Question: Hey, there are no solutions shown here, the steps are blank. Your assistance would be greatly appreciated Suppose a mutual fund manager is worried that

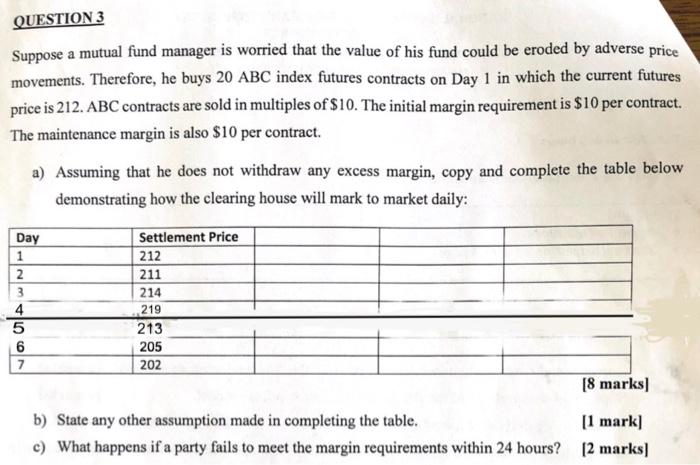

Suppose a mutual fund manager is worried that the value of his fund could be eroded by adverse price movements. Therefore, he buys 20ABC index futures contracts on Day 1 in which the current futures price is 212 . ABC contracts are sold in multiples of $10. The initial margin requirement is $10 per contract. The maintenance margin is also $10 per contract. a) Assuming that he does not withdraw any excess margin, copy and complete the table below demonstrating how the clearing house will mark to market daily: [o marks] b) State any other assumption made in completing the table. [1 mark] c) What happens if a party fails to meet the margin requirements within 24 hours? [2 marks] Suppose a mutual fund manager is worried that the value of his fund could be eroded by adverse price movements. Therefore, he buys 20ABC index futures contracts on Day 1 in which the current futures price is 212 . ABC contracts are sold in multiples of $10. The initial margin requirement is $10 per contract. The maintenance margin is also $10 per contract. a) Assuming that he does not withdraw any excess margin, copy and complete the table below demonstrating how the clearing house will mark to market daily: [o marks] b) State any other assumption made in completing the table. [1 mark] c) What happens if a party fails to meet the margin requirements within 24 hours? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts