Question: Hey, would you please help with this question? I do not know what process to use or how to execute a process to solve this

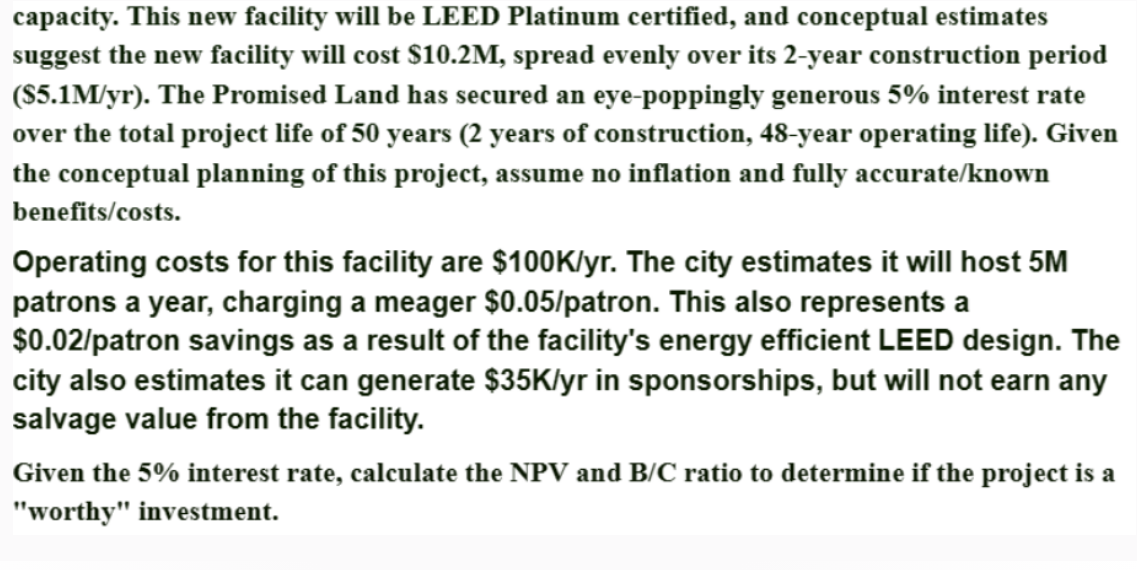

Hey, would you please help with this question? I do not know what process to use or how to execute a process to solve this question. Please explain what you are doing and why you are doing it. Also, please make the final solution clear. I know the equations: P=F(1+i)^-n and A = P[(i(1+i)^n)/(((1+i)^n)-1)] and B/C = (Annual User Benefits-Annual O&M Cost)/AE of Installed Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts