Question: hey there , could you please help me with this problem The exchange rates in New York are 1000=$9 and the exchange rates in Tokyo

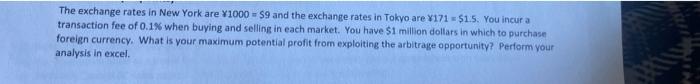

The exchange rates in New York are 1000=$9 and the exchange rates in Tokyo are $171=$1.5. You incur a transaction fee of 0.1% when buying and selling in each market. You have $1 million dollars in which to purchase foreign currency. What is your maximum potential profit from exploiting the arbitrage opportunity? Perform your analysis in excel

Step by Step Solution

There are 3 Steps involved in it

To solve the problem of arbitrage between two markets New York and Tokyo lets break down the situati... View full answer

Get step-by-step solutions from verified subject matter experts