Question: Hey, I'm working on some practice problems for my upcoming prep course. Can you help me with the calculations of the relevant cash flows associated

Hey, I'm working on some practice problems for my upcoming prep course. Can you help me with the calculations of the relevant cash flows associated with the new product line in the attached case for Kola? Also, I think I know how to do the NPV and IRR with a calculator but not sure how to do it manually or in excel. Please assist with the first 2 questions in the attached "Kola Question." If you're able to help with the others, even better. The case is attached in 5 parts, including financial information please read to help with this. Please let me know if there's anything else needed. Thank you very much!

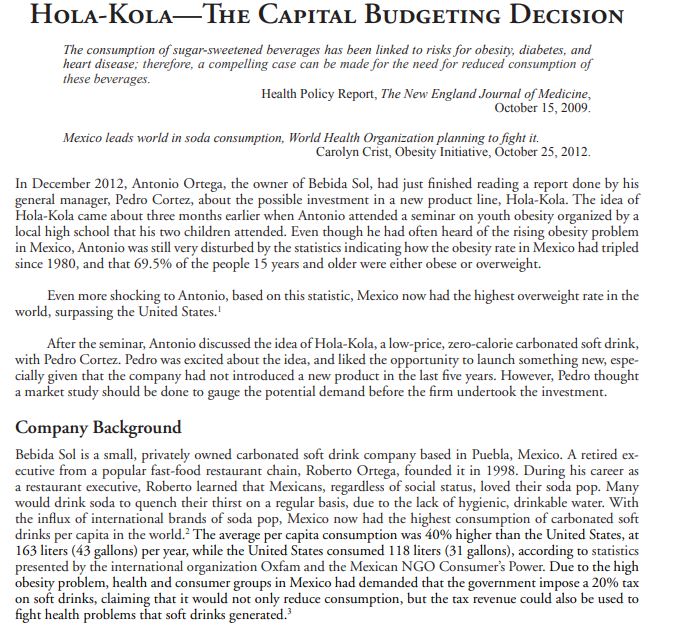

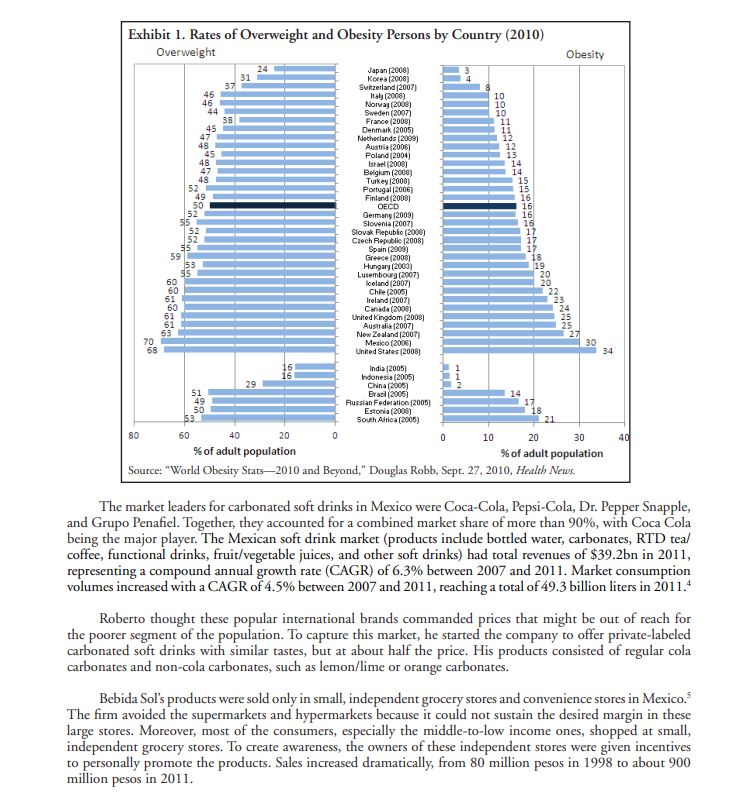

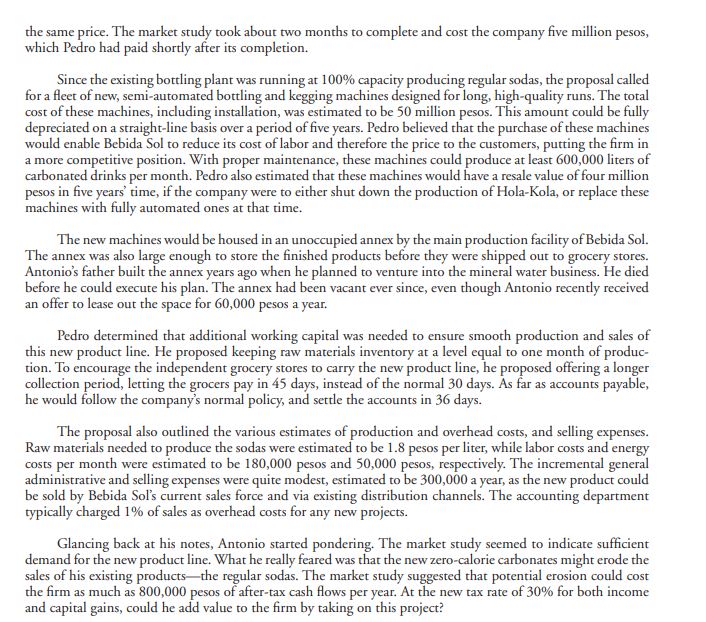

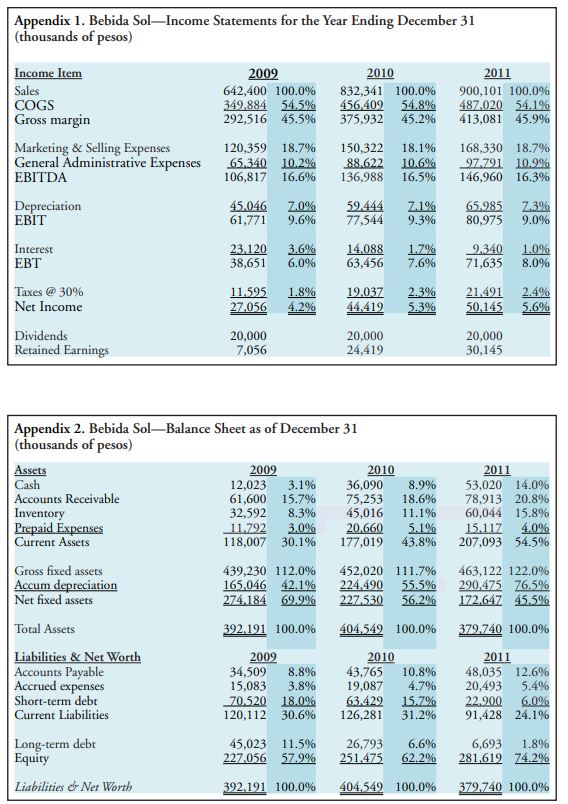

Practice questions Please respond to the following questions regarding the Hola Kola case in your coursepack. 1] 2] 3] 4] Calculate the relevant cash flows associated with the new product line. Calculate the net present value [NPV], internal rate of return tIRR} and payback period for the ola Kola project. Based on these results would you recommend proceeding with the project? What qualitative factors [i.e.Ir henefitsfrisks] should be considered in the investment decision and why? Based on the results of your quantitative analysisIr and your qualitative considerationsIr write a letter to management making a recommendation whethe_or not to purchase the new machines. You must include support for your recommendation. \f\f\fthe same price. The market study took about two months to complete and cost the company ve million pesos, which Pedro had paid shortly aFter its completion. Since the existing bottling plant was nrnning at 100% mpacity producing regular sodas, the proposal called list a eet ofnew, semi-automated bottling and kegging machines designed For long, high-quality runs. The total cost ofthese machines, including installation, was estimated to he 50 million pesos. This amount could he Fully depreciated on a straight-line basis over a period of ve years. Pedro believed that the purd'iase of these machines would enahle Eebida Sol to reduce its cost oFlabor and thereFore the price to the customers, putting die rm in a more competitive position. 'Wid'l proper maintenance, these machines could produce at least 600,000 liters of carbonated drinks per monll'r. Pedro also estimated that these machines would have a resale value offour million pesos in ve years' time, iFthe company were to either shut down the production ofHola-Kola, or replace daese machines with Fully automated ones at that lime. The new machines wouldhe housed in an unoccupied annex by the main production facility ofEehida Sol. The antler was also large enough to store the nished products heare they were shipped out to grocery stores. Antonio's lather built the annex years ago when he planned to venture into the mineral water business. He died before he could execute his plan. The annex had been vacant ever since, even though Hntonio recently received an offer to lease out the space for 0,000 peso-s a year. Pedro determined that additional working capital was needed to ensure smooth production and sal of this new product line. He proposed keeping raw materials inventory at a level equal to one moods ofproduc- tion. To encourage the independent grocery stores to carry the new product line, he proposed ofFering a longer collection period, letting the grocers pay in 45 days, instead ofae normal 30 days. rs Far as accounts payable, he would Follow the company's normal policy, and settle the accounts in 315 days. The proposal also outlined the various estimates ofproduction and overhead costs, and selling expenses. Raw materials needed to produce the sodas were estimated to be 1.3 pesos per liter, while labor costs and energr costs per month were estimated to be 130,000 pesos and 50,000 pesos, respectively. The incremental general administrative and sdling expenses were quite modest, estimated to be 300,000 a year, as the new product could he sold by Behida Sol's current sales force and via existing distribution channer. The accounting department typically charged 1% oFsales as overhead costs for any new projects. Glancing back at his notes, Antonio started pondering. The market study seemed to indicate suHicient demand for the new product line. What he really feared was that the newzero-calorie carbonates might erode the sales of his existing productsthe regular sodas. The market study suggested that potential erosion could cost the rm as much as 800,000 pesos ofaer-taat ash ows per year. At the new tax rate oflh For both income and mpital gains, could he add value to the rm by taking on dais project? \f