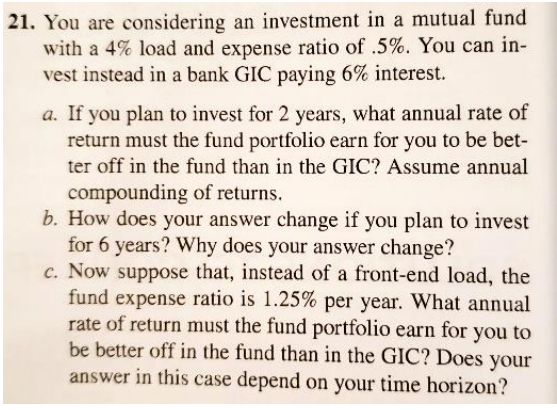

21. You are considering an investment in a mutual fund with a 4% load and expense ratio of 5%. You can in- vest instead in a bank GIC paying 6% interest. a. If you plan to invest for 2 years, what annual rate of return must the fund portfolio earn for you to be bet- ter off in the fund than in the G10? Assume annual compounding of returns. b. How does your answer change if you plan to invest for 6 years? Why does your answer change? us. Now suppose that. instead of a frontend load. the fund expense ratio is 1.25% per year. What annual rate of return must the fund portfolio earn for you to be better off in the fund than in the GIC? Does your answer in this ease depend on your time horizon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts